Two initiatives targeting Colorado’s oil and gas industry are effectively dead as of yesterday, August 4, 2014. The announcement was a somewhat surprising end to a escalating issue spearheaded by two Democratic officials. Popular sentiment among local and national news outlets is the two sides reached a compromise to not only work through industry regulations in a diplomatic fashion, but to protect the best interests of their party in the upcoming November elections. Despite representing the same party, the opinions of Governor John Hicklenlooper and Representative Jared Polis were starkly different in regards to the oil and gas industry.

Instead of moving forward with the initiatives, the two sides agreed to create a “blue-ribbon panel” consisting of a total of 18 members. The panel will be divided into three groups of six, with groups respectively representing the industry, citizens and “respected Coloradans.”

Repercussions from the Right?

Many Democratic officials, including both Governor Hickenlooper and Representative Polis, are up for re-election in the fall. TIME Magazine suspects that Polis’ seat is relatively safe, but the positions of Hickenlooper and Senator Mark Udall are expected to be close races. Steve McMahon, a Democratic strategist and Howard Dean’s 2004 campaign manager, said the measures would be “turn out machines” for right-wing voters and ultimately harm the chances for Democrat candidates.

Republican Bob Beauprez will run against Hickenlooper in the fall and agrees with his opponent on the energy issue, but the governor-hopeful still criticized Hickenlooper’s methods in a blog post on his site: “[Hickenlooper is] allowing extreme uncertainty to continue to rock Colorado’s job creators… [The] latest backroom deal leaves many unanswered questions. It’s failed leadership once again, and Colorado deserves better.”

Positive Reviews from Oil & Gas Industry

Two pro-industry measures were enacted in response to the initiatives orchestrated by Polis, and one was withdrawn the day after the compromise announcement. Paperwork to dismiss the other initiative has been filed. “Colorado and U.S. energy independence are the big winners,” said Steve McNulty (R-Representative), one of the drivers of the pro-industry initiatives. The Colorado Oil & Gas Commission also agreed to withdraw its lawsuit against the city of Longmont, who had previously enforced a ban on hydraulic fracturing.

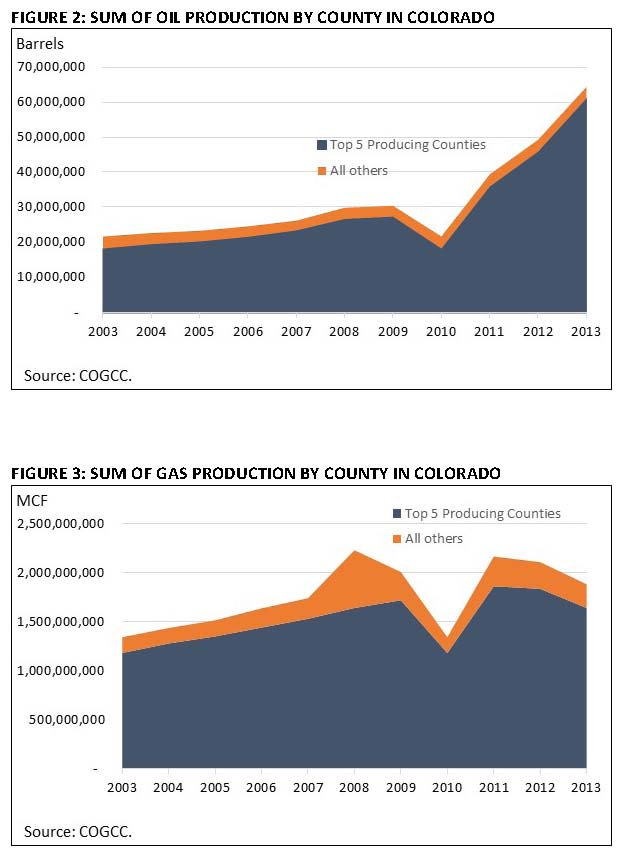

Source: University of Colorado Study

The American Petroleum Institute issued a statement “welcoming the support” for Colorado oil and gas production. “Short-sighted initiatives that threaten responsible energy production and undermine job creation do a disservice to Coloradans who want a more reasoned discussion,” said Jack Gerard, President and Chief Executive Officer of API. “Today’s call could clear the path for a more balanced and inclusive conversation that will preserve Colorado’s leading role in America’s energy revolution, and we look forward to participating in that dialogue.”

Protect Colorado “applauded” the announcement. Communications Director Karen Crummy released an emailed statement that said: “Policy questions of this importance should never be decided at the ballot box and certainly not through inflexible constitutional amendments. Today, tens of thousands of Coloradans who depend on responsible oil and natural gas development to make their living, can breathe a sigh of relief.”

Conservation Colorado, an environmentalist group backing Polis, also supported the decision. The Sierra Club, an anti-fracing group, said it was “reviewing” the decision but did not encourage Polis to seek a compromise.

Food and Water Watch was not nearly as accepting. Its representatives from communities across Colorado harshly denounced the agreement, claiming the deal is no more than a hollow compromise. A Broomfield representative expressed “severe disappointment,” while a Fort Collins member referred to oil and gas as a “toxic industry.”

In a note, Wells Fargo Securities said the compromise “appears to be a win-win in the frac’ing debate, allowing the various parties and factions to get what they want, save face, or some combination thereof.” Many analyst firms said the news is a positive for companies with extensive operations in Colorado, including Noble Energy (ticker: NBL), Anadarko Petroleum (ticker: APC), PDC Energy (ticker: PDCE), Whiting Petroleum (ticker: WLL), Bill Barrett Corp. (ticker: BBG) and Synergy Resources (ticker: SYRG).

These companies and others are actively developing new projects in the Wattenberg Field, northern Colorado’s Niobrara shale play in Weld County, where the economic aspects of continued development are driving an economic boom. Economic growth in local communities could have ground to a halt if either or both of the propositions had become amendments to the Colorado constitution.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.