Baker Hughes rig count for the week ended August 21, 2015

Baker Hughes (ticker: BHI) reported an increase of just one rig to the total number of rigs drilling for oil and natural gas in the United States for the week ended August 21, 2015. The number of active rigs in the U.S. has remained relatively stable over the last three weeks, staying at 884 in the weeks ended August 7, and August 14, before adding one rig last week.

The number of rigs drilling for oil rose by two, to 674 last week, while the number of rigs drilling for natural gas remained unchanged at 211. BHI reduced its “miscellaneous” from one to zero, accounting for the single rig increase in the overall tally.

Texas saw the largest change in its rig count this week, with the rig count showing the state laid down six rigs. The decline was made up for in North Dakota and Oklahoma, each of which added three rigs this week.

Canadian rig counts dropped slightly, losing three rigs week-over-week, totaling 208 on August 21. The Canadian rig count has remained high as the country goes through its drilling season, but is not expected to remain at these levels.

Even as rig counts remain relatively unchanged, and U.S. production begins to slow, the price of U.S. crude benchmark West Texas Intermediate (WTI) continued to decline. On the same day that BHI reported the stable rig count, WTI shed 2% of its value, closing out last week at $40.45 per barrel.

More robust growth expected

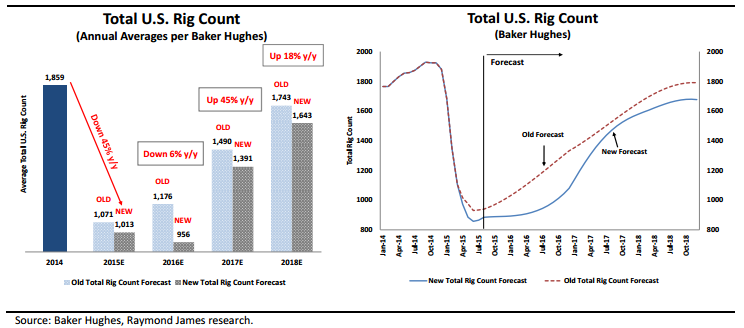

Raymond James said that it expects a recover in prices to be slower than it initially predicted, and that rigs will likely follow suit. In a note released today, Raymond James said that it expects the U.S. rig count will exit 2015 at 891 rigs, 12% lower than it previously forecasted, while full-year 2015 will average 5% lower than it expected before. For 2016, the U.S. rig count is expected to be down 6% from 2015 at 834 rigs.

The flip side to the lower rig forecasts for this year and next is that Raymond James expects growth moving through the end of the decade will be stronger. “We expect this [slow recover] will lead to a U.S. E&P cash flow and oilfield service spending surge in 2017,” said the note. This surge in spending is expected to spur rig counts 45% higher in 2017 from their levels in 2016.

This growth will still leave rig counts lower in absolute terms for 2017 than the analysts had initially expected, but it will also offer a platform for further growth of approximately 18% in 2018. Despite the strong growth numbers, Raymond James does not expect the U.S. rig count to reach highs seen in 2014 as efficiencies continue to reduce the need for large numbers of rigs.