“We believe the returns in Terryville rival the Southern Marcellus”: Jeff Ventura

Range Resources (ticker: RRC), the legacy shale gas developer credited with discovering the Marcellus shale play, announced today that it will acquire all of the outstanding shares of Memorial Resource Development Corp. (ticker: MRD) in an all-stock transaction valued at $4.4 billion. The acquisition by Range of Memorial places the Terryville natural gas asset in northern Louisiana into Range’s portfolio.

Range said the valuation includes the assumption of MRD’s net debt, which was $1.1 billion as of March 31, 2016.

MRD shareholders will receive 0.375 shares of Range common stock for each share of MRD common stock held. Based on the Range closing price on May 13, 2016, the transaction has an implied value to MRD shareholders of $15.75 per share, representing a 17% premium to the closing price of MRD stock. Following the transaction, shareholders of MRD are expected to own approximately 31% of the outstanding shares of Range. MRD will have the right to nominate an independent director from MRD to a seat on Range’s Board. Both boards unanimously approved the terms of the agreement. The transaction is expected to close in the second half of 2016 following customary approvals.

In a press release Jeff Ventura, Range’s chief executive, summed up the transaction as combining “two high-quality unconventional producers with large de-risked, high-return projects into one portfolio.”

Memorial Resource Development’s Terryville Assets – Range Resources is Acquiring MRD in an all stock transaction valued at $4.4 billion.

The acquisition of Memorial gives Range the long-lived northern Louisiana assets of Memorial—Terryville—an area that has been producing since 1954.

Range is getting an “accretive transaction, high margin production, high quality rock, proximity to higher prices and growing gas and liquids markets in Gulf coast/SE U.S. region”

Jeff Ventura talked about the combination in the conference call today: “Finding an accretive transaction that competes with our results in the Southwest Marcellus is not a small hurdle. Therefore, any potential transaction has to start with high quality assets. The Terryville assets particularly the Upper Red are highly prolific well developed by a high quality technical team was evidenced by their industry leading production rates per well. Similar to the Marcellus, the Upper Red is relatively low risk, highly repeatable, high quality rock.

“Terryville is a stack pay area that provides future upside and the ability to drive operational efficiencies and improvements to our cost structures in the months and years ahead. Terryville also has the advantage of being in close proximity the growing demand and the higher prices near the Gulf Coast, boosting relative returns. When closed this transaction will be immediately accretive to cash flow per share as a result of Memorial’s high margin production.”

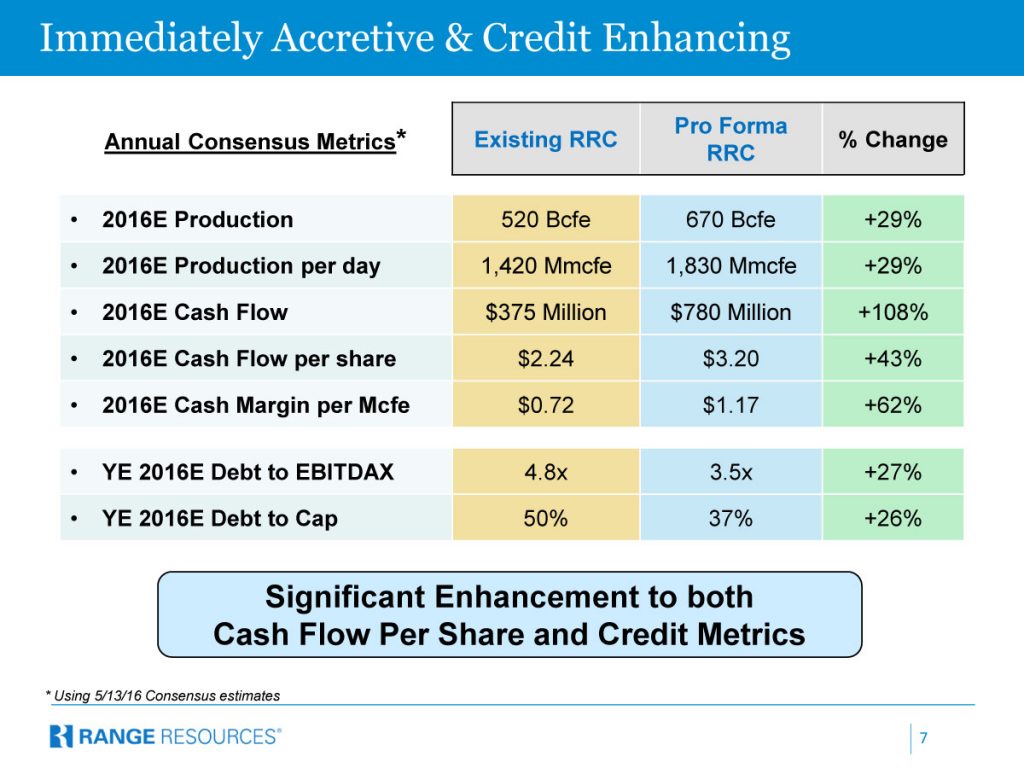

Ventura went on to point out that on a pro forma basis, Range will “improve its 2016 margins by approximately $0.45 per Mcfe based on analyst consensus. Memorial also has hedges in place to cover approximately 270 million per day of 2017 production at an average floor price of $3.50, securing a significant portion of the expected cash flow next year.”

Memorial’s Terryville Play

In the conference call, Range’s Chief Operating Officer Ray Walker, summarized some of the aspects of the Terryville assets.

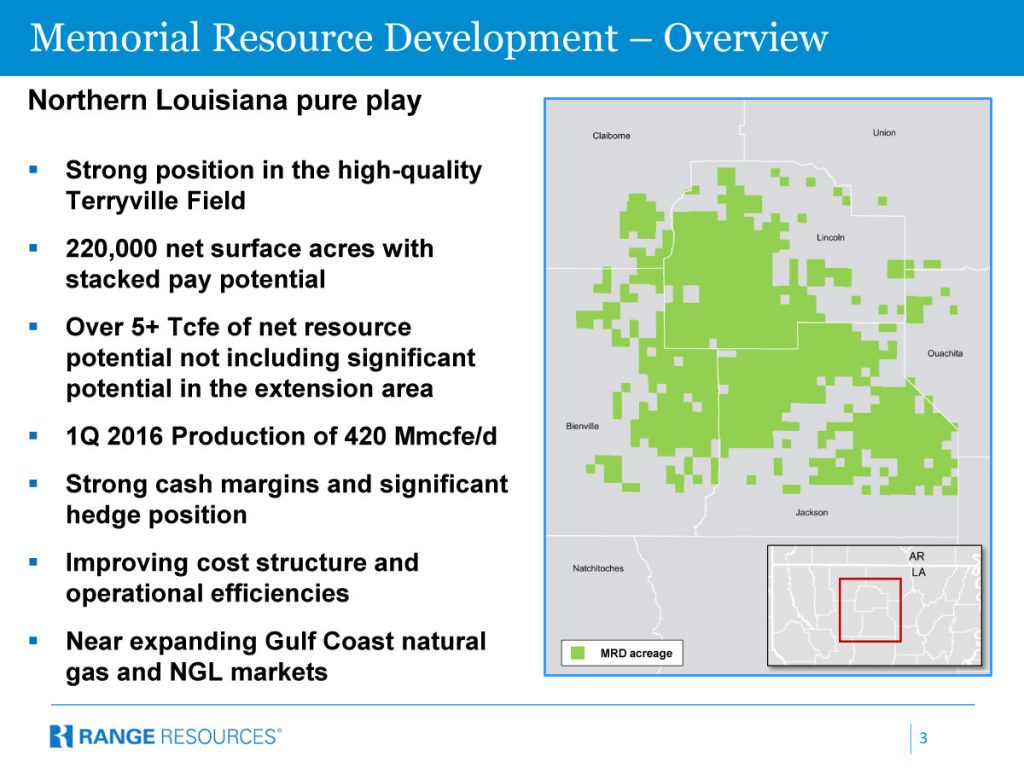

- 220,000 net surface acres

- Geo-pressured lower Cotton Valley

- Multi-year inventory

- 5 Tcf equivalent of net resource potential, not including the very attractive southern expansion area

- Q1 production – 420 million cubic feet equivalent per day

- Memorial team has achieved a 26% reduction in well cost, a 28% improvement in drilling times, and a 31% improvement in frac execution time

Marcellus and Terryville – similarities

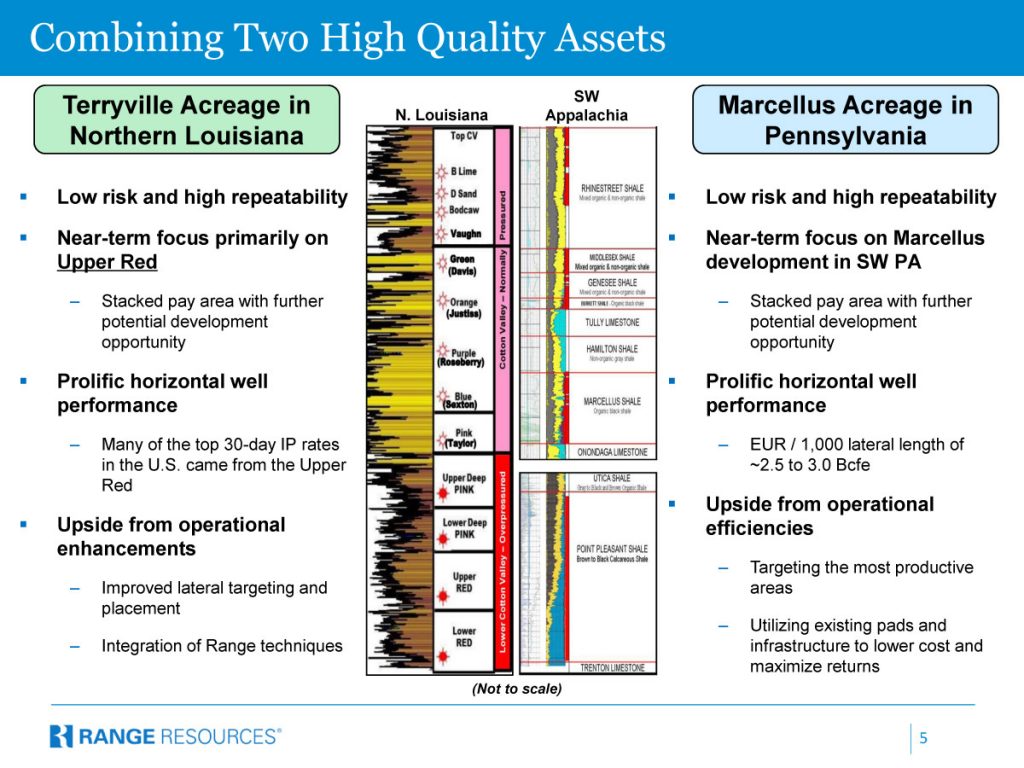

Walker went through some of the similarities between the two producers in their respective plays.

“Range has over 1,000 horizontal wells in almost 12 years of production history in the Marcellus.

“The Terryville field is de-risked by 15 horizontal offset wells, drilled by others and by over a 100 horizontal wells drilled by Memorial. The Southern expansion area has four adjacent ELG horizontal wells and 110 lower Cotton Valley vertical producers on the expansion area acreage and this directly offset by the Vernon Field, which is over 350 wells and over a TCF of production.

“Both Range and Memorial positions have extensive 3D coverage further de-risking future potential. Both plays have primarily focused in only one interval today leaving a lot of potential for infield and

stacked-pay development going forward. Both plays are stellar performers. Range’s Southwest Pennsylvania Marcellus is the best performing EUR per 1,000 foot of lateral in that portion of the basin and even after 10 plus years, we’re still seeing improving performance. We have some of the best economics in the entire Marcellus play and we have not drilled our best well yet.

“The Memorial team has drilled a 105 horizontal wells in just a few short years and 101 of those wells are in the top 10% of gas wells drilled in the U.S. This is an unbelievable and a real testament to the quality of the rock and importantly the quality of the team. I don’t believe they’ve drilled their best well yet either,” Walker said.

“The Memorial team has drilled a 105 horizontal wells in just a few short years and 101 of those wells are in the top 10% of gas wells drilled in the U.S. This is an unbelievable and a real testament to the quality of the rock and importantly the quality of the team. I don’t believe they’ve drilled their best well yet either,” Walker said.

Business Case Upside

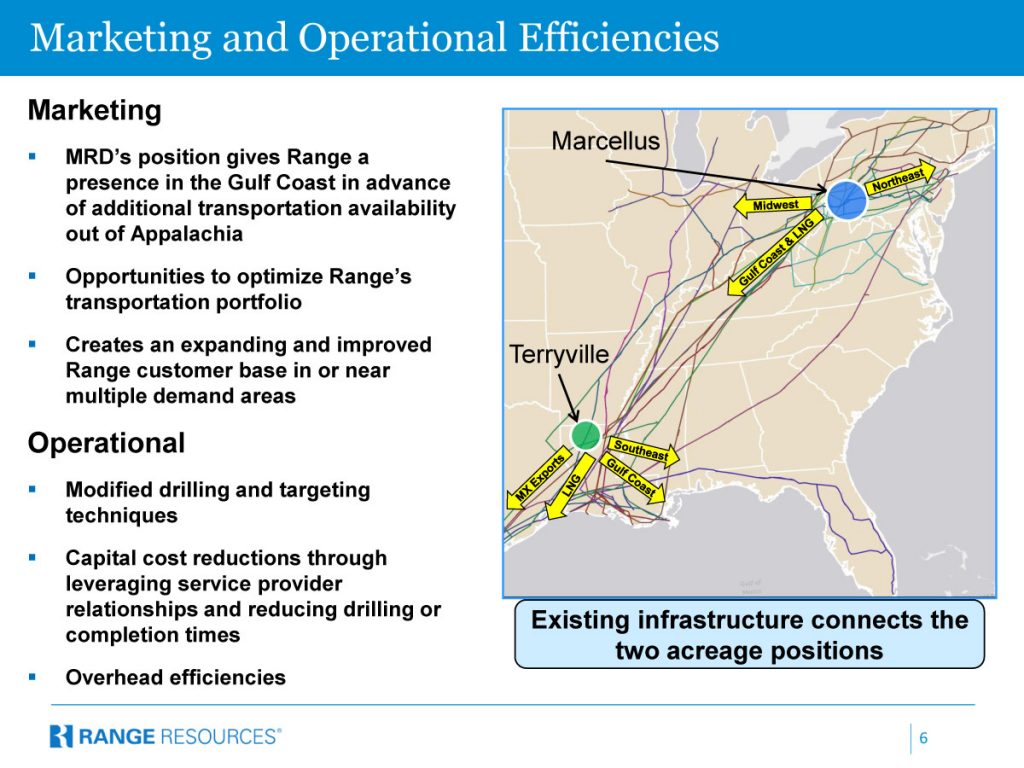

Ventura summed up the benefits of the merger as follows: “We’ll have a dominant position in the core of the Appalachian Basin and proximity to major northeast population centers, feeding domestic consumer demand as well as international petrochemical demand. We’ll also have a sizable position in the prolific North Louisiana Terryville Complex, in close proximity to Gulf Coast industrial and petrochemical demand, LNG export facilities, Mexican pipeline exports and new power generation demand.

Conference Call Q & A

Below is a summary of the Q&A in today’s conference call with analysts about the merger.

Q: How do you think that capital allocation plays out between two of the better gas assets out there?

RRC: Basically it gives us the optionality to be able to allocate capital to what we see best returns will be, which is a great position to be in. We think there’s marketing advantages, some of our transportation links directly down to where they are. So that creates some great optionality in terms of how we can maximize our transportation portfolio. So, it’s – having high quality assets in two area – having choices is always good, having choices between two great assets and two teams is a really good thing to have.

And then there – from a marketing perspective, their location relative to the Gulf Coast and the demand centers obviously is a nice advantage and have transportation that connects it. And then it’s great that we’re able to do that, it’s an operationally led transaction that really makes us a better, stronger company, but it also helps significantly with the balance sheet. It’s great that it’s immediately cash flow accretive in delevering with all the efficiencies that it brings. So, we’re very excited about the Transaction.

Q: What do you like about the Upper Red versus the Marcellus and then – shale versus a sand play, as you think about the Lower Red and upper things and other zones that MRD has, how your technical team can add value to those zones as well?

RRC: I think that we’ve got a lot of expertise, we’ve been up the learning curve for a lot of years now, we fine-tuned a lot of techniques that I think are unique to range and our performance is good reason, why we are where we are. Looking at the Memorial assets down there, we see that clearly, the Memorial team’s done a great job. I mean, when you look at just the facts, the – that they’ve done a 105 horizontals and 101 of those were in the top 10% of wells that have ever been done. Its economics are really good. Like Jeff said, not to repeat all of that, but it’s close to the markets, it’s got really attractive pricing and cash flow. It just makes a lot of sense to have a lot of potential left – potential locations left to drill on the Terryville Complex itself. We believe there’s some infill potential there. Of course, it’s got the stack pay potential, and of course, we’ve got a lot of experience with that in the Marcellus, that we think will transfer. And then, it’s got some really attractive expansion opportunities in a lot of that Southern acreage, lot of offset activities, we got producers on it, it’s in the geo-pressured lower Cotton Valley. … I wouldn’t expect a lot of changes in capital allocation or anything for this year, we’re pretty much going to – I think we’re going to see exactly what both of us have been talking about, and then, later this year, like we do typically in the cycle, we’ll begin putting together plans for 2017 and like Jeff said has an option, having really high class options in two of the best plays out there is going to be an awesome opportunity of course going forward.

Q: Lot of discussion around leverage metrics as part of the rationale for doing this, I know you’re clear to say it was an operationally led transaction but can you speak to a little bit given that there were no real concerns over violating financial covenants weighing an acquisition versus just doing potentially straight equity as a solution to deleveraging?

RRC: When you look at that Range is an operating strategy driven given company and when you look at all of our activities for the last decade and a half, that’s really what’s driving the bus. That said, we all have attempted to combine operating strategy of objectives with our financial strategy of objectives, a great example of that is the $4 billion plus in asset sales we’ve consummated over the last eight years to 10 years. All of those transactions were operations driven but they also raised funds for the company to grow focused us on our highest return plays, high graded the assets. So it’s a good example of how we prefer to combine operating strategy and financial strategy elements into a single transaction. In pursuing this opportunity, we saw exactly that, the opportunity to perform a really accretive transaction from an operating perspective, but also from a financial perspective. So, we’re really happy about that attribute of the deal. I wouldn’t say that either one side of the balance sheet or the other let us to the transaction. I think together they did and I think the results will be superior because of it.

Q: Following-up on your comments of the $4 billion divestitures, realizing kind of the debts of your portfolio, up in the Marcellus and if we think of it from a stacked-pay perspective, Utica, Devonian, do you think about carving-off any of your asset base, divesting any slug of either the Terryville assets or small slug of the Marcellus assets to further enhance the balance sheet going forward?

RRC: We still have some assets in the Midcontinent, perhaps see us divest with time. And I think, choosing the time and the perspective buyers are really critical. To the extent it makes sense to do so elsewhere, we’ll consider that as we always have and I think people should – like Roger said over the last decade, we sold $4 billion worth of assets. So, people could clearly understand – we always from our perspective try to do the best thing in terms of making us a better stronger company. This transaction is going the other way, it’s adding to it. But adding to what we have, this will make us a better stronger company but we’ll – whatever that is you can be assured that our team is always looking for ways to get a little bit better every day.

Q: I know obviously those guys had Jay and the guys were talking about bringing on three kind of new wells in the area and continually delineate that area, will that be the plan or is it still a little bit too early to speculate on that?

RRC: We think that there’s high quality opportunities right in Terryville in and around in multiple horizons as well as the extension areas to the south, where they’re currently drilling. So there’s really five look alikes to Terryville and Burnett. That’s very exciting opportunity and provides nice upside, but there’s a lot of low risk things to do but there is great ways to enhance it for the team, their team in fact have as you might have guessed, I’ve been talking to Jay for quite a while. So they’re in a process of that. They’ve done a great job when we look forward to just continuing their plan.

Q: On the Midstream side there’s a lot of opportunities between now the two companies, given just how proactive you all have continued to be in the Appalachian obviously given the position that they have, can you maybe talk on that a bit and will you mention here the opportunities to optimize similar Range’s transportation portfolio, I’d kind of curious does seem like there is some opportunities because the synergies in this midstream – can you maybe talk on that a bit?

RRC: I’ll give you an example. We think – in time a lot of opportunities will come out of that based on where the two assets are located example and a simple example might be – we have transportation obviously you can look at on our presentation, when talking about going to the Gulf Coast. But by having both assets, at times and for example – when we get in winter time, in Northeast particularly if we have a normal or cold winter, there is great opportunities in the Northeast to the extent with this transaction – what this will enable us to do is may be supply the contracts we have in the southern part of the U.S. or Gulf Coast with gas from Terryville keep the gas that we have in the Northeast to take advantage of opportunities when pricing is higher up there, and then sell the transportation in between. Now so having both assets creates a lot of optionality that’s just one example of things that we can do.

RRC: I’ll give you an example. We think – in time a lot of opportunities will come out of that based on where the two assets are located example and a simple example might be – we have transportation obviously you can look at on our presentation, when talking about going to the Gulf Coast. But by having both assets, at times and for example – when we get in winter time, in Northeast particularly if we have a normal or cold winter, there is great opportunities in the Northeast to the extent with this transaction – what this will enable us to do is may be supply the contracts we have in the southern part of the U.S. or Gulf Coast with gas from Terryville keep the gas that we have in the Northeast to take advantage of opportunities when pricing is higher up there, and then sell the transportation in between. Now so having both assets creates a lot of optionality that’s just one example of things that we can do.

Obviously a lot of demand down in the Gulf Coast and into the Southeast and power generation and we – and I’d believe demand for gas will surprise to the high side because it’s a clean or better fuel and having the best assets, the two premier assets in two great locations with the connection in between will give us a lot of optionality to maximize that value that others won’t have.

And having a multiyear inventory of wells to develop in both – on both ends, essentially in Appalachia and Northern Louisiana is going to make us a real attractive supplier for that – all that new demand that’s coming on board. A lot of those customers today are worried about long term sustainability, are they are going to be able to buy gas year after year after year especially, as we look at the Mexican exports and LNG exports and even the international deals that the unique deals that we’re in for LNG exports and even the international deals that the unique deals that we’re in for propane and ethane as such.

So this is going to give us a ton of optionality to be able to – be able to leverage a lot of those relationships that we’ve already created over the last ten years and as – as it grows going forward.

Q: The pro forma for Range, is that just with the – to me it looks like that was just kind of what the guidance was for both geologists that combines, I assume I think you said Jeff kind of what those guys they were going to let a couple of rigs go, I think from the five they have now, that’s just sort of the combination of the two guidance that was out there?

RRC: Yeah the footnote on the bottom that’s based on a consensus estimates, which would include for that.

Q: I don’t know if you can comment on them at this point, but the lockups for MRD, could you perhaps talk about it and the other thing is whether this was a competitive situation?

RRC: In terms of the second question first quarter to answer that, internally we always look at ways to make our company better and stronger. So we’ve looked at things for a long while you’re seeing us now acquaint something, so it’s an opportunity that we identified, that we thought was very exciting in a great way to improve the company. We began talking with Jay and the Memorial team really in early February. So the discussions began – there has been a lots of due diligence and its heavily negotiated on both sides and I think we ended up with the transaction that’s very good for both sides. So that’s kind of how it came about. The first part of that question, I’m looking at our General Counsel in terms of lock up. David anything that we can say about that.

RRC: With regards to lock ups we’ll obviously be following the merger agreement related agreements in the next day or so and the detail of it I really refer you to the agreements themselves. But as you would expect in the transaction like this where you’ve got a significant amount of the shares held by folks that are affiliated with the company. There will be a lockup provision that are going to apply to substantial portion of the shares that will be distributed to those individuals on closing.

Q: Okay, thanks. And a final one for me any deal on MRD’s bank debt addressing it somehow or just keeping it as is.

RRC: We’ve got 29 banks in our group, they’ve got 20 in there’s. We’ve got relationships with 19 of the 20. So I think that’s going to be pretty easy and the bonds there is a change of control put and we’ll see how that evolves with the transaction. Obviously we have an unused essentially $3 billion committed borrowing base. It was just recently approved. That’s approved for a full year. So it runs through May of 2017. So we have the liquidity currently in hand to take care of whatever might arise on the debt side of their balance sheet.

Q: Just curious if you’d like to talk about the Northeast area and your view on transportation and color your thoughts on this transaction obviously diversifying but anything you could say on sort of the pace that maybe push it towards diversifying a little bit particularly post NORA.

RRC: Yeah, let me comment on that. I think what really led us is it gets back to we think they have excellent quality, excellent returns and it’s just really a strong asset and again it’s a transaction that we have the optionality of being allocated capital, significantly deleveraging cash flow per share, improved margins, reduced leverage all that type of stuff. That being said, there is marketing synergies and clearly where their assets are located is their integrated area. When you look at natural gas price and differentials, but only be clear, if we really like the Marcellus, we have great you know – we’re going to stay active there. We got a fantastic position, as they, I’d say it’s a world class asset which STACK pays.

We think differentials in the Marcellus will improve with time and particularly in the Southwest part of the play, maybe more challenged farther up in the Northeast part of Pennsylvania, but what we are in the Southwest and the STACK pay area. We’re in the area of the best infrastructure. So we think differentials will get better that’s a nice upside for Range [indiscernible] actually if you look at the Range presentation, we have our net bags for 2016 are better than they were in 2015 that we’re projecting or projecting in 2017 they improve again. So all those things are going in the right direction. This isn’t the statement at all about the Marcellus we have absolute confidence in our team and our assets there. This just makes us a better stronger company and we think that we were an excellent company before, we think we’re even a better company today.

Q: On the change of control on the bonds, I think there’s that $600 million in notes, the mechanics of that is that typically portable [indiscernible] after closing.

RRC: Yeah we’ll manage that process, John just as efficiently as we can. We’ll do – what makes the most sense to work with that issue. So I think it’s pretty mature to really know how it’s all going to transpire but you’re absolutely correct. There is a change of control put there and our bonds stayed very close to the same price right now. So I don’t see any issues on the bond side of plenty of liquidity to take care of whatever arises whenever it arises.

Q: one of the benchmarks of the Range story over the last couple of years has been a gradual and fairly consistent improvement in your completions. You’ve continuous surprise and things like [indiscernible] consecutive things about nature. So I’m just wondering as you look at what MRP has done and what you guys have done, are there any obvious technical differences that you think in either directions whether them coming to you or you coming to them coming to you or you coming to them in terms of what you think the Terryville asset looks like under Range as you operate it?

RRC: Yeah that’s a great question and like I went through in my remarks to start off the call, I mean, there is a lot of similarities when you look at what most of us talk about for instance on the last quarterly call improved drilling cost, improved frac execution time. The facilities are improving and so forth and I think when you look at our track record in the Marcellus like you said very impressive. Our team is I think world class team, its continued to improve and improve and improve performance and cost and efficiencies. I think we’ve learned a lot, we have a very high-tech database innovative organization in Pennsylvania that is really focused on improvements all along the road extensive reservoir models and just some high end stuff that most of us older guys wouldn’t even dream you could do years ago. And I think there is a high probability that we can take some of those learnings and put that to work in the Terryville and make some substantial steps that changes, cost, efficiencies, operations, completion designs, lateral targeting, reservoir modeling, I think we can do a lot of that. That does not mean by any means that a Memorial team’s done a poor job. I mean remember the 101 of their 105 wells are the top 10% well ever drilled. So they’re already doing a great job, but I do

think that we got a lot more years lot more under our belt and I think that it’s going to be a combination unlike I said earlier, it’s not just adding to that, so it’s also a multi – it’s really multiplying the abilities of the two teams to exponentially improve what were both doing and I think, we’ll see some of that on both sides.

Q: A concern about MRD’s operation, is that it may be too capital intensive, perhaps only to what could be steeper decline rates coming from applying modern day completion designs to what are still conventional reservoirs at Terryville? How do you address this concern? And what does this mean to Range’s own capital intensity and capital efficiency going forward, including the change in the base decline rate?

RRC: Let me just start with by saying, this year, they’re looking at 20% growth within cash flow, that’s pretty darn good. You look at on the hedge recycle ratios for both company, I would argue that they’re not only class-leading for natural gas producers, but for oil producers or on either side in the U.S. So, it’s the strongest economics I think of oil or gas. And so, I think it puts us in good shape

RRC: Let me just start with by saying, this year, they’re looking at 20% growth within cash flow, that’s pretty darn good. You look at on the hedge recycle ratios for both company, I would argue that they’re not only class-leading for natural gas producers, but for oil producers or on either side in the U.S. So, it’s the strongest economics I think of oil or gas. And so, I think it puts us in good shape

When you put the two pieces together and do the analysis, what you’re going to see is with our large production volume and our retentively low decline rate, it doesn’t materially move our decline rate. It may move it from 19 percentage what we’ve said to maybe combine them together somewhere in the mid-20%s. So, you’re not looking at a huge change in decline rate.

The other thing, as well as what you’ve seen with our maintenance capital to be able to hold production plan. On the last call, we talked about somewhere in the $300 million range for Range. You also probably saw that MRD’s stock was, earlier talking about a $150 million, but that was before they really accounted for a lot of their lower drilling and completion costs. So, really you’re talking about a relatively low maintenance capital and then the ability to be able to grow from that standpoint.

And I would say, combined decline rate, like Alan said in the mid-20%s is still better than most of our Appalachian peers at our Marcellus only.

Q: How many folks are in MRD’s operating team will join the combined company? I asked that question just in light of the conventional resources being acquired and maybe the different expertise that maybe necessary to exploit that asset base?

RRC: Well, at this point, of course, we’re planning to keep nearly all of them. We clearly have get our arms around it. The transaction doesn’t close till late third quarter, early fourth quarter, and we’re going to want some time after that to work with them, to integrate technologies. At this point, and of course all the field employees we would keep for sure, and I would expect that almost all of the Houston employees we would keep, also especially the petro professionals, the engineers, geologists, landman, tax analyst and those sort of folks for sure, I think past added. You have to be determined once we pull the two teams together and of course the senior management team, it will be us. And I think we’re beginning to work on the integration plan that will fated all that out much later this year, as we get closer to closing.

Q: If you look at slide eight, the recycle ratio for MRD, it’s certainly is attractive in works with that $5 PUD as a de-cost. But it looks like this will be about 2x too high if you believe that the average Upper Red Well is 20 Bcf and well costs are now under $9 million. So, I guess my question is whether we should believe that you guys believe the average Upper Red Well is 20 Bcf and that just naturally there is a lot of downward pressure before even going there and sweep things operationally on that $5 metric there?

Q: If you look at slide eight, the recycle ratio for MRD, it’s certainly is attractive in works with that $5 PUD as a de-cost. But it looks like this will be about 2x too high if you believe that the average Upper Red Well is 20 Bcf and well costs are now under $9 million. So, I guess my question is whether we should believe that you guys believe the average Upper Red Well is 20 Bcf and that just naturally there is a lot of downward pressure before even going there and sweep things operationally on that $5 metric there?

RRC: If you look at, it’s year-end 2015 PUD cost, which would be based upon what they disclose in their 10-K, which is around $11.5 million growing cost. So, what you’re going to see is that cost is going to come down fairly materially based upon the recent capital numbers that they’re talked about somewhere in the $8.7 million range currently getting down to about a $8.4 million by the end of the year. I believe if I by do the math very quickly in my head, that moves it to somewhere – that moves it to somewhere in the $0.60 range which will be very comparable to what our number would, is this well. So it is something that we see is very strong and moving forward they’re going to be very comparable.

Q: On location count for the upper, Memorial lease out over 1,700, how did you guys think about this being risking that location comp in more conventional in nature at this point to hear your thought process on that?

A: When we did the analysis – this is Alan again. When we did a analysis, we’ve done a fair amount of due diligence on this and we really looked at the inventory in a number of location that were there and we think we’ve really risked it appropriately and as a result there was a multiyear drilling inventory of what they have. We believe it’s going to be a combination because of the stack pay nature of what’s out there. There’s going to be multiple pay enables, there is also going to be the opportunities for some tighter spacing as well in addition expanding the area to the South.

Q: Does this transaction end your need to divest properties. Are you pretty good with your balance sheet and where you’re going from here or do we expect to see more one-off things to kind of reduce leverage.

RRC: The divestitures do many things for us. If you go back we started divesting of non-core assets about 10 years ago. And there is things that, and I can give you different examples. For instance, when we were in the Barnett we got to the point because it’s about building and hydrating the inventory focusing our capital on our best assets and divesting of things that don’t compete.

So the Barnett for instance, we got to the point that we never were going to drill another Barnett well because the economics didn’t compete with anything in the Marcellus, so by divesting it keeps our capital focused in the highest quality assets. It keeps our teams focus that way. It’s a source of funding. It reduces operating expense. So we’ve tended to divest things that don’t compete from a capital point of view that have higher LOE and that type of thing. And we’d become a better and better company with time, I think this transaction will continue that. Like I said, there is still might be areas that we think at the proper time might be worthy of selling. For instance our Northern Oklahoma, we add two packages in the Mid Continent, we sold the Southern one that within statutory and we had another acreage position just north of it. That clearly isn’t core to us probably in time we’ll be really valuable to someone else, so you’ll see us continue to do those types of things, but any other color, Roger you want to add?

This makes Range a much more durable story much more durable company and I think that applies to the balance sheet leverage as well. That brings the leverage down, reduces its sensitivity and I think it places us – places the leverage ratios in a real comfortable place for us. So we don’t with no covenants or anything out there, no interim maturities, no financing contingencies, we’re very pleased with where this places the balance sheet in the combination alone.

Q: Do you think you’re going to have a different strategy for Terryville? Is there going to be kind of a more shift for development versus step out or is it to too early to get into that?

RRC: Well I think it’s too early to get into that for sure, but we will – I think you can look at our track record in the Marcellus and we very much a lot of the same thing. We will continue with the plans that they have in place, we’ll continue to do a lot of development drilling, trying to getting to a manufacturing mode. We believe like Alan said there is significant infield potential or probably do something testing there and then like we talked about much earlier, I think Jeff answered the question, but they already have a plan to start testing some of the southern expansion area. We’re really excited about that. We see a lot of opportunity there and I think they’ve got one of those wells going right now and plans to at least one or two more I think this year, so I think it’s too early to lay out any definite plans at this point. We’ve got a lot of integration to do. We still in spite of doing months’ worth of due diligence we still have a lot to learn once we take it over and I think we’re excited about the future going together, it’s going to give us a lot of great options and a lot of great opportunities to really create value as we look at all these potential things that we could do down there.

Q: Returning quickly to transportation I just wanted this is the merger providing a market expansion for your South-West PA liquids production.

RRC: Well I think in terms of the South West PA liquids production, we’re already in great shape. We have with Mariner East coming on, a great outlet for propane to be able to export at a market facility, we believe it in to the northeast or there is good markets at certain times or to move it really all around the globe and we’ve got a team in place that’s doing a great job with that. In terms of ethane, we have three outlets. We’re excited with the relationship we have with [indiscernible] a good partner as well as NOVA. And then, we have the optionality with ATEX to bring some to the Gulf Coast. And looking forward, that’s another exciting part about the Range story is the potential improvement in ethane prices as the crackers and different things come on that people have been spending billions of dollars on. So there could be a nice uplift literally not too far in a distant future, as well as, the exports of everything from ethane now leaving the U.S. as well as propane. So we’ll be in good position with the Terryville assets will be in good position with the Range assets.

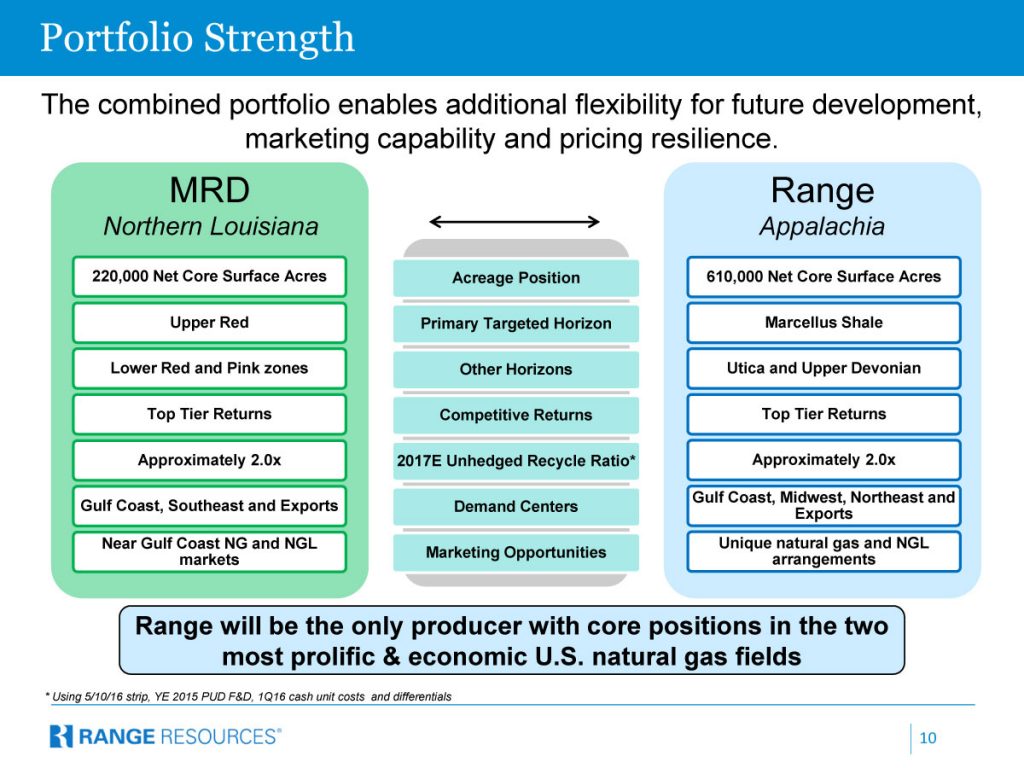

Q: Slide 10 clearly shows that the Upper Red and the Marcellus are the current zones for capital allocation in the near future. I was wondering maybe if you could rank order how the other Terryville zones and the secondary Appalachian zones might move forward towards activity a few years out and I ask that because I noticed a recent impressive Lower Red results from MRD?

Q: Slide 10 clearly shows that the Upper Red and the Marcellus are the current zones for capital allocation in the near future. I was wondering maybe if you could rank order how the other Terryville zones and the secondary Appalachian zones might move forward towards activity a few years out and I ask that because I noticed a recent impressive Lower Red results from MRD?

A: That’s a great question. And, yes, they do have some very impressive results in the Lower Red and

even a few of the [indiscernible] completions. We think there is a lot of staked-pay potential there. I think it is just like we’ve been talking about throughout the whole call, we’ve got lots of really good options here.

And I think as we start developing plans for 2017 and 2018 and beyond we’ll start incorporating more and more tests to that – more and more tests of infields, some expansion opportunities, we’ll still be looking at The Utica/Point Pleasant completions in Southwest PA, still got the Upper Devonia there.

Both, the great thing about this is both projects are really stacked pay potential, there are over to geo pressured type reservoirs, there is lots of 3D that we’ve got in both cases, there is lots of penetrations and active producer wells and offset activity, it’s just a great, great story and so they’re both very attractive offsets and with loss effect by potential and I do believe we’ll start working more and more of those and as we go forward.

Range Presentation on the Merger

View the Range Resources slide presentation regarding the merger with MRD.

Analyst Commentary

ANALYST OPINION

From SunTrust Robinson Humphrey

Memorial Acquisition Boosts Near-term Credit Metrics, Liquidity and Inventory

Rating: Neutral

Market Cap (M): $6,995; Price: $42.01 as of 05/13/2016

Price Target: $45.00

Sector: Exploration & Production

Range Resources announced one of the first corporate deals we have seen since the 2014 massive decline in commodity prices with an acquisition of Memorial Resource Development (MRD, $13.45, Buy) for $4.4 billion or $15.75/sh all stock (17% premium). For Range, the deal significantly boosts liquidity and lowers leverage in the all equity deal while also increases pro-forma 2016 cash flow from ops to ~$750mm from ~$375mm prior. Importantly, Range’s leverage drops to 3.5x from 4.8x prior and pro-forma liquidity should be well over $2B vs. $1.7B prior. Other contributing factors of the deal were likely Memorial’s ~220,000 Gulf Coast acres and the new strong combined hedge book. Sad to see the Memorial guys ride off but we know they’ll be back… We expect Memorial to clearly outperform today, while RRC is likely under pressure.

Transaction Details:

· MRD shareholders will receive 0.375 share of RRC stock for each MRD common stock held.

· The transaction has the implied value of $15.75/share, representing a 17% premium based on the closing price of $13.45/sh on 5/13/2016.

· Upon closing, MRD shareholders will own ~31% of the outstanding shares of RRC.

· Closing to take place 2H16, subject to shareholder and certain regulatory approvals and customary closing conditions.

· Our Friday closing valuations of 10.8x ‘17EBITDA for MRD versus RRC at 15.4x

Pro-Forma RRC Metrics:

· 2016E Production goes from 520 to 670 Bcfe (up 29%)

· 2016E Cash Flow goes from $375 mm to $780 mm (up 108%)

· YE 2016E Debt to EBITDAX goes from 4.8x down to 3.5x (down 27%)

· YE 2016 E Debt to Cap is reduced from 50% down 37% (down 26%)

· Liquidity likely ~$2.0B from ~$1.7B prior

Rationale:

· Complementing assets: Range establishes Gulf Cost presence by adding 220,000 net surface acres in Terryville Field to its Marcellus-focused portfolio;

· Transportation Portfolio Optimization: Combined transportation portfolio offers larger flexibility and greater exposure to various off-take markets;

· Know-how exchange: RRC should be able to benefit from MRD’s drilling and targeting techniques;

· Corporate and other synergies.

From Wells Fargo

Summary. Range announced the acquisition of Memorial Resource Development for $4.4 Billion enterprise value or a 17% premium to Friday's close in an all-stock transaction. Big picture takeaway for us is the move from a regional bellwether to acquire non-Appalachia gas signals perhaps longer term growth outlook from Appalachia could potentially be constrained by midstream and takeaway. Transaction is expected to close in 2H16 subject to shareholder approval from both RRC and MRD.

Details. RRC announces merger with MRD in all stock transaction valued at $4.4B. Expected to be immediately cash flow accretive. Transaction expected to close in 2H16. MRD shareholders will receive 0.375 shares of RRC for each share of MRD. Transaction implies a $15.75 per share value for MRD shareholders and a 17% premium to Friday's closing price. RRC to assume net debt of $1.1B, however pro-forma 2016E leverage expected to decrease more than 1x. Combined company lead by RRC with MRD to nominate an independent director from MRD to a seat on the board.

Metrics. With 220,000 net acres in North Louisiana, translates to $10,500/acre at $5,000/Mcfe/d; on EBITDA, equates to 12.7x 2017, slightly above gassy peers in our coverage at 12.0x.

RRC Implications. Diversifying out of Appalachia, and getting solid, if early stage acreage with Henry Hub exposure, while de-levering, and increasing resource upside. Stock viewed as Appalachia pure play, and to the extent that deal highlights growth constraints, could be a source of investor concern.

MRD Implications. Given IPO less than two years ago, and largely untested acreage position, company is perhaps leaving some upside on the table given that still in early stages of development. That said, shares have outperformed since IPO (6/12/14) in a difficult commodity tape with transaction coming in 17% below IPO price of $19/share versus 12-month strip gas prices are down 34%, EPX down 59%. Given all-stock transaction, should allow shareholders to participate in upside under new, larger entity.

Range Resources Corp. (RRC-NYSE)--Market Perform (2) / V

Price as of 5/13/2016: $42.01

FY 16 EPS: $-0.49

FY 17 EPS: $-0.61

Shares Out.: 166.8 MM

Market Cap.: $7,007.27 MM

Memorial Resource Development Corp. (MRD-NASDAQ)--Outperform (1) / V

Price as of 5/13/2016: $13.45

FY 16 EPS: $0.47

FY 17 EPS: $0.12

Shares Out.: 203.9 MM

Market Cap.: $2,742.45 MM

Rating Basis Information:

RRC Thesis: Range Resources (RRC) has built an impressive inventory in the Marcellus Shale, one of the preeminent emerging shale plays in the lower 48. Combined with its portfolio elsewhere, this lowers reinvestment risk for shareholders, in our view. However, uncertainty involving future ethane volumes and potential basis risk remain a concern for investors.

MRD Thesis: Memorial Resource Development's operations are concentrated in the Terryville Complex in North Louisiana. The prolific nature of wells at Terryville should drive industry leading production and reserve growth, leading to superior capital efficiency and returns on equity.

From Capital One

RRC and MRD to Merge

RRC - $42.01, Equalweight, $39.00 Target, Velie; MRD - $13.45, Overweight, $19.00 Target, Velie

• Range Resources is set to acquire Memorial Resources in an all-stock transaction valuing Memorial at $15.75 (17% premium). MRD shareholders will receive 0.375 shares of RRC stock for each share of MRD common stock held. The implied equity value is ~$3.3B and RRC will also assume ~$1.1B of MRD's net debt, for a total transaction value of $4.4B.

• At first blush, the deal looks positive for RRC for a number of reasons: 1) the price looks attractive, 2) it looks significantly accretive to RRC's cash flow per share, 3) it will significantly compress RRC's EV/EBITDA multiples, 4) it will improve RRC's projected leverage ratios, and 5) it will diversify RRC's production base and improve margins.

• The take-out price is below Street/COS valuations of $19/$18 per share, respectively, so we believe the deal will be accretive to our $39 NAV est for RRC. On a standalone basis, we estimate RRC is trading at EV/EBITDA multiples of 19.3x/20.0x/12.9x based on ‘16/’17/’18. At the implied purchase price of $15.75, RRC is paying ~9.3x/12.0x/8.6x. We estimate the merger will drive RRC’s multiples down to 14.5x/17.1x/11.3x, which represents significant multiple compression, especially for this year and next. In terms of the impact to RRC’s balance sheet, the company’s standalone leverage ratios at YE16/YE17 are estimated to be 5.2x/5.7x. We project the merger will drive these ratios down to 3.9x/4.8x, a significant improvement.

• A presentation including merger highlights is available on the RRC website and a conference call will be held this morning at 8 AM Central.