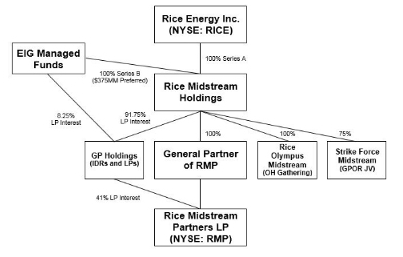

Rice Energy (ticker: RICE; RiceEnergy.com) has closed a financing agreement with EIG Global Energy Partners (“EIG”; www.EIGpartners.com).

EIG has agreed to a $500 million equity investment with Rice: $375 million upfront in exchange for preferred equity and common units in Rice Midstream Holdings (“RMH”) and Rice Midstream GP Holdings, respectively.

The investment from EIG will generate increased liquidity to grow midstream business in the Utica shale and will simultaneously allow Rice Energy to fund their capital program in 2016 without incurring any more debt.

Rice Midstream GP Holdings is a newly formed company in partnership with EIG. The deal will allow EIG to have an interest in both RMH and a limited partner interest in Rice Midstream Partners.

RMH will use approximately $75 million of the proceeds to repay all outstanding borrowings under its revolving credit facility and to pay transaction fees and expenses. The remaining $300 million will be distributed to Rice Energy to fund a portion of its 2016 development program in the cores of the Marcellus and Utica Shales.

In addition, RMH will have an additional $125 million commitment from EIG (subject to designated drawing conditions precedent) for a period of 18 months. The subsidiary would exchange $25 million of preferred equity for each $25 million it draws from those funds.

Commenting on the announcement, Grayson T. Lisenby, Chief Financial Officer, said, “By fully funding our 2016 E&P budget without incurring any debt, we expect to exit 2016 with E&P leverage of 3.0x, strong operating cash flow and a healthy backlog of wells in progress that favorably positions Rice Energy for seamless economic growth in 2017. [This] supports our belief that RMP’s continued strong distribution growth will result in a long-term GP Holdings valuation in excess of $1 billion.”

The recent decline in oil prices has generated reservations in the capital markets towards oil and gas investment. By obtaining an equity investment, the company will improve liquidity, preserve cash flow, fund a portion of the upstream capital program, and will not be relinquishing a substantial portion of RMP.

According to benchmarks measured by EnerCom Analytics, Rice Energy has above average net debt to EBITDA at 4.0x, compared to an average of 2.4x for their mid cap peer group. Alleviating the need for more debt to fund the capital program should allow Rice to keep production flowing and generate increased cash flow with lower debt.

EIG Global Energy Partners Funds handles negotiated private transactions with mid- and large-cap energy companies, focusing on transactions that are underpinned by hard assets. In December the firm had more than $14 billion under management.