Range expects annual uplift of $90 million in net cash flow once all three pipelines are online

Range Resources (ticker: RRC) has always prided itself on optionality and takeaway capacity, and the commissioning of the Mariner East 1 pipeline is about to add to its portfolio.

Mariner East 1 will be fully operational in February 2016, according to an article on TankTerminals.com that was relayed to the RRC site.

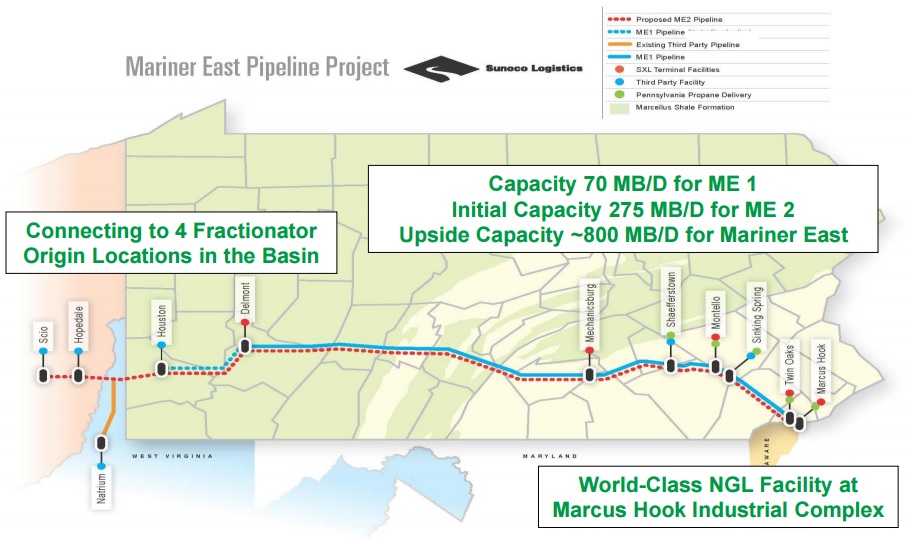

Source: Sunoco Logistics Presentation

Mariner East 1 will serve as a vital piece of ethane exports and is currently rated at about 70 MBOPD, but the previous inability to export the resource had rates running well below its maximum capacity. Now that the export outlet is commissioned, volumes of natural gas liquids (NGLs) are expected to be running above the maximum due to additional deliveries including other modes of transportation.

Marcus Hook, the destination of the newly commissioned pipeline, is one of only two export outlets on the East Coast, with the only other being DCP Midstream’s Chesapeake terminal in Virginia.

Range Resources and MarkWest Energy are the two primary shippers on the Mariner East 1, and Range currently has a 15-year contract to deliver 40 MBOPD (half ethane, half propane). MarkWest is currently being purchased by Marathon Petroleum.

Once the pipeline is fully operational, all three of RRC’s major ethane and propane projects will be in service. The company expects to realize annual uplift of $90 million in net cash flow from the three pipelines.

Optionality Relieves a Stressed Commodity Market

The Mariner East 1 loosens the regional infrastructure strain in the northeast, but the export ability is the key driver for Range and its market. By next month, more than 70% of RRC’s ethane will be priced at indices other than Mont Belvieu in Texas and provide the company with the option of selling the product in Canada or Europe.

Chad Stephens, Senior Vice President of Range Resources, said the new route provides ample flexibility and a wide ranging group of buyers. “We can use seasonality demand on the East Coast [or] focus on best prices, whether it be into Europe, or Asia or South America,” he explained in the company’s Q3’15 conference call. “We have a new contractual relationship with a global trader that has deep understandings of all the international markets and have relationships with Asian propane buyers and European propane buyers. They have a deep understanding of shipping and logistics.”

Chad Stephens, Senior Vice President of Range Resources, said the new route provides ample flexibility and a wide ranging group of buyers. “We can use seasonality demand on the East Coast [or] focus on best prices, whether it be into Europe, or Asia or South America,” he explained in the company’s Q3’15 conference call. “We have a new contractual relationship with a global trader that has deep understandings of all the international markets and have relationships with Asian propane buyers and European propane buyers. They have a deep understanding of shipping and logistics.”

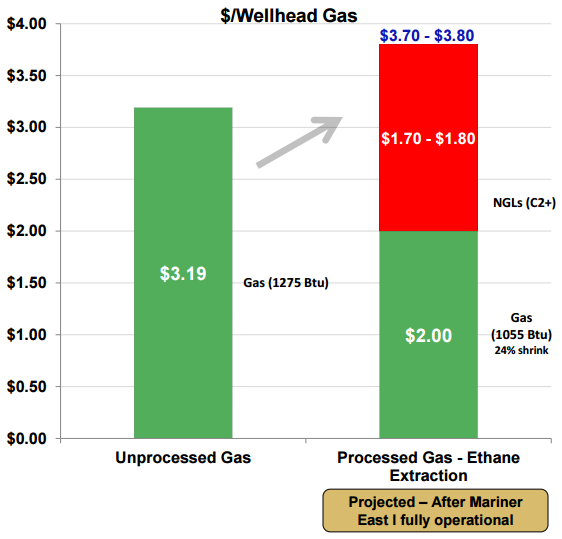

The export increase is a boon for the Fort Worth-based natural gas company, which believes it has the highest Btu inlet gas volumes of any producer in the Appalachia. The NGL benefits of processed gas create an uplift of roughly $0.50 to $0.60 per Btu (about a 16% increase in realized prices).

Range is currently participating in four other takeaway projects through 2017 – all targeting the Gulf Coast. Total capacity is in excess of 3.0 Bcf/d and all are expected to be operational by year-end 2017.