Range Resources expects natural gas demand to reach 15.8 Bcf/d by 2020; focusing on Marcellus well returns

Low commodity prices continue to take their toll on E&P companies across the U.S., and Range Resources (ticker: RRC) is no exception. But the company is preparing to take advantage of better natural gas prices as the market starts to tighten through the end of 2016 and into 2017.

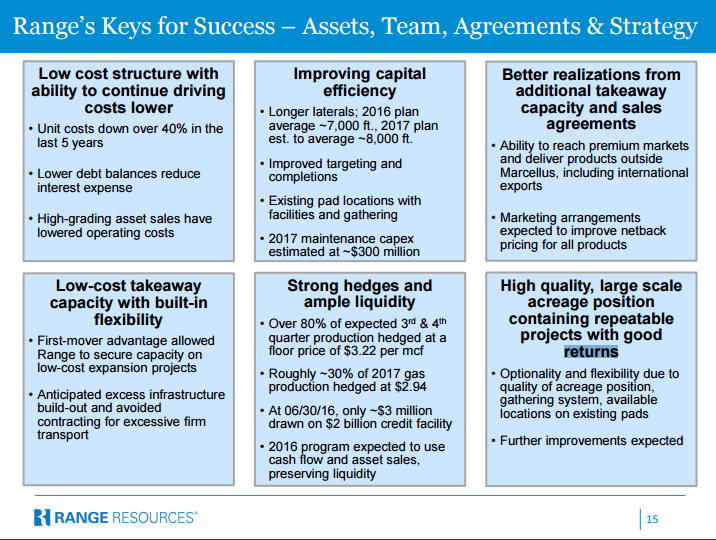

During the company’s conference call today, management highlighted Range’s lower costs per unit on a year-over-year basis. “LOE is down 44%. G&A is down 23%. Interest expense, down 17% and DD&A was $0.95 in the second quarter, down 22% year-over-year. We continued to achieve operational improvements in the Marcellus and our wells continued to exhibit strong performance,” said Range CEO Jeff Ventura.

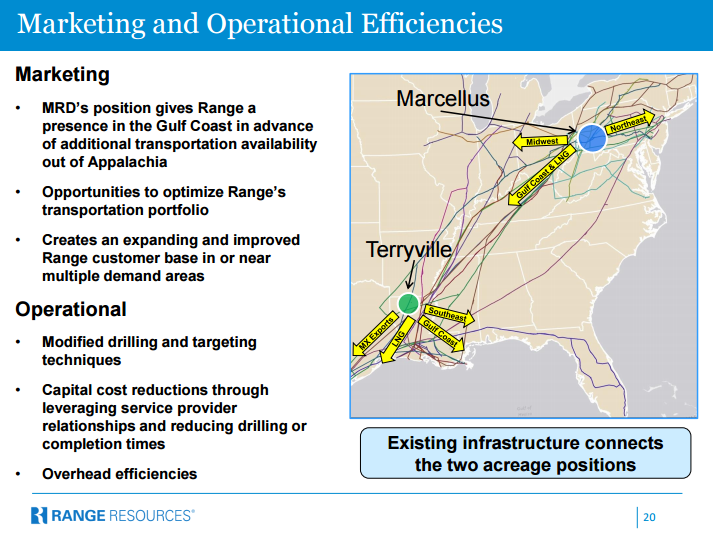

These improvements continue to strengthen Range’s margins as the company exports larger quantities of its production out of the Appalachia region. “By the end of this year, approximately 70% of our natural gas is projected to be sold in markets outside of the Appalachian Basin, further improving our expected natural gas differentials going forward. By year-end 2017, we expect over 80% of our production to be sold in markets outside of the Appalachian Basin,” said Ventura.

The completion of the Spectra Gulf Markets project and the Columbia Leach/Rayne Xpress project will create 150 MMcf/d and 300 MMcf/d of additional carry-away capacity for Range to the Gulf, where the company expects demand will continue to grow.

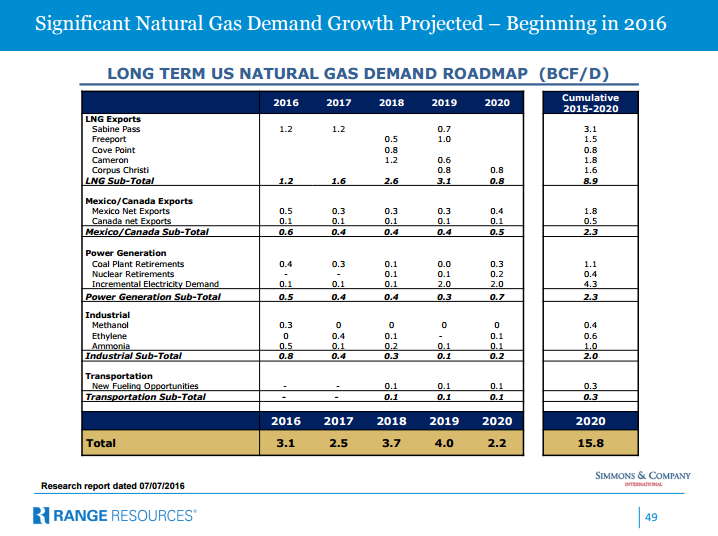

From 2015 to 2020, Range expects demand for LNG to reach 8.9 Bcf/d, Mexico and Canada exports to reach 2.3 Bcf/d, power generation demand to total 2.3 Bcf/d, industrial demand to clock in at 2.0 Bcf/d and transportation demand to grow from zero to 0.3 Bcf/d by the end of the decade. Range’s estimates peg total natural gas demand by 2020 at 15.8 Bcf/d, and the company believes it will be well positioned to supply that demand from its assets in the Marcellus and from Memorial Resource Development’s Terryville assets, which the company will close on in the third quarter.

Range sees basin production continuing to fall as demand grows, with just 30 rigs drilling in the Marcellus and Utica formations, 20 fewer than Range believes is necessary to keep production flat. As the market continues to tighten, prices should improve, allowing the company to ramp up production and meet increased demand.

“Gas pricing remained challenged during the second quarter, but pricing has improved since and there are signs that later this year and into 2017 supply and demand will be more balanced and pricing could significantly improve,” said Ventura.

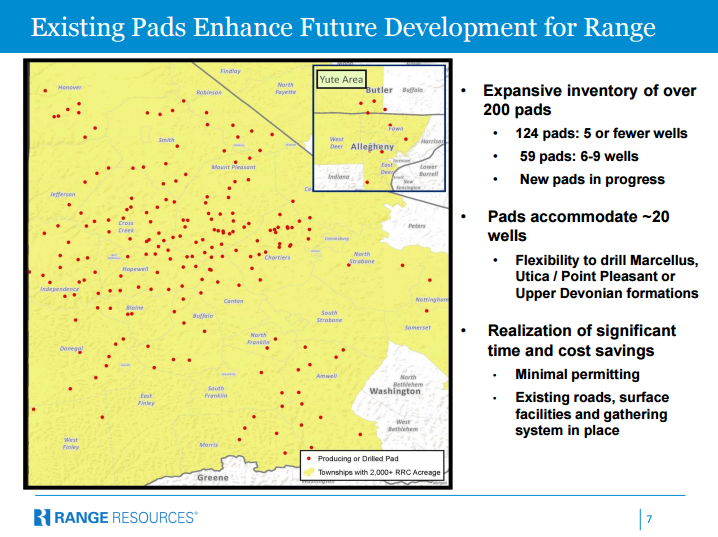

Extensive inventory of pads and permits ready for turnkey drilling

According to the presentation that accompanied the conference call today, Range currently has over 200 pads to drill from.

“At Range, if these price increases occur, we have the ability to ramp activity with increased cash flow. We have 231 existing pads that we can go back onto to drill additional wells, which increases capital efficiency and decreases the cycle time to ramp up,” said Ventura.

In addition to the pads Range has ready, the company already has the permits necessary to drill 42 laterals on those pads when it decides that activity makes sense.

“This is critical when you consider our ability to quickly ramp up activity and volumes at much less cost than others that don’t have a deep acreage and existing pad inventory,” said Range Resources COO Ray Walker. “Considering Pennsylvania, the cycle time for a grassroots multi-well pad and all of the permitting that goes with it, civil engineering, environmental permitting and title can take a long time.”

$3.10 natural gas prices offer 10% growth

Range is positioning itself to take full advantage of markets tightening, with lower costs from its production, increased take-away capacity and the infrastructure and permits required to quickly increase production when the price signals indicate there is more demand for the company’s gas. Looking at the forward NYMEX strip, Ventura said the company was looking for about $3.10 per MMcf for organic growth.

“I think next year somewhere around $3.10, that’s organic growth of about 10%, allocated, and both sides can grow,” he said. “Both sides, so I think the Memorial and Range both have strong economics right now. We see they’re probably about equal. We expect to invest cash flow in both and both can get organic growth of about 10% at strip prices for next year. As prices improve and we have the ability, cash flow increases, we have plenty of places to drill to be able to ramp to get back to higher growth rates when prices warrant.”

More information on the Memorial acquisition will come in Q3

The conference call today stay focused mainly on Range’s current assets, with management saying it would wait until the third quarter to offer more color on its acquisition of Memorial Resource Development, and how the company’s assets fit into Range’s current portfolio.

“We remain very excited about our pending merger with Memorial, but since we don’t expect to close the transaction until mid to late September, Ray and I will primarily focus our comments on the results, opportunities and plans for our Marcellus operation. In the next quarterly call, we expect to be able to talk more about plans for the combined company,” Ventura started off the call by saying.

Range believes that it will be able to apply the cost cutting it has executed in the Marcellus in the Cotton Valley as well, where Memorial’s assets are located.

”We believe the combined entity offers investors five key positive attributes,” said Ventura. “The first is a very high-quality, low-cost asset base in two complementary basins. The second is improved capital efficiency, as illustrated by the opportunity to go back onto existing pads to drill new wells in the Marcellus and to drill highly prolific wells in the Lower Cotton Valley. Continuing to drill longer laterals and optimizing landing and targeting will also drive improved capital efficiency in both regions.”

The company clearly remains focused on drilling the assets that provide the best returns, however, with Range saying further Utica development will likely be sidelined due to price considerations.

“The Utica costs almost 2.5 times more than our dry Marcellus. And while the Utica represents tremendous future resource potential, even with anticipated efficiencies, the returns from our Marcellus wells currently exceed Utica returns. Given limited production history thus far, on a risk-adjusted basis, it’s clear to us to that our high quality Marcellus wells are currently the superior investment,” said Walker.

When asked how the company ranks growth versus optionality, Ventura reiterated that returns are what drive decision making.

“If we rank anything it’d be returns. So we’re not focused on growth as much as we’re focused on returns,” said Ventura. “Growth falls out of that. Having a portfolio is good and having multiple choices is good, but it’s a combination of where do we think we’re going to get best returns with time. And we’ll allocate capital that way.”

Range Resources will be presenting at EnerCom’s The Oil & Gas Conference® 21 in Denver, Colorado, on August 16, at 4:45 EST. To learn more about the conference and see who else will be presenting, click here.