Samson Oil & Gas Limited (ticker: SSN) is an independent oil and gas company with dual listings on the Australian ASX and the NYSE. All of the company’s assets and operations are based in the United States, with a current emphasis on the Bakken oil shale play in North Dakota.

Samson Oil & Gas is scheduled to present at EnerCom’s London Oil & Gas Conference™ 6 on June 10, 2014.

Samson Overview

SSN is unique for a small-cap E&P, having a well-diversified portfolio consisting of seven projects in five basins, ranging from pure exploration to tried-and-true development drilling. The company has employed farm-ins and acreage swaps to both build its portfolio and mitigate risk.

“Operational control for Samson is good, but it’s not mandatory,” said Terry Barr, Chief Executive Officer of Samson, in an exclusive interview with OAG360. “Growth is more important.”

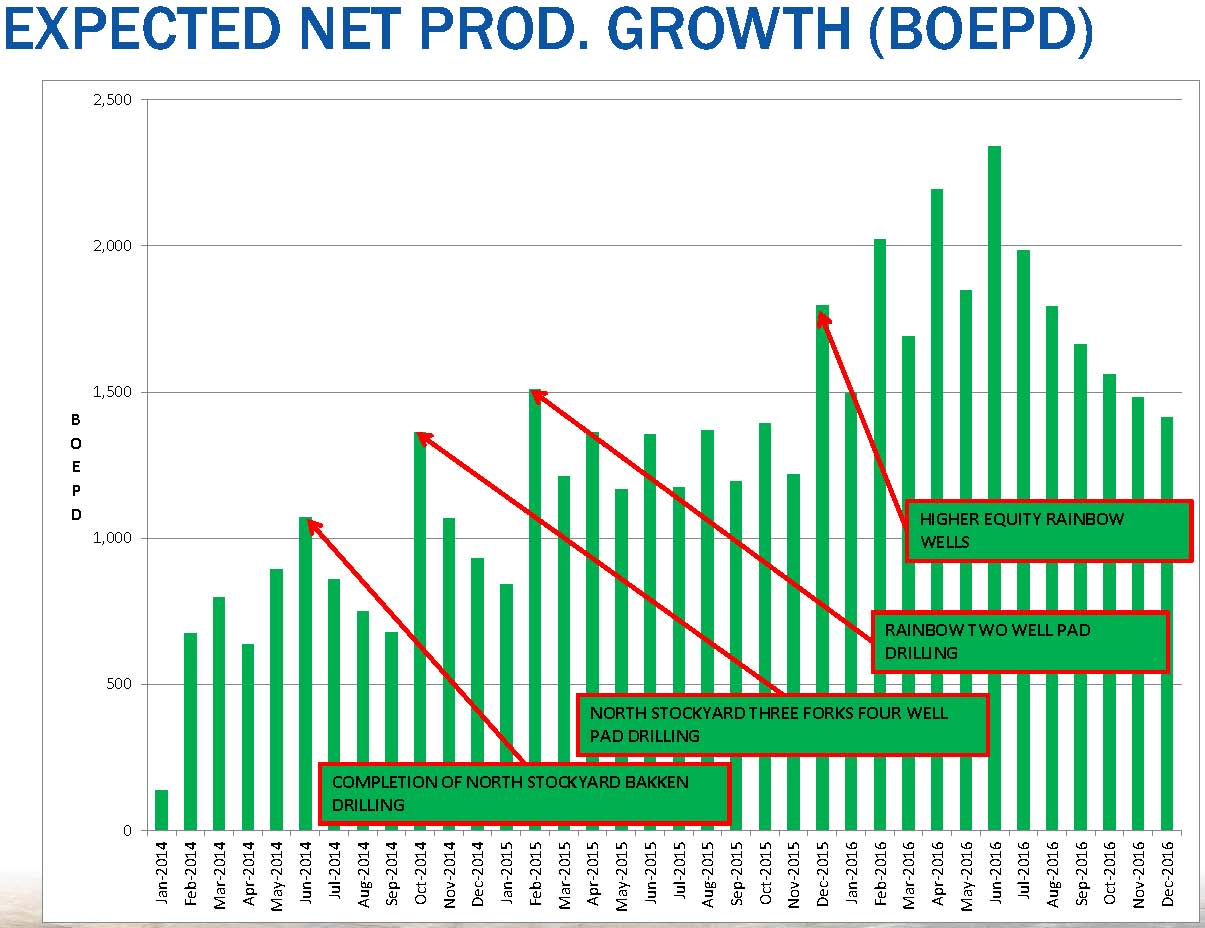

In the near-term, the source of Samson’s growth is going to be the Williston Basin, particularly the company’s North Stockyard field in North Dakota.

North Stockyard Primer

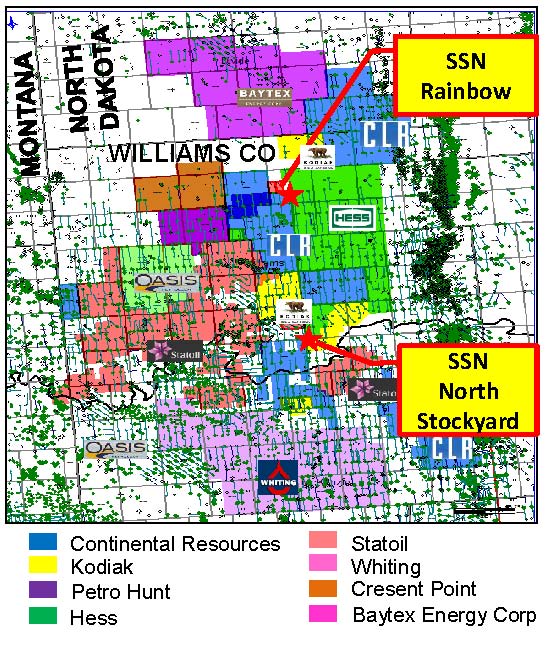

Source: SSN April 2014 Presentation

Samson’s North Stockyard project covers three sections in Williams County, North Dakota – the heart of the Bakken oil shale play. Samson holds a 25% working interest or approximately 503 net acres in North Stockyard. In 2013, Samson farmed-out its working interest and operatorship to Slawson, a private operator with a regional exploration office in Denver. Slawson is a seasoned Bakken operator with ample resources and access to services, which facilitates more rapid development of the North Stockyard project.

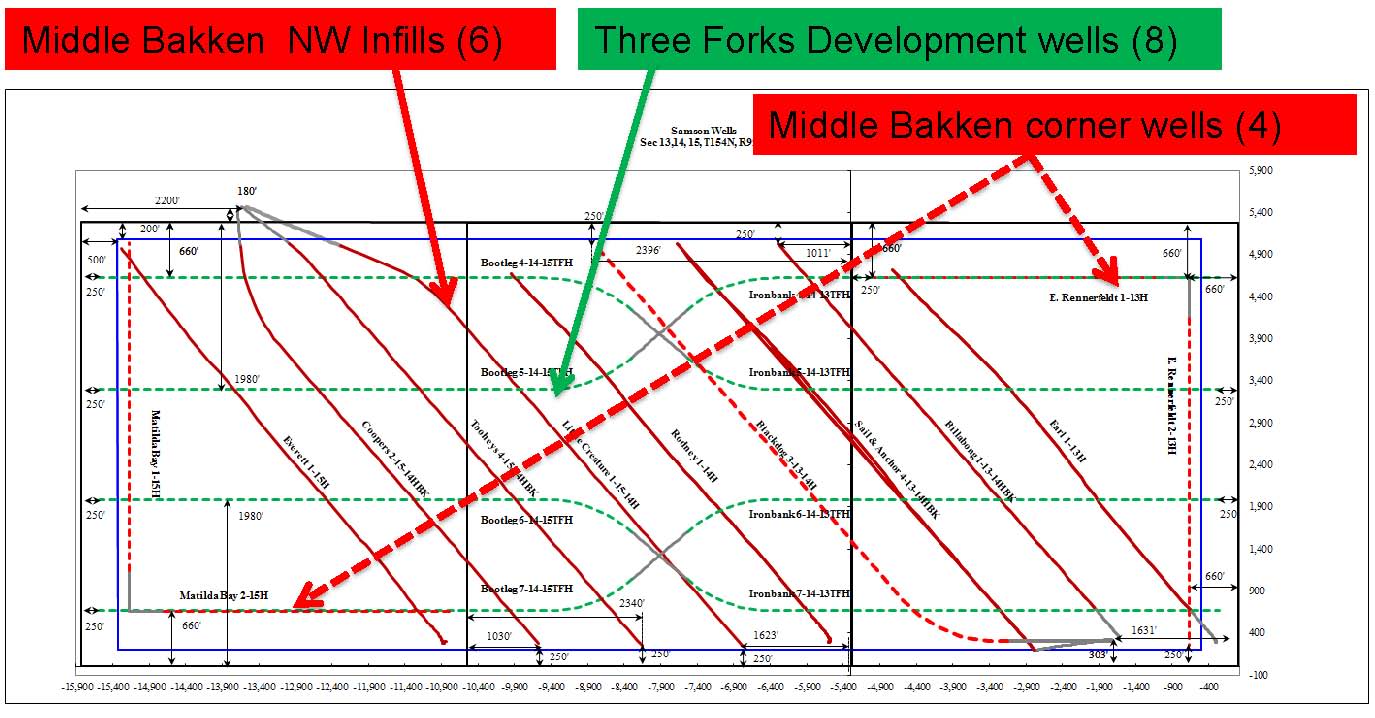

North Stockyard will receive the bulk of Samson’s 2014 operational focus, which includes drilling 18 infill wells in calendar 2014 (Samson’s fiscal year ends June 30), ten of them targeting the Middle Bakken interval and the other eight targeting the Three Forks formation.

Of the ten Middle Bakken wells, six are complete and producing, two have been fracked and are waiting on completion and two are in various stages of being drilled. This provides Samson a series of wells that will come online through 2014. The wells are being drilled on pads, meaning that we expect the production increases to be lumpy, as more than one well will be turned over to production at once.

Current production from North Stockyard is 331 BOEPD net and accounts for 80% of SSN’s producing assets (413 BOEPD net overall).

Progress has already begun on developing the Three Forks resource at North Stockyard. “We’re almost done with our first two Three Forks wells, and the first was completed on May 29,” said Barr. “The Three Forks laterals are longer than the Bakken ones. They’re a section and a half, or 9,000 feet, while the Bakkens were one section, or 6,000 feet. The Three Forks wells are also virgin pressure so we anticipate they’ll produce well.”

Barr explains the reasoning for the various lateral lengths, given current industry practice to use 1,280 drilling spacing units (DSUs). “When North Stockyard was first drilled it was in the early days of the Bakken and was before 1,280 acre spacing became the standard. Our first Bakken well was on 640 acre spacing, and once you drill one of those you have to stick with that orientation. We’re going to be drilling the Three Forks wells from the middle of the three sections with one goes east and one that goes west. It’s really just the historical configuration.”

Source: SSN April 2014 Presentation

Other Williston Basin Projects

Besides its focus on the North Stockyard field, Samson has three other projects in the Williston Basin, including Rainbow, South Prairie and Roosevelt.

The Rainbow field (950 net acres, 52% WI) is located in Williams County, north of the North Stockyard field, and Samson has interests in two DSUs. In the eastern DSU, operations are just now kicking off. SSN will participate in a well (23% WI) to be drilled by Continental Resources (ticker: CLR) on 1,280 spacing, and is scheduled to spud in June. Samson is also the operator of the western DSU with a 53% working interest. The Rainbow area holds 16 identified opportunities, eight each in the Bakken and Three Forks formations. A successful first well is likely to lead to additional drilling and production growth in the region.

Nearby Rainbow and North Stockyard, drilling activity in the North Dakota Bakken remains strong. Continental, for example, is running 20 rigs in the play and 870 gross wells (287 net) are expected to be drilled in 2014. CLR’s production from the area has increased by 27% since Q1’13. Whiting Petroleum (ticker: WLL) has doubled its downspacing program to match SSN’s plan of 160 acre spacing. Four wells drilled off of one pad in a WLL area combined for an overall flow rate of roughly 4,000 BOEPD.

Samson also holds ownership in the South Prairie (6,415 net acres, 25% WI) and Roosevelt (30,000 net acres, 67% WI) projects. A test well is scheduled to be drilled in South Prairie within Q2’14. Testing and surveying will soon commence in the Roosevelt as part of a farm-out agreement. Per the agreement terms, Samson’s partner will cover costs for exploration and the drilling of a test well in exchange for half of SSN’s existing stake in the field.

DJ Basin and New Mexico

In addition to its projects in the Williston Basin, Samson has three others located in Wyoming (DJ Basin) and New Mexico.

In the Wyoming DJ Basin, Samson holds nearly 24,000 net acres with the bulk in its Hawk Springs prospect (20,733 net acres) located in Goshen County. A test well was drilled in the quarter and the company is evaluating future operations in the area through its acquired data sets and hydraulic fracturing results. The conventional targets are Permian age structures and the project is intended to be farmed out. Negotiations for a rig are underway and SSN anticipates drilling operations to commence in June.

The New Mexico project (130 net acres) also targets Permian age structures and may hold an additional 20 identified drilling locations if a test well, scheduled to be drilled in June, is successful.

Barr said: “Certainly the Williston Basin is our bread and butter because it’s so predictable. But we are the frontrunners in evaluating the Permian in the DJ. I don’t think anybody else is actively pursuing that, but they’re all watching it very carefully. It will be a very important case to the Permian down there. So from a pure exploratory point of view I think the DJ Basin is very exciting and has a lot of merit.”

Q1’14 Results

Samson reported that Q1’14 oil production jumped 130% higher from the same quarter in the previous year. Contributing to the rise were volumes from the North Stockyard field, where production increased by 160% as wells were placed back online following scheduled downtime. Production from the region is expected to climb as SSN further executes its infill well project in the field.

Source: SSN April 2014 Presentation

Drilling Success Increases Reserves

With drilling success, comes growth. In May 2014, Samson reported proved reserves at March 31, 2014 were 1.805 MMBOE with a PV-10 value of $47.7 million, per the company’s independent reserves engineers, which was double the value from 11 months prior. The PV-10 values of the company’s estimated Probable and Possible reserves were $12.8 million and $7.1 million, respectively.

Financial Resources to Grow

To fund its growth plan, Samson bolstered its cash with approximately $5.0 million in net proceeds from an equity offering to U.S. and Australian investors in April 2014. The company sold approximately 65 million ordinary shares at $0.02 per share to Australian investors and another 11.3 million ADSs (SSN’s ADSs trade on the NYSE MKT at a conversion rate of one ADS to 20 Australian shares) to U.S. investors at $0.375 per ADS. Combined, the new shares represent approximately 11% of shares outstanding.

The company reported that the capital is earmarked for “…the planned drilling and completion of the four Three Forks wells in our North Stockyard project (Bootleg 5-14- 15, Bootleg 5-14-16, Ironbark 5-14-3 and Ironbark 4-14-14) as well as for working capital.”

Samson has a $25 debt facility with a current borrowing base of $8 million. As of March 31, 2014, $6 million was drawn on the facility.

“Our financial capabilities are on the forefront,” said Barr. “Being able to finance the Bakken is really the key issue and we’ve been successful in pulling together our 4% loan with no strings attached to it. For a company our size, that’s pretty special. I haven’t seen many other companies of our size that has a 3.75 plus Libor loan. Usually it’s 15% to 20%.”

Observable liquidity of $16.4 million includes $5.7 million of cash on hand as of March 31, 2014, $2.0 million of available borrowing capacity, $5.0 million from the April equity offering and $3.7 million of estimated cash receipts from oil and gas sales to be collected. Samson estimates that its borrowing capacity on the debt facility will be increased by $5.0 million, given the recent rise in Proved reserves, bringing total liquidity up to a potential $21.4 million.

Summary

In summary, Samson has 30 potential infill drilling locations in the Williston Basin; 18 at North Stockyard and 12 at Rainbow. Near-term growth in oil production this year will come from the company’s relatively low-risk infill drilling program in the North Stockyard field.

Based on Samson’s North Stockyard development plan, we estimate that production in Q4’14 could average approximately 1,100 BOEPD net, which is more than double the Q1’14 rate of 413 BOEPD. A peer group of four other Bakken operators, including Triangle Petroleum, (ticker: TPLM), Kodiak Oil & Gas (ticker: KOG), Continental Resources (ticker: CLR) and Northern Oil & Gas (ticker: NOG) were trading at an average EV to BOEPD of $179,456. If we applied this metric to the estimated Q4’14 average production rate for SSN, Samson’s implied Enterprise Value is $197.4 million, or 354% higher than the approximate EV of $43.5 million at May 30, 2014.

We note that SSN’s EV is currently less than the PV-10 value of its Proved reserves of $47.7 million. Given the company’s line-up of Bakken infill wells poised to be turned over to production, Samson today appears to be at the front end of the growth curve.

Upside exists from exploration drilling targeting conventional Permian targets at Hawk Springs (partnered with CNOOC) and a farmed-out Montana Bakken prospect in the Roosevelt project.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.