Baker Hughes rig count for the week ended May 8, 2015

Total rig counts in the United States fell by just 11 rigs this week, or by just 1%, in one of the smallest week-to-week declines since the price of oil tumbled last November, sending rig counts plummeting. The Baker Hughes (ticker: BHI) rig count for the week ended May 8, 2015, shows a total of 894 rigs active in the U.S.

Rigs exploring for oil fell about 2% to 668 from 679 last week, while rigs drilling for gas fell to 221 – just one below last week’s total. The largest decline was seen in Oklahoma, which had six fewer rigs in this week’s BHI rig count.

Colorado saw two rigs added to its inventory this week, while North Dakota added one. Alaska, Pennsylvania and Wyoming saw no changes.

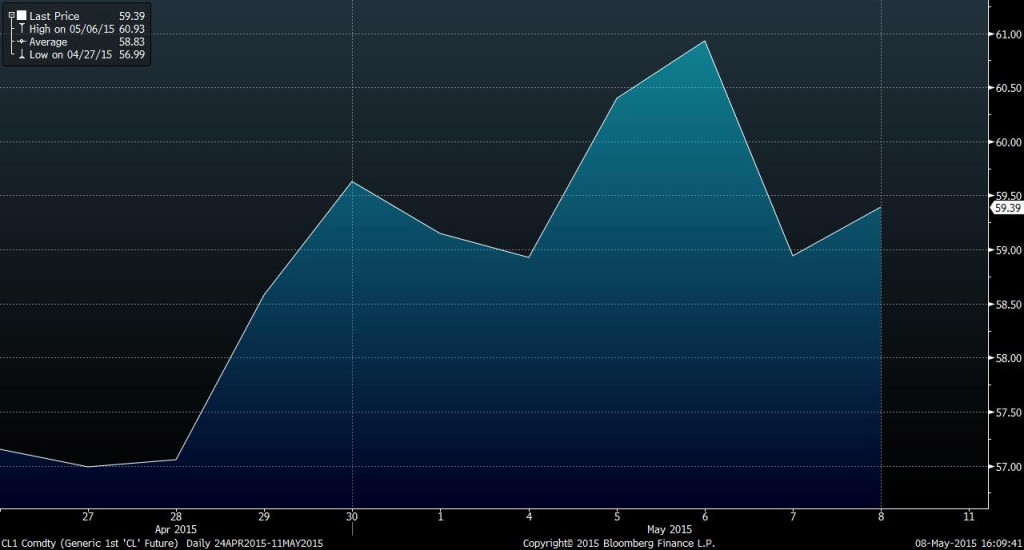

Slowing production was met favorably by markets this week as oil prices broke $60 per barrel. Despite the rise in prices, Wunderlich Securities Chief Market Strategist Art Hogan told Oil & Gas 360® that further price improvement is needed before additional rigs are added to the field. “$65 to $70 per barrel [WTI] is where we can expect to see some more production becoming economical again.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.