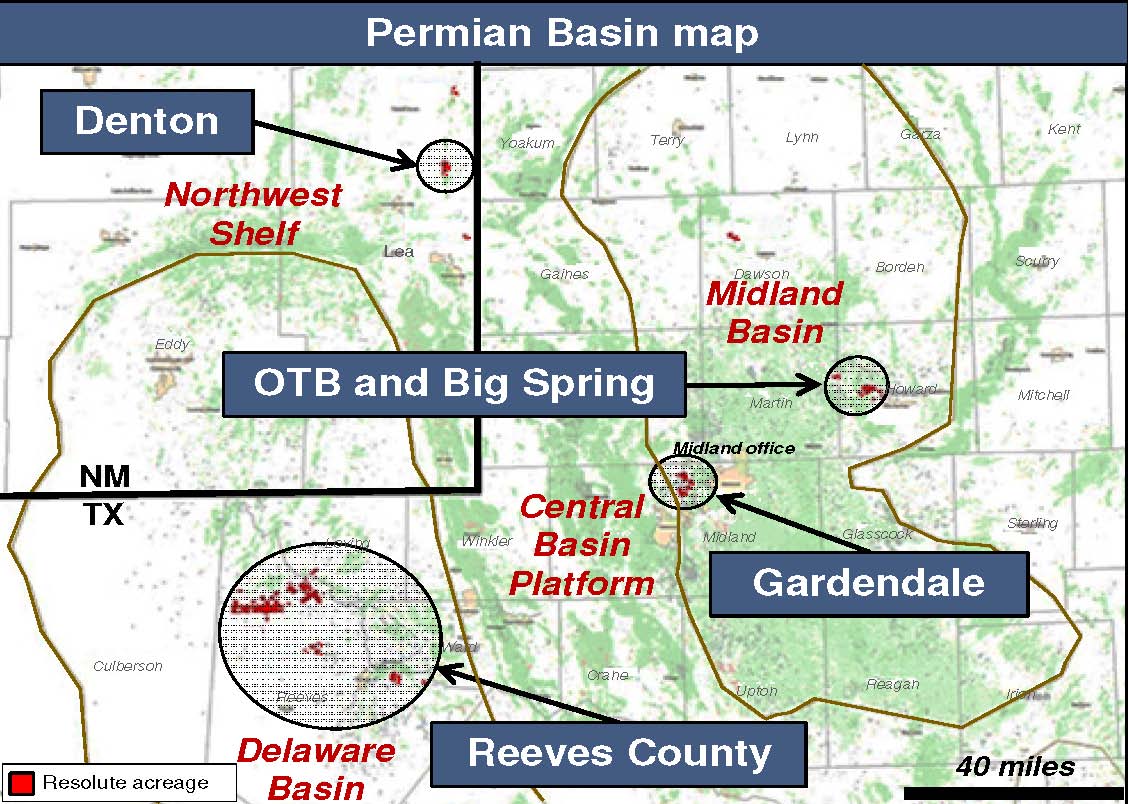

Resolute Energy Corp. (ticker: REN) is engaged in the acquisition, development and production of onshore domestic hydrocarbons, principally crude oil. Resolute’s producing assets are the Aneth Field in the Paradox Basin of Utah and Hilight Field in the Powder River Basin of Wyoming, in the Permian Basin of West Texas and in the Bakken trend in the Williston Basin of North Dakota.

The major themes highlighted by management included capital allocation to high-return oil drilling projects, a complete transition to horizontal oil drilling and a continued focus on driving oil production volumes higher.

In the company’s earnings release on March 10, 2014, Resolute Energy announced Q4’13 production of 12,709 BOEPD with a 2013 full-year average of 12,239 BOEPD – increases of 26% and 31% compared to the comparable periods in 2012.

Adjusted EBITDA reached approximately $50.6 million and $160.4 million for Q4’13 and full-year 2013, respectively, which represented increases of 59% and 48% compared to 2012. REN attributes the EBITDA gains due to a 10% rise in commodity prices and increased production. Revenue, net of hedging, also increased by 33% year over year to reach $314.0 million.

Resolute reported a net loss of $117.1 million ($1.60 per share) for Q4’13 and an overall loss of $113.8 million for fiscal 2013. The 2013 losses resulted from a one-time, non-cash $188 million impairment charge to recognize the roll-off of certain projects at Aneth, subject to the SEC’s relatively new “five-year rule.” The regulation required Resolute to reclassify reserves associated with projects that had been on the books longer than five years as of year-end 2013 from the proved category to probable reserves, moving them out of the proved asset pool. Importantly, the reserves volumes are still in the ground, and the company reported that they could be restored to the proved category once a firm financing commitment for the projects is put into place.

Source: REN March 2014 Presentation

Transition to Horizontal Drilling Complete

In the fourth quarter, Resolute reported that it had drilled its last vertical well for the foreseeable future, and updated results from its horizontal Permian program originally provided in an operations update in December 2013.

In the Delaware portion of the Permian Basin, in Reeves County, Resolute drilled two horizontal wells and was drilling a third at the time of the announcement. The first horizontal well was the LH Meeker C21 1501H, which came on with a 24-hour peak IP of 1,403 BOE per day. The Meeker well later posted a 30-day average rate of 1,074 BOE per day from the Wolfcamp A and was 48% oil.

Resolute’s second horizontal well in Reeves County is the James 02 1401H and is waiting on completion, while the third well, is nearing total depth. The company’s primary objectives in the Delaware Basin are the Wolfcamp A and B intervals. Resolute reported expected internal rates of return between 20% and 40%.

In the Midland portion of the Permian Basin, Resolute drilled its first three horizontal wells at Gardendale into the Wolfcamp B interval. The Munn-Clark 2617H well was drilled to a lateral length of 4,550 feet, completed with 15 frac stages and came on with a initial 24-hour IP rate of 600 BOE per day. The well later posted at a peak 24-hour rate of 877 BOE per day and for its first thirty days produced at an average daily rate of 465 BOE with 94% being crude oil. Resolute estimates EURs of 350 to 400 thousand BOE per well and internal rates of return 25% and 45%.

REN’s acreage in Reeves County (28,200 gross, 12,800 net) is mostly concentrated, allowing the company to operate most of its drilled wells. In a conference call following the release, REN management said Permian production is currently 3,950 BOEPD, which is nearly six times greater than 2012 totals.

Resolute’s first horizontal well in the Powder River Basin of Wyoming, the Castle 3-21TH, was drilled into the Turner/Frontier formation, tested at a peak 24-hour production rate of 1,134 BOE per day with 90% being oil. The Castle well went on to post a 60-day average production rate of 763 BOE per day, which was actually 84 BOE per day higher than the well’s 30-day IP. In its first 90 days of production, the Castle well has produced at an average rate of 723 BOE per day. Resolute’s early estimates of the well’s EUR to be approximately 500 thousand BOE and expects internal rates of return for horizontal Turner/Frontier wells range between 14% and 60%. The company has identified up to 48 potential horizontal Turner/Frontier drilling locations on its current leasehold of approximately 47,400 gross (45,000 net) acres, which are all held by production.

REN estimates the Powder River, in addition to the Permian, hold a combined 460 potential drilling locations on its current acreage.

Operations in the Aneth Field were affected by adverse winter weather and resulted in production remaining relatively flat, but three new wells were placed online in Q4’13 with total production of 372 BOEPD. Gas from the wells is being re-injected in order to maximize its oil return, resulting in oil flow ranging from 88% to 94% of the mix.

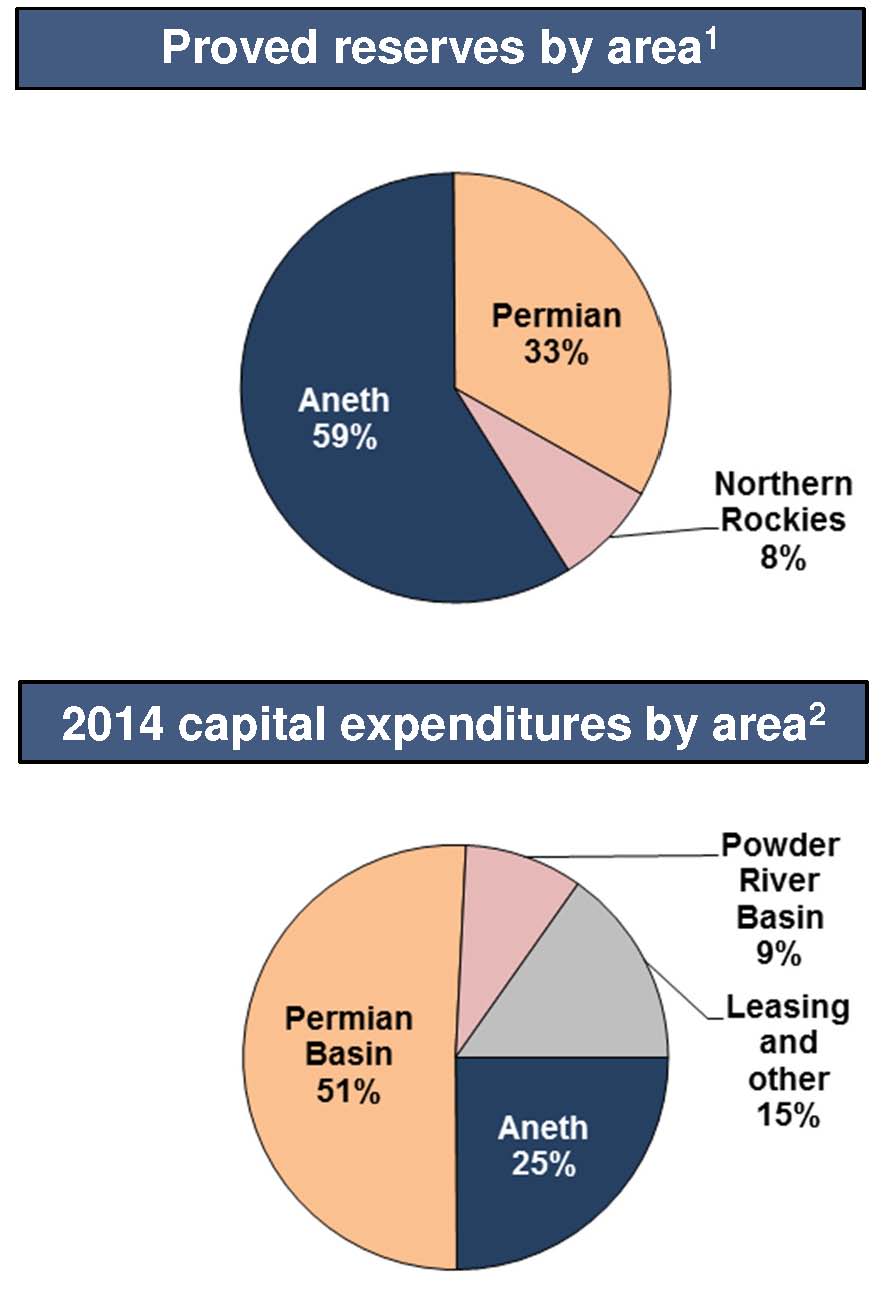

Source: REN March 2014 Presentation

1) Per 2013 SEC Reserve Report

2) Based on Midpoint of 2014 Guidance

Resolute reported estimated proved reserves of 59.4 MMBOE (88% liquids) with a PV-10 value of $1.1 billion. The company held 78.8 MMBOE in proved reserves at year-end 2012, but 19 MMBOE was reclassified as proved undeveloped reserves from the previously discussed SEC measure. Nick Sutton, Chairman and Chief Executive Officer of Resolute Energy, said, “Several high value, high rate of return projects must compete for capital with our horizontal drilling program… It is important to note that those projects and assets have not disappeared, and are no more and no less viable and valuable today than they were a month ago.”

Seeking to Accelerate Growth

On the company’s earnings conference call, management reported it expects its 2014 capital budget to range between $136 to $153 million, below the $237 million invested in 2013 on Aneth and drilling programs (which did not include $290 million of net acquisitions and divestitures). The lower capital spending guidance is designed to maintain debt at or near current levels, and ensure that 2014 spending is funded by existing liquidity of $80 million and expected cash flow from operations.

The lower capital budget translates into 5% production growth in 2014, which represents the company’s “base case” scenario. Resolute projects 2014 total production to reach 4,525 MBOE to 4,890 MBOE (12.4 to 13.4 MBOEPD), with oil and natural gas liquids expected to account for 82% of flow. Management conveyed it was evaluating financial options to increase its capital allocation into its high-return horizontal oil drilling projects in the Permian and Powder River basins, which offer a multi-year drilling inventory. Despite the reduction in capital for Aneth, management is confident its production levels will remain consistent through 2014.

Nick Sutton commented on the company’s earnings conference call: “Clearly, we are very encouraged by the results of our horizontal wells in both the Permian and Powder River basins, and we expect these assets will be the primary driver of our production growth going forward. We are currently reviewing several financing options that would enable us to allocate more capital to these projects and accelerate our horizontal oil drilling program.”

The company did not comment on specific alternatives, however, management did mention that the use of any proceeds raised by asset divestitures, financings or other options would be allocated to both debt reduction and Resolute’s horizontal drilling programs.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.