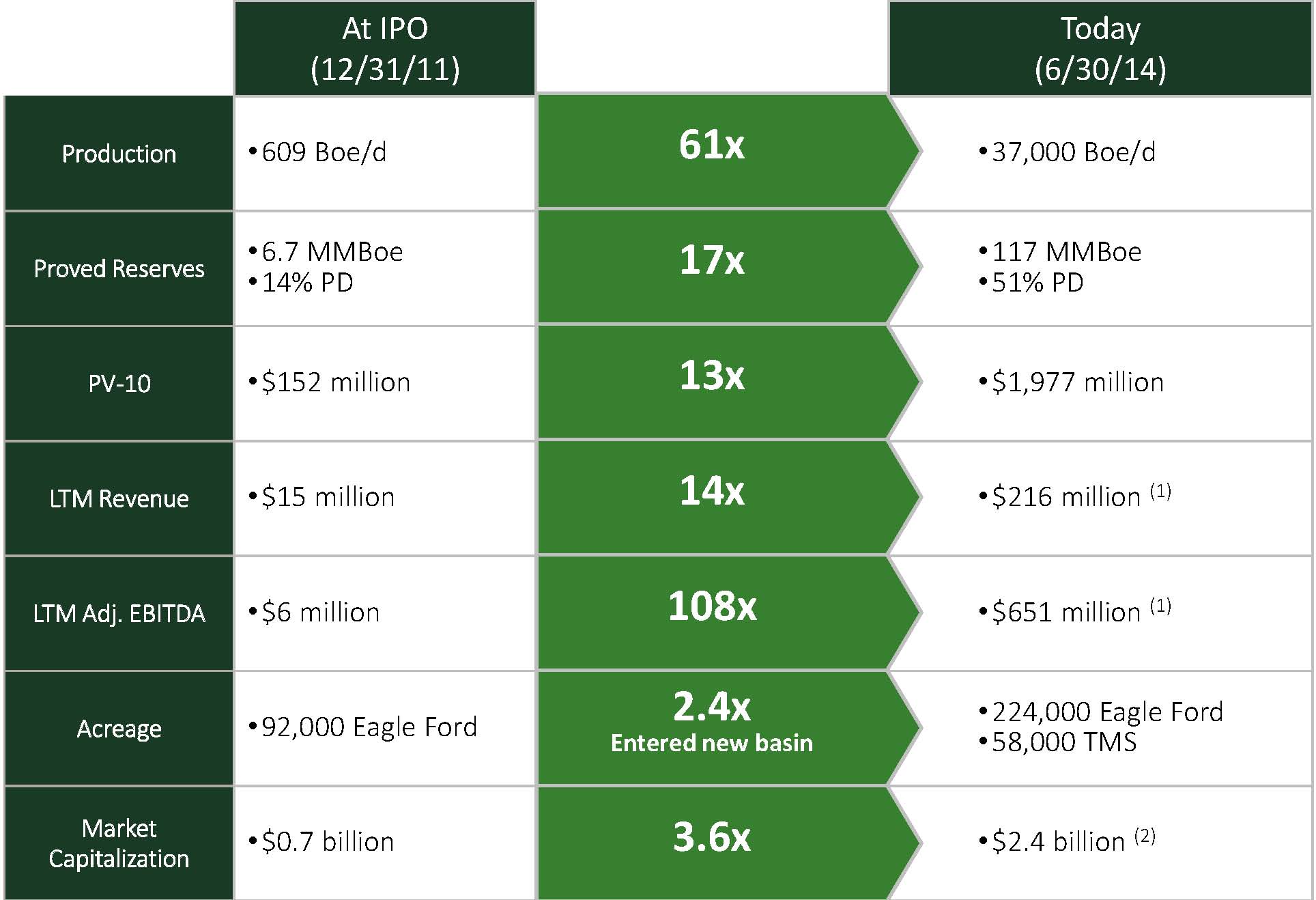

Sanchez Energy (ticker: SN) is an Eagle Ford-focused E&P that has built a sizeable footprint through acquisitions following its IPO in December 2011. Since going public, Sanchez has spent more than $1.1 billion to add approximately 163,400 acres in what has become one the second greatest play in the United States based on oil production volume. The EIA expects Eagle Ford production to surpass 1.5 MMBOEPD in September 2014.

Sanchez Energy held its first-ever Analyst Day on August 26, 2014, in Houston, Texas – roughly one week after presenting at EnerCom’s The Oil & Gas Conference® 19 (click here for the webcast). Management spent more than four hours updating attendees on the company’s direction following the closing of its landmark Catarina acquisition on August 1. The Catarina nearly doubled Sanchez’s reserve base, boosted its acreage by 113% and raised production rates by 128%.

Source: SN Analyst Day Presentation

Asset Snapshot

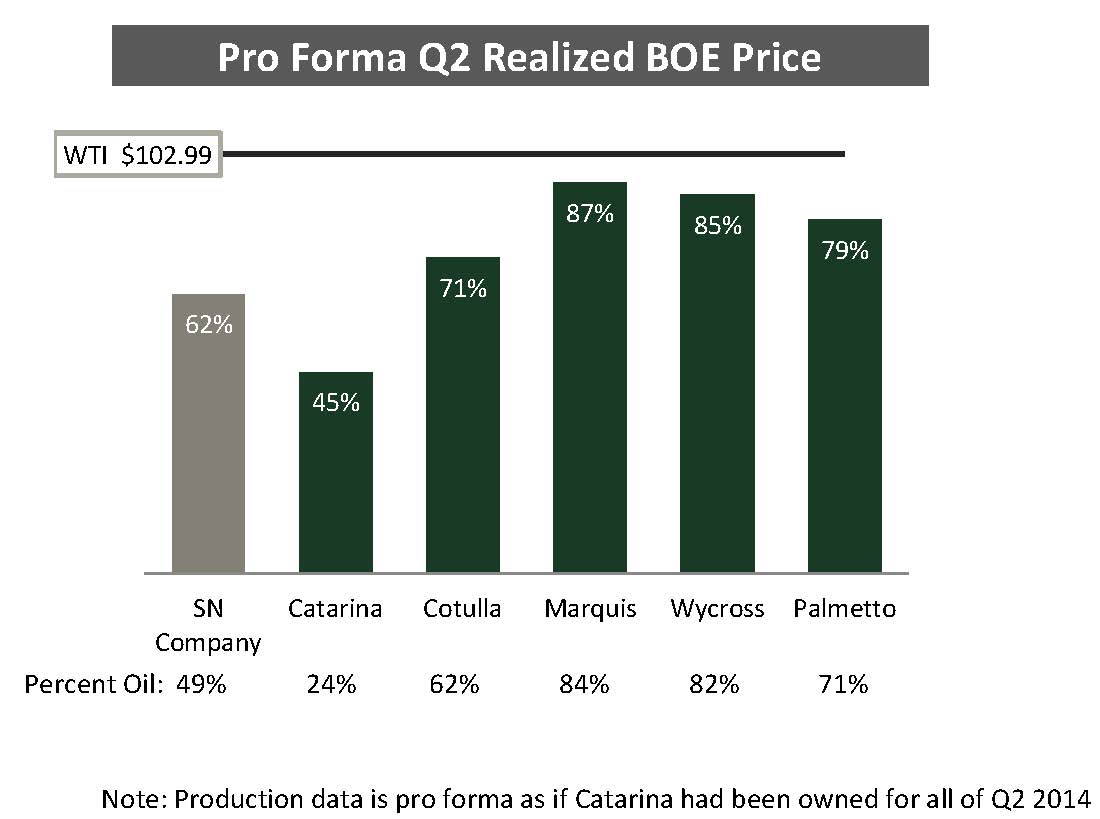

Production volumes for Q2’14 totaled 20.4 MBOEPD (87% liquids), but management expects Q3’14 production to reach 36 MBOEPD to 40 MBOEPD with a full quarter of Catarina on its portfolio. Volume at the time of its Analyst Day was approximately 37 MBOEPD. Q4’14 production is forecasted at 48 MBOEPD to 50 MBOEPD (70% liquids), with fiscal 2015 estimated at 53 MBOEPD to 58 MBOEPD (50% higher than current Q3’14 rates at its midpoint).

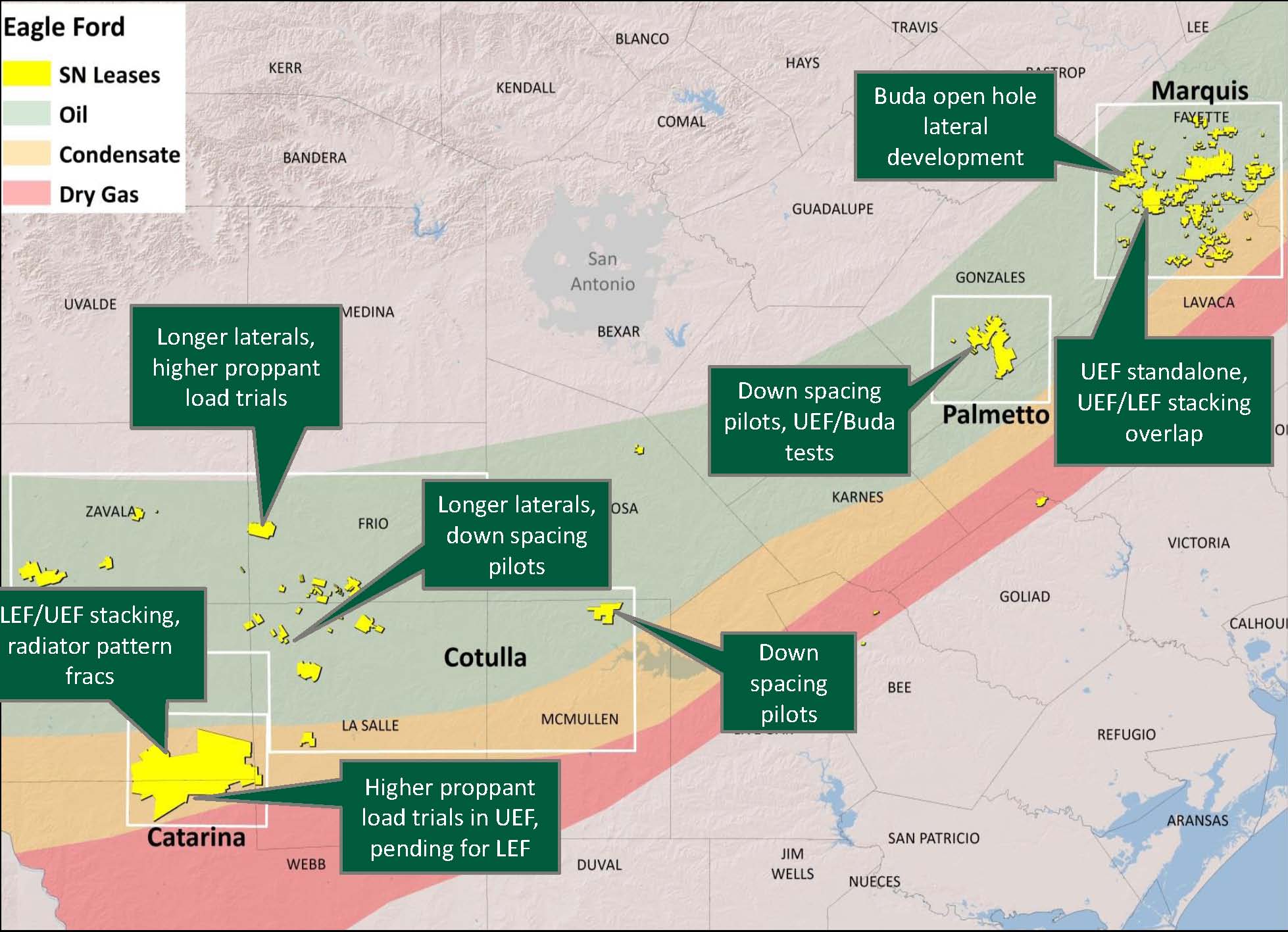

The company holds 224,000 net acres and has identified more than 2,800 drilling locations on its acreage. Sanchez also has more than 58,000 net acres of exposure to the Tuscaloosa Marine Shale, along with additional opportunities in the Buda formation. Seven net rigs (nine gross) are currently running with 422 gross producing wells. Another 40 gross wells are in various stages of completion.

During the Analyst Day presentation, Tony Sanchez III, Chairman, President and Chief Executive Officer of Sanchez Energy, said: “We’ll probably end this year closer to 450 wells or more, and drill between 120 and 140 wells next year. So we’re rapidly increasing well count, which adds stability to our quarter-on-quarter production and cash flows. “

Sanchez believes the company can exceed the 60 MBOEPD mark by year-end 2014 “while keeping tight control of our costs.” Capital expenditures for 2014 are estimated at $840 million to $900 million, with costs expected to ramp up to $1.1 billion to $1.2 billion in 2015. The company currently has $811 million in liquidity and is targeting to remain levered by 2.0x to 2.5x.

“We’re self funded through our cash flow, balance sheet and cash on hand,” said Sanchez III. “Funding for the new Catarina program is already largely in place.”

Source: SN Analyst Day Presentation

Point of the Day: Efficiency through Technological Expertise and Planning

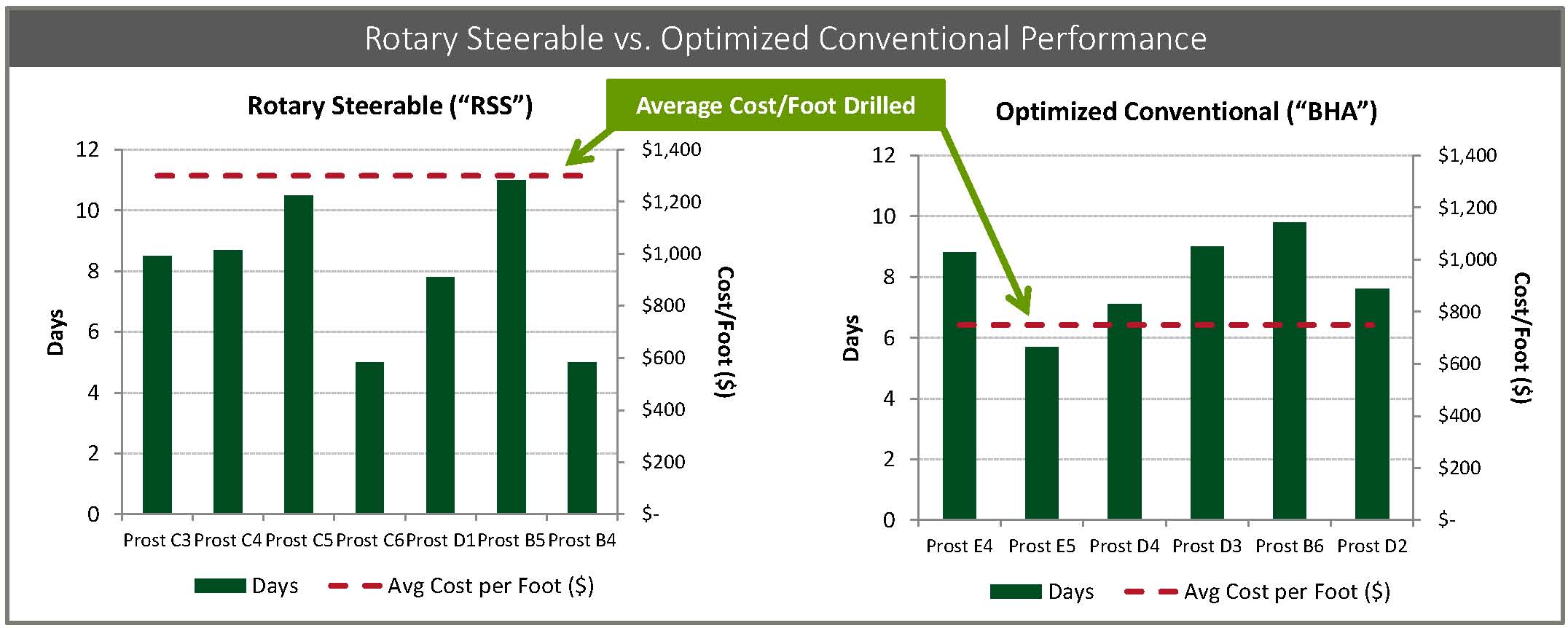

Management outlined a handful of case studies detailing its development of the Eagle Ford, including the evolution of its Marquis asset.

Will Satterfield, Senior Vice President of Asset Development, said: “The Marquis area is one of the more challenging parts of the Eagle Ford to drill. In fact, a few years ago, many people said there wasn’t even a prospect here. We used some rotary steerable equipment and it worked very well. It was very costly, but it worked very well. Our goal in the engineering department was to see if we could duplicate those efforts with conventional equipment.”

Source: SN Analyst Day Presentation

Since then, well costs in the Marquis have dropped from $15 million to $8.5 million in 2014. SN management believes costs will drop even further, eventually reaching $7.3 million per well in 2015. A similar knowledge was gained in the Cotulla, with well costs dropping from $15 million to its current level of $7.3 million. Company executives credited SN’s efficiency to growing prospective positions as a result of more cost-effective capital. The Catarina is targeted as SN’s next big hotspot, and the company has already realized uplift of 120 MBOE in estimated ultimate recovery (raising the total to as much as 500 MBOE through the use of tubing).

“We’re already outperforming the way we modeled Catarina’s development,” said Sanchez III.

Future Development

The Eagle Ford makes up about 80% of SN’s acreage, but the company plans to spend 92% of its 2014 expenditures on Eagle Ford development. The Tuscaloosa Marine Shale properties will retain one operated rig and roughly $60 million of capital while the Eagle Ford will command the other $780 million to $840 million.

Source: SN Analyst Day Presentation

SN’s amount of reserves is referred to by the company as its “bullpen,” allowing it the opportunity to ramp up production if necessary. Based on its current assets, SN believes its optimum capacity includes 20 rigs with production capable of exceeding 100 MBOEPD.

The ability to ramp up operations provided a segue into its next topic, as covered by John Happ, Senior Vice President of Marketing and Midstream for Sanchez. “We believe we have “fit for export” facilities near Catarina,” he said. “Our condensate is focused on new markets, and by new markets, I mean exports. We are holding our breath just like everybody else about what Congress will decide, but we are confident in our ideas about the Catarina.”

Its facilities have 40 MBOEPD in processing capacity, and the Catarina sits in the more condensate/gas window of the Eagle Ford.

ECI Valuation of Sanchez Energy

EnerCom’s Five Factor model accounts for valuation of 85 E&P companies, taking financials and metrics into consideration. Sanchez ranked fifth among its peers in three-year production replacement. Despite the focus on acquisitions and building reserves, the company’s debt-to-market cap ratio of 31% is below the industry median of 35%. The company has room to run. The company currently trades at a ratio of 4.1x in price to cash flow per share. Based on EnerCom’s predictive model, and using a 21-company group with similar market capitalizations, the Sanchez P/CFPS ratio could be as high as 6.7x under current operating and financial metrics.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.