New pipeline represents the first infrastructure deal between the two countries since the 1970s

Pakistan is expected to sign an agreement with Russia for the construction of a 1,100 km (about 684 mile) liquefied natural gas (LNG) pipeline from Karachi in southern Pakistan to Lahore in the North. Under the partnership, Russia will provide $2 billion to lay the pipeline, and in exchange Pakistan will award the contract to Russia without inviting bids, reports The Express Tribune.

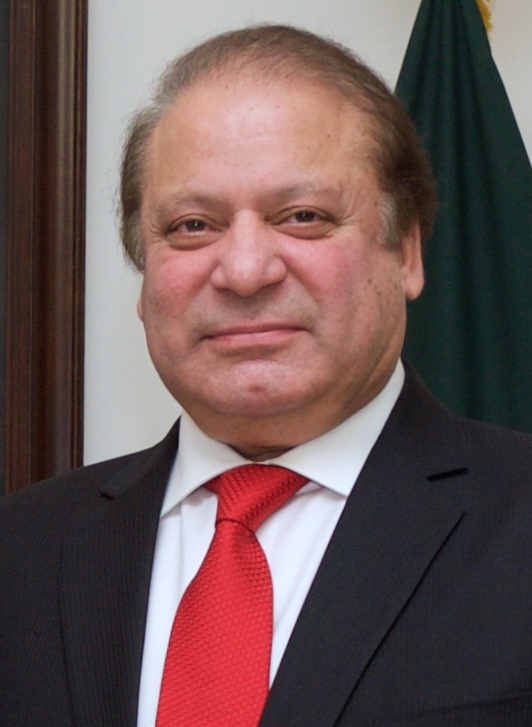

“We are trying to sign an LNG pipeline accord with Russia in a government-to-government arrangement during the visit of Prime Minister [Nawaz Sharif] to Moscow,” Peroleum Minister Shahid Khaqan Abbasi said. Prime Minister Sharif is expected in the Russian capital July 9, to attend a summit of the Shanghai Cooperation Organization (SCO).

In addition to financing the pipeline, Russia agreed to export LNG to Pakistan, which has suffered from energy shortages. “The Russian side is very positive about helping Pakistan in tackling the energy crisis,” an official told Express Tribune. “It will start LNG exports in 2016.”

Earlier this month, Pakistan launched its first LNG import terminal in Karachi, receiving 147,000 cubic feet of LNG from Qatar in a floating storage regasification unit (FSRU). The price per MMBTU has not been disclosed, but the two countries signed a $22 billion for the supply of 500 Mcf/d of LNG for 15 years, reports Dawn News.

The new LNG pipeline deal with Russia marks the latest deal in a series of projects to meet growing demand in the country. Pakistan is also considering deals to source more LNG from countries like Brunei, Malaysia and China, which is not a producer but may have excess imports that it can resell, reports The Wall Street Journal.