Resolute Energy Corporation (ticker: REN) today announced that it has priced its underwritten public offering of 3,800,000 shares of its common stock at a price of $38.00 per share, for total gross proceeds of approximately $144.4 million. The company intends to use the net proceeds from the offering to repay the company’s second lien secured term loan, with any additional proceeds to be used to partially repay outstanding debt under the company’s revolving credit facility. Resolute has granted the underwriters in the common stock offering an option for 30 days to purchase up to an additional 570,000 shares of common stock.

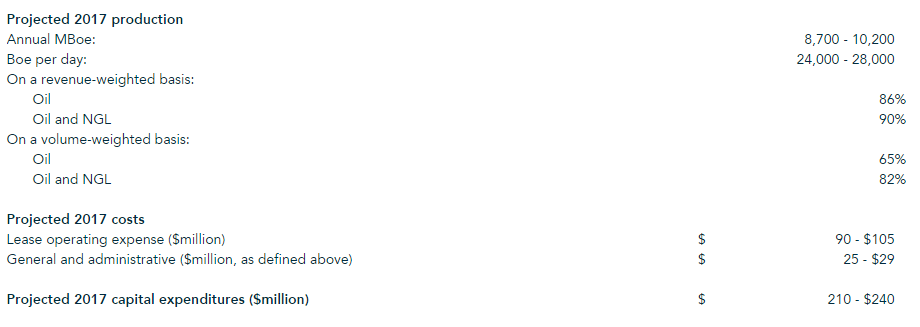

The Denver-based company announced its 2017 capital expenditure budget Monday. Resolute expects to grow production 85% year-over-year at the mid-point of its guidance. In order to hit its production target, the company plans to $210-$240 million, primarily in the Permian Basin. Roughly 65% of the 2017 budget will be funded internally, with the remainder coming from the company’s credit facilities.