Range Resources Corporation (ticker: RRC) is a leading independent oil and natural gas producer with operations focused in Appalachia and the southwest region of the United States. The Company pursues an organic growth strategy targeting high return, low-cost projects within its large inventory of low risk, development drilling opportunities.

For the past decade, Range Resources has evolved into one of the largest producers of the Marcellus Shale and surpassed the 1 Bcfe/d gross milestone in December 2013. Overall production from the company is currently 1.1 Bcfe/d net. Range has averaged a 20% compounded yearly growth rate since it entered the Marcellus in 2004, when it was producing roughly 200 Mcfe/d. Range has sustained the upward trend despite selling off roughly $2.3 billion in assets over the last decade.

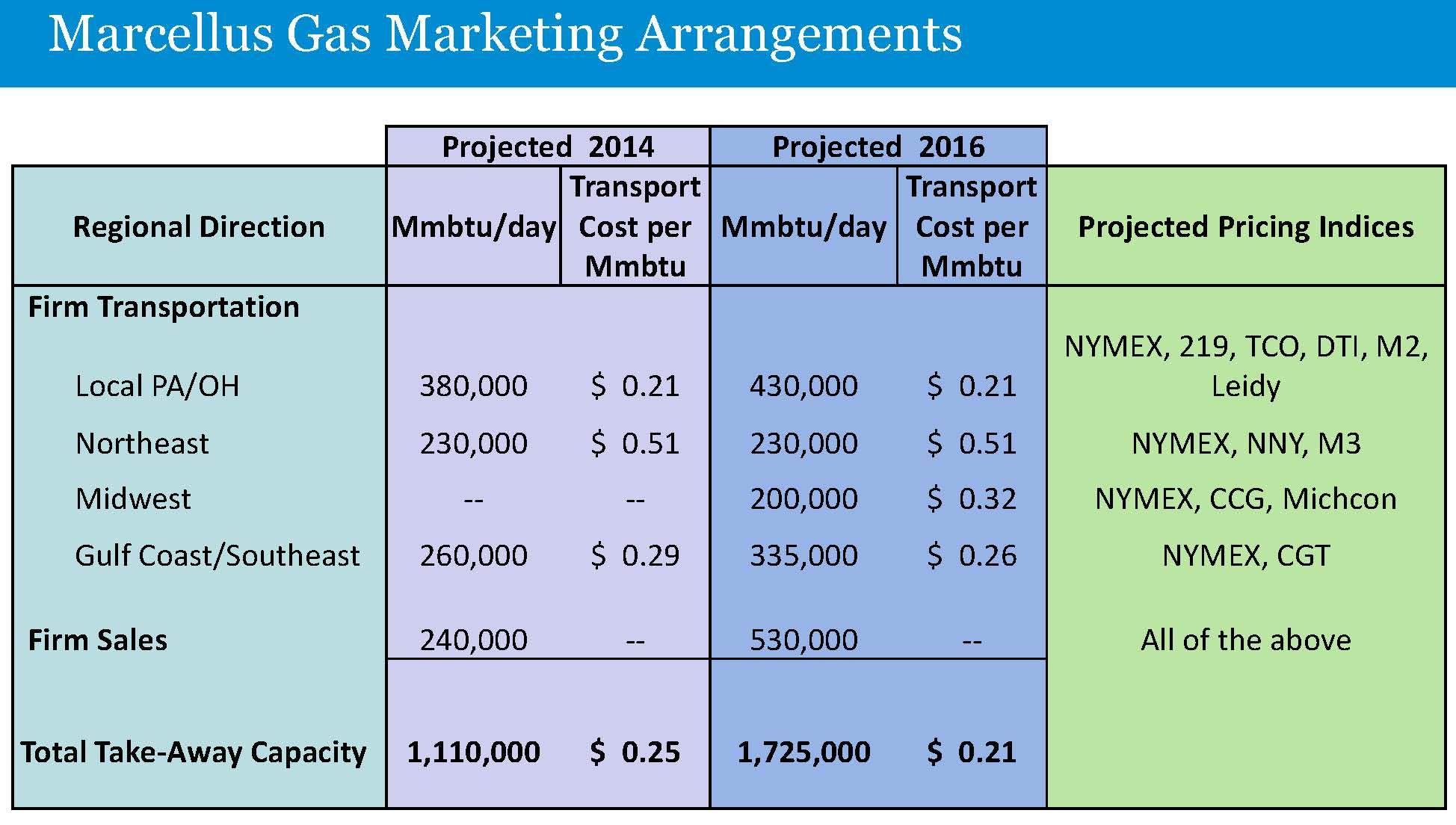

Balance Sheet Strengthened by Decreasing Transportation Costs

Range Resources has historically guarded information on prices and indexes due to market volatility but finally broke its silence in an investor presentation for April 2014. Per the marketing arrangements, total takeaway capacity is projected to reach roughly 1.7 Bcfe/d by 2016 (55% greater than 2014) while transportation costs are expected to simultaneously drop by $0.04 per Bcfe (16% decrease from 2014). Management attributes the improvements to progressing infrastructure in the Northeast markets and the work of its marketing team and the ability to secure favorable contracts.

Source: RRC April 2014 Presentation

Gas Contract Details

In RRC’s Q4’13 conference call, Jeff Ventura, President and Chief Executive Officer of Range Resources, said the company’s marketing team has turned exceptionally rich gas from a detriment to an asset. Rather than pay fees to extract ethane from the gas, Range formulated a marketing plan involving different pricing formulas based on gas quality to meet the needs of customers while minimizing refinement. Today, 85% to 90% of natural gas is under contract to be sold to nine different indices, with only 10% to 15% under contract for what Range believes are volatile indices. Management believes the arrangements enable the company to expand production to 3 Bcfe/d in the near-term.

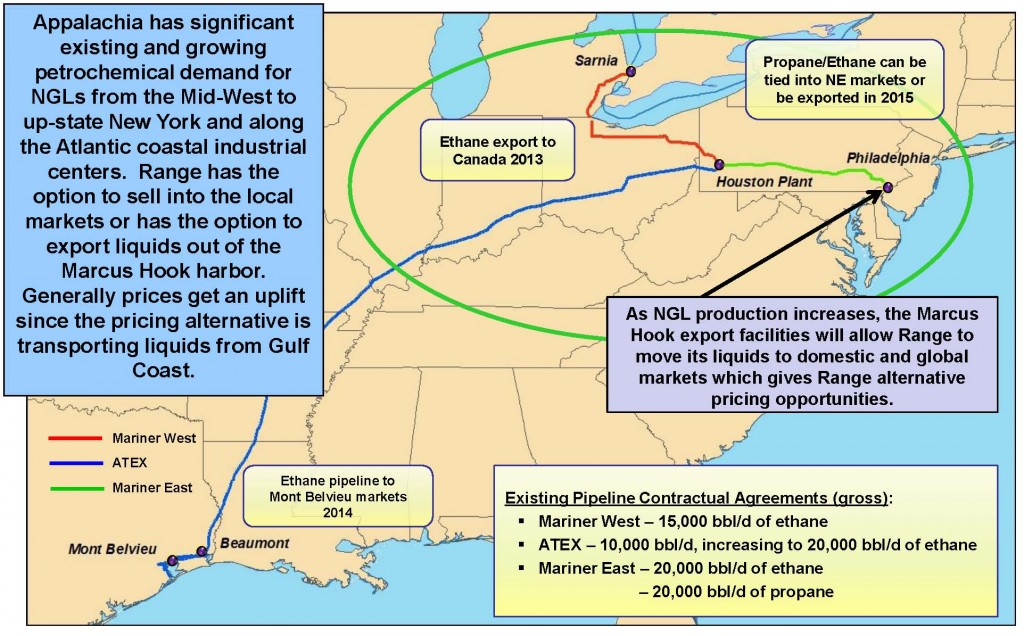

In addition, Range has created a market based purely off of its ethane extraction. Contracts are already in place to move a total of 75,000 barrels of ethane per day to three LNG hubs across North America.

“I think we have the best ethane portfolio that I’m aware of,” said Ventura at a conference on April 8, 2014. “Once all three pipelines are running, net (revenue) to us is a 25% cost uplift as opposed to selling as BTU… If you look at all those projects combined, it clears the path for us to get to greater than 3 Bcf/d, and that’s big when we’re continuing on a 20%-25 % line of sight growth.”

RRC Backed by Pipeline Projects

Source: RRC April 2014 Presentation

A Range Resources representative provided more information on the pipelines in an exclusive interview with OAG360. The pipelines include:

- Mariner West. The project that went online late in 2013 and has no transportation costs to RRC. The line is self-sufficient and takes out enough ethane from the gas to meet the required specifications.

- Mont Belvieu. Range elects to pay a transportation fee and then sells the product on the market. No contracts are currently in place. The representative said, if not for RRC’s ethane extraction method, the company would lose money shipping its resources to this location. However, RRC is able to cut out the refining process and ultimately return a profit in a difficult region.

- Mariner East. This pipeline is viewed by Range as its most favorable due to exposure in the energy-hungry Northeast and European export markets. RRC holds an exclusive contract with Eneos and NGLs are transported across the Atlantic Ocean at no cost to Range. The representative called this partnership a win/win situation for both parties. The pipeline will become fully operational in 2015.

The representative said Range is comfortable in its position now, but additional pipelines and contracts can be negotiated in the future if necessary. Talks about a Mariner 2 project are underway, but construction of the line is not imminent. All of Range’s major lines will be bidirectional and increase efficiency.

Range and its Line of Sight

The ethane projects, once operational, will allow Range to increase its gross Marcellus capacity to 1.8 Bcf/d. Its current movement level is staying ahead of the curve and will increase from its current level of 3 net Bcf/d to between 4 and 5 net Bcf/d by 2017.

The company has been a pioneer of sorts in the Northeast, and Ventura said the dropping costs are a product of getting a head start on the rest of the industry. Ventura says: “We started early. We had the advantage of picking (up contracts) in 2007 when a lot of our competitors weren’t convinced the Marcellus was going to grow and build, so being the first mover with a high quality team has given us a big advantage.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.