Number of Oncoming Pipeline Projects in Place through 2017

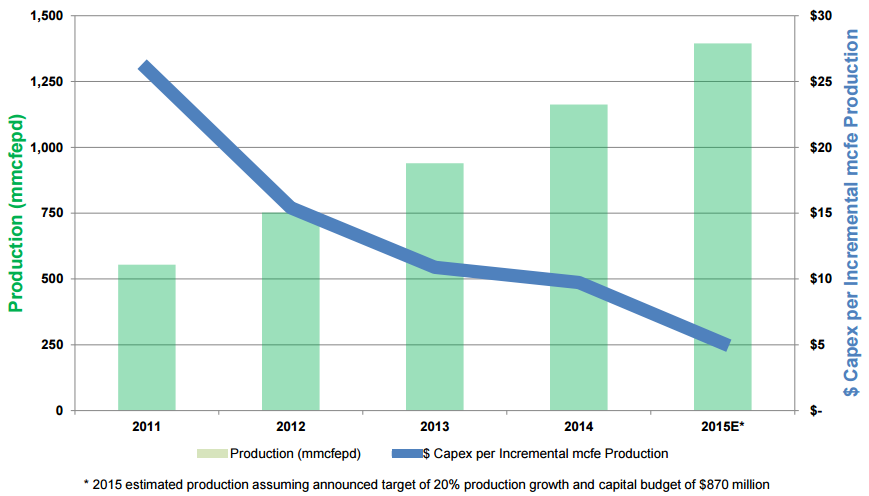

Range Resources Corporation (ticker: RRC), one of the largest exploration and production companies in the Appalachia region, increased volumes on a quarter-over-quarter basis by 3% in its Q2’15 earnings released on July 28, 2015. The flow of 1,373 MMcfe/d are a company record and are expected to climb to 1,390 to 1,400 MMcfe/d (28% liquids) in Q3’15 – in line with RRC’s projected volumes for fiscal 2015. Capital guidance was unchanged at $870 million and about 66% has already been expended as part of RRC’s front-loaded drilling program.

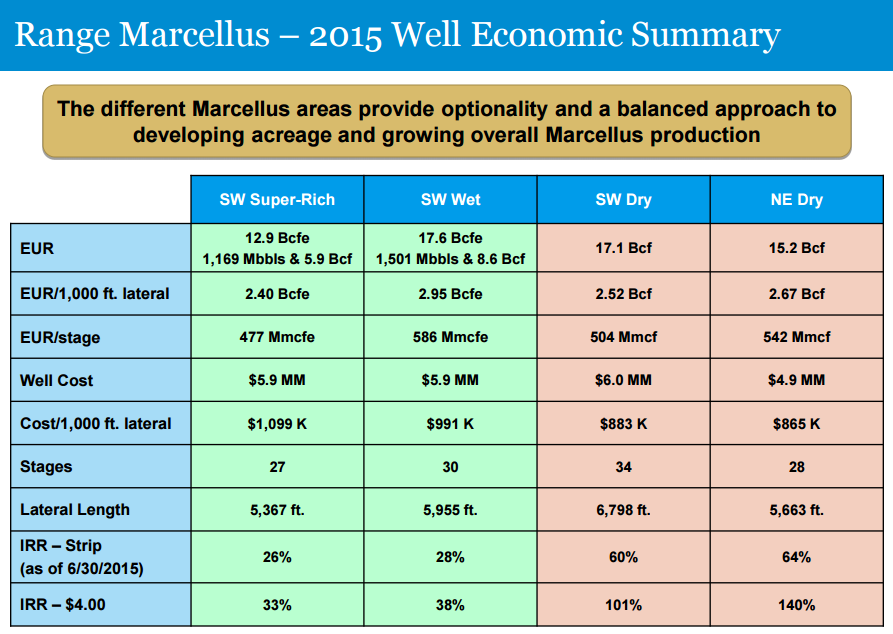

Drilling efficiencies are the driving force behind the upward production trend. The company believes it can turn in line 19 more wells than previously expected, even though its current rig count of 10 will drop to six by year-end. Management said a “strong inventory of wells” will be waiting on completion by that time and will be in line to take advantage of improved regional prices in early 2016.

Range Resources will be the first company to present at EnerCom’s The Oil & Gas Conference® 20 in Denver later this month.

Incoming: More Takeaway Capacity

Jeffrey Ventura, President and CEO of Range Resources, pointed to oversupply and stressed prices as a major factor in the quarter. In the first half of 2015, Range reported revenue of $842.0 million – down 14% from H1’14, even though average MMcfe prices (including cash-settled hedges and derivatives) have dropped by 35% in the same time frame. “The second quarter traditionally brings the mildest weather of the year, which tends to amplify the pricing impact of a supply surplus,” said Roger Manny, Chief Financial Officer, in a conference call following the release.

Ventura offered optimism, adding that “The good news is that we put some arrangements in place years ago that will come to fruition later this year, which should make some of this pricing pain short lived for Range.”

Those “arrangements” are pipelines fraught with access to RRC. Included are:

- Spectra’s Uniontown to Gas City project, expected to open on August 1, will provide 170 MMcf/d of net takeaway capacity. The takeaway accounts for 28% of RRC’s projected volumes from its southwest Marcellus operations and will ship the product to the Midwest markets. Ventura said the pipeline will increase realized prices by $1.00 under current strip pricing.

- Sunoco’s Mariner East I, expected to open in Q3’15, will increase RRC’s access to natural gas liquids (NGL) markets. NGLs account for about 25% of overall production and the Mariner East I will have a takeaway capacity of 40 MBOPD, split evenly between propane and ethane.

- Spectra’s Gulf Markets Expansion project, targeted for startup in Q4’16, with gross capacity of 150 MMcf/d to the Gulf region.

- Rover Phase I, planned to start up around the same time as the Gulf Markets Expansion.

- An assortment of expansion projects that will increase Range’s total takeaway capacity by 900 MMcf/d to target markets in the Gulf Coast, Midwest and Canada.

RRC management believes its NGL market access increases its annualized net cash flow by $90 million, not including potential propane price uplift opportunities.

Short Term Outlook

Range has heavily hedged itself in the short-term, with 85% of its gas production hedged at $3.70/MMcf and 90% of remaining liquids production at a floor price of $85.87. RRC’s hedges drop considerably in 2016 – the same time Range expects the market to improve.

“On a macro basis, good things are happening inside the Appalachian Basin,” said Ventura, explaining that Marcellus and Utica rig counts have dropped by 55% and 66%, respectively. Marcellus pipeline flows have been flat since the beginning of the year, and most of the reduced rigs have been pulled from the liquids-rich areas. Range was one of the companies who redirected its focus on the dry window, citing better margins in the constrained price environment. Ventura said: “Given the steep declines of most of these Utica liquids wells, the rebalance should happen sooner rather than later. With the drop in Utica rig count by two-thirds, coupled with the lack of hedges for 2016 and beyond by most companies, and with lower strip pricing for 2016, the Utica rig count will probably stay low for a while, which will help on the supply side.”

Other factors, including natural gas exports to Mexico and growing demand on the industrial transportation side, will right the supply/demand ship.

Positioned for the Upside

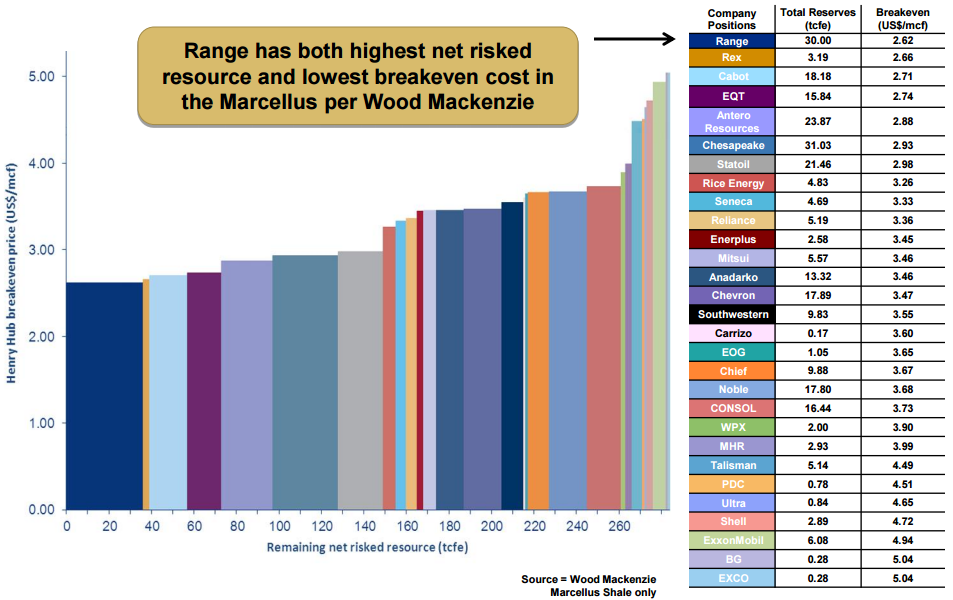

Analytics compiled by EnerCom, Inc. has routinely placed Range as one of the most cash-efficient operators in North America.

Its three-year finding and development costs of $0.73/Mcf are the fifth lowest of 84 companies in EnerCom’s E&P Weekly Benchmarking report. A new report by Wood Mackenzie says RRC has the lowest breakeven costs of any operator in the entire Marcellus region, and the company has the second greatest amount of reserves.

Management mentioned its ability to reduce year-over-year capital expenditures by 45% and still maintain a growth profile of at least 20% speaks volumes for its ability to operate in such a difficult environment. The company believes a maintenance capital of only $200 to $220 million is enough to replace its reserves.

In the near-term, RRC’s trailing twelve month debt-to-EBITDAX ratio has climbed to 3.3x in the new commodity environment, but management is not concerned. “This leverage ratio is charted territory for Range, as we have been over 3.0x on several occasions over the years,” said Manny. “Even though we no longer have a debt-to-EBITDAX loan covenant and our next annual borrowing base determination isn’t until May of next year, our stance on leverage has not changed.” A possible asset sale would bring the leverage back under the 3.0x multiple. Divestures is also charted territory, as the Marcellus/Utica leader has sold more than $3 billion in assets in the last ten years.