Range Resources extends deal

Range Resources (ticker: RRC) announced Wednesday that it has extended its previously announced exchange offers for certain of Range’s and Memorial Resource Development Corp.’s (ticker: MRD) notes listed in the table below and the cash tender offers for Memorial’s notes listed below, in order to coincide with the expected closing of Range’s acquisition of Memorial. Accordingly, the offers will expire at 6:00 a.m. New York City time, on September 16, 2016. All other applicable terms and conditions of the offers remain unchanged.

As of 5:00 p.m. New York City time, August 30, 2016, the results of the offers and the related consent solicitations are as follows:

|

Issuer |

Title of Series of Existing Notes |

CUSIP / ISIN | Aggregate Principal Amount Outstanding |

Principal Amount of |

Approximate Percentage |

||||||

| Memorial Resource Development Corp. |

5.875% Senior Notes due 2022 |

58605QAB5 | $ | 600,000,000 |

For Exchange: $329,244,000 For Cash: |

For Exchange: 54.87% For Cash: |

|||||

| Range Resources Corporation |

5.75% Senior Sub. Notes due 2021 |

75281AAM1 | $ | 500,000,000 | $ | 441,473,000 | 88.29 | % | |||

| Range Resources Corporation |

5.00% Senior Sub. Notes due 2022 |

75281AAN9 | $ | 600,000,000 | $ | 563,997,000 | 94.00 | % | |||

| Range Resources Corporation |

5.00% Senior Sub. Notes due 2023 |

75281AAQ2,75281AAP4 /U75295AC6 |

$ | 750,000,000 | $ | 737,668,000 | 98.36 | % | |||

| TOTAL | $ | 2,450,000,000 | $ | 2,342,048,000 | 95.59 | % | |||||

The Memorial deal

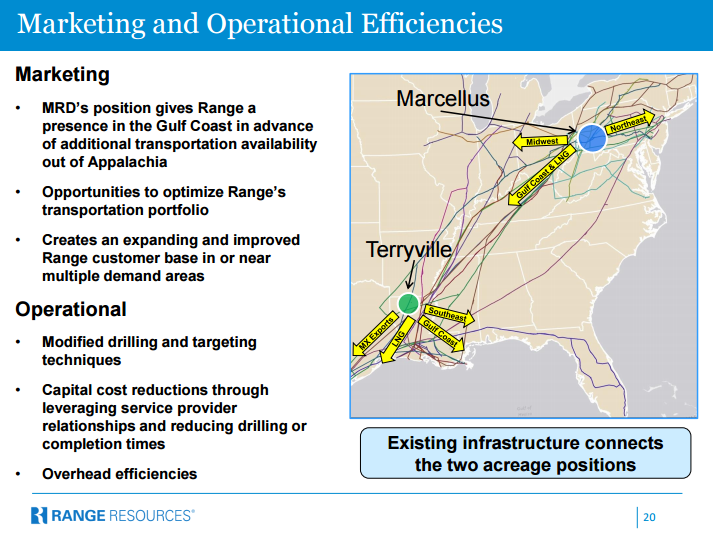

Range CEO Jeff Ventura talked about the deal on a conference call following the deal’s announcement as follows: “Finding an accretive transaction that competes with our results in the Southwest Marcellus is not a small hurdle. Therefore, any potential transaction has to start with high quality assets. The Terryville assets particularly the Upper Red are highly prolific well developed by a high quality technical team was evidenced by their industry leading production rates per well. Similar to the Marcellus, the Upper Red is relatively low risk, highly repeatable, high quality rock.

“Terryville is a stack pay area that provides future upside and the ability to drive operational efficiencies and improvements to our cost structures in the months and years ahead. Terryville also has the advantage of being in close proximity the growing demand and the higher prices near the Gulf Coast, boosting relative returns. When closed this transaction will be immediately accretive to cash flow per share as a result of Memorial’s high margin production.”

Ventura went on to point out that on a pro forma basis, Range will “improve its 2016 margins by approximately $0.45 per Mcfe based on analyst consensus. Memorial also has hedges in place to cover approximately 270 million per day of 2017 production at an average floor price of $3.50, securing a significant portion of the expected cash flow next year.”

The highlights of the deal are:

- 220,000 net surface acres

- Geo-pressured lower Cotton Valley

- Multi-year inventory

- 5 Tcf equivalent of net resource potential, not including the very attractive southern expansion area

- Q1 production – 420 million cubic feet equivalent per day

- Memorial team has achieved a 26% reduction in well cost, a 28% improvement in drilling times, and a 31% improvement in frac execution time.