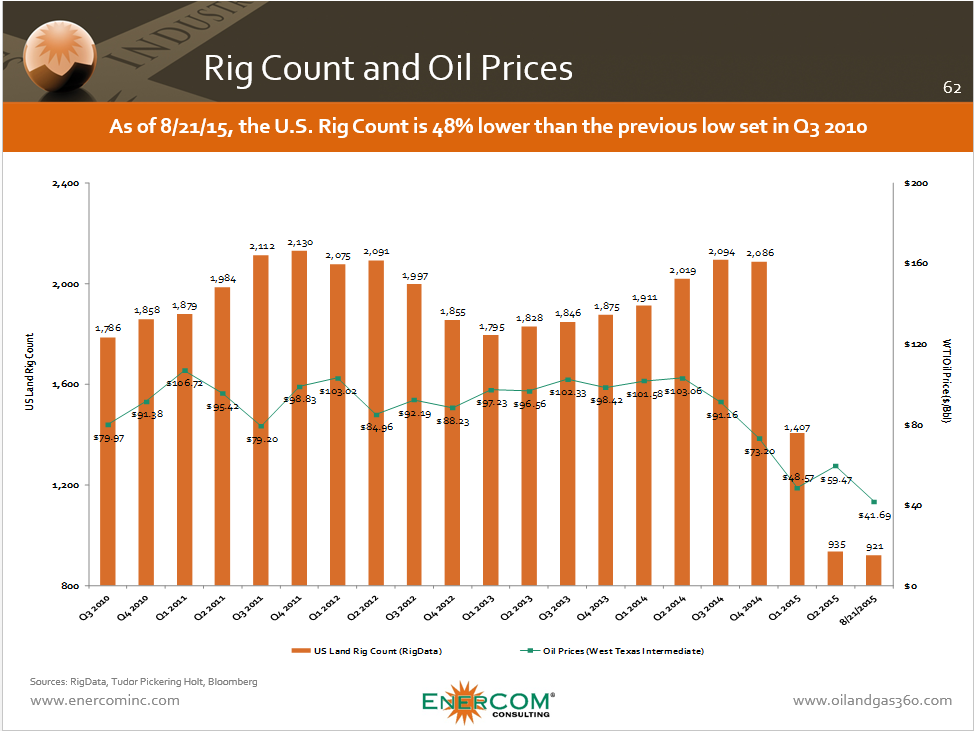

Rig counts remain low along with prices

The total rig count in the United States for the week ended August 28, 2015, fell eight rigs to 877, according to information from Baker Hughes (ticker: BHI). Rig counts have remained in the same 50-rig range since the week ended May 1, 2015, after falling precipitously along with oil prices since the end of last year.

The number of rigs drilling for oil in the U.S. increased by one to 675 this week, but the total rig count was still brought down by a loss in rigs drilling for gas. Gas rigs totaled 202 this week, down nine from their numbers this time last week.

Canadian rigs also saw a dip this week, losing 6% of their total number, or 12 rigs, and falling to 196. Canadian rig counts have been at a seasonal high as the country goes through its winter drilling season.