Well Efficiencies, Cost Improvements Lead to Adjustments

Sanchez Energy (ticker: SN) raised its guidance for the second time in less than a month in its Q2’15 earnings release, issued on August 10, 2015. Revised 2015 volumes estimate production at 46 to 50 MBOEPD (69% liquids), up from the previous estimate of 44 to 48 MBOEPD announced in an operations update on July 15. Its latest guidance is 14% higher than the 2015’s first forecast of 40 to 44 MBOEPD and represents a midpoint production increase of 57% compared to fiscal 2014. Average Q2’15 volumes amounted to 53.9 MBOEPD.

The upwards production adjustment comes despite a $50 million reduction in SN’s 2015 drilling program. Its latest forecast places expenditures at $550 to $600 million, while its 2016 program plans to spend only $250 to $300 million while maintaining a flat production profile. Analyst firms are projecting the oil mix to decline considering operations are focused on the Catarina – an asset in the Eagle Ford gas window.

Tony Sanchez III, Chairman, Chief Executive Officer and President of Sanchez Energy, will further discuss the company’s Eagle Ford progress at EnerCom’s The Oil & Gas Conference® 20 in Denver on August 17.

The Three Keys

Management credited three operational drivers for impacting its latest projections; efficiency, cost reductions and well performance. “With this continuing focus, we have positioned the company to both thrive and grow in a $40 to $50 oil price environment,” said Sanchez in a conference call following the release. He later added that some of its acreage “looks like they’re economic at $40 and below.”

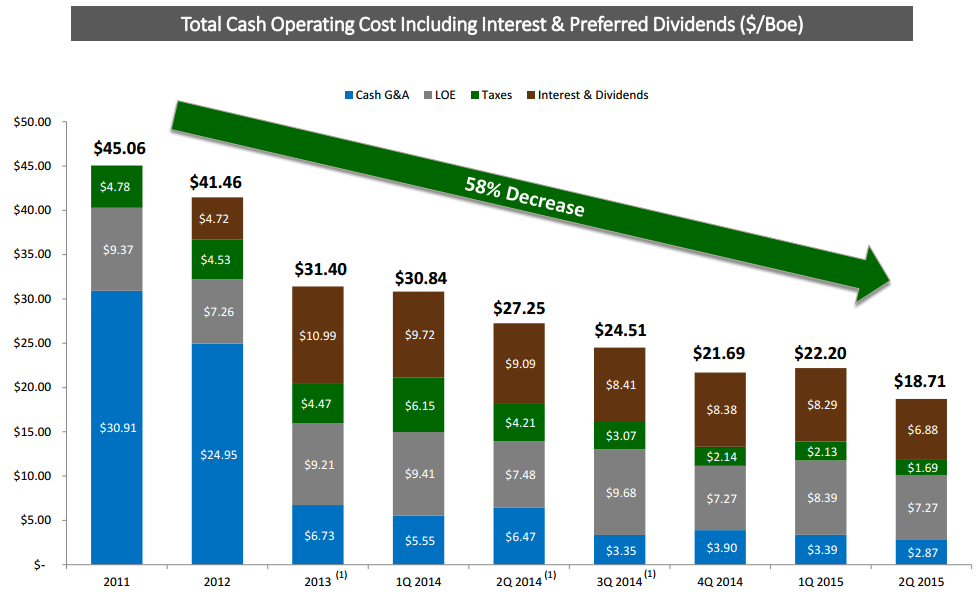

The low projected break-even costs are aided by dropping prices in the field. Management said wells are now being completed for about $4.4 million apiece, down from $7.5 million when operations first began in the region. Some have even been completed for less than $4.0 million. Cash unit operating costs per BOE dropped 16% compared to Q1’15 and are 31% lower than Q2’14.

Operational quickness is also on the rise. Per terms of its drilling agreement on its Catarina asset, SN is required to drill 50 wells per year ending June 30. The company drilled 68 in its latest annual commitment period and is allowed to “bank” the 18 extra wells into its new term. Even though SN is dropping its rig count to two from three, it still believes it can achieve the 2015-16 commitment by year-end 2015 – six months ahead of schedule. “This gives us considerable flexibility to drastically reduce activity in the first half of next year if warranted by market conditions,” said Sanchez III. An additional 32 wells are currently awaiting completion.

Finally, two recent pads brought online in South-Central Catarina are outperforming their 600 to 700 MBOE type curve and are trending in line with those on the Western side of the project, which are currently the best to date. Sanchez had a total of 565 wells online as of June 30, 2015.

Sanchez Energy 2014 Annual, Designed by EnerCom, Inc.

Winner: Bronze – Energy Sector

2014 LACP Annual Report Awards

Cash In Mind

Sanchez built its sizable Eagle Ford position through a series of acquisitions in the last few years, but management believes the need for new capital has been “dramatically decreased” due to the company’s ability to reduce operating costs in recent quarters. Sanchez currently has total liquidity of $572 million, including $272 million in cash and an elected $300 million from its undrawn credit facility (which holds a borrowing base of $550 million). Approximately 50% of its total production is hedged in the second half of 2015, when the company plans on slowing its drilling program.

“Our capital spending reduction reflects a conservative approach to managing the balance sheet until more certainty develops around a commodity price recovery,” said Tony Sanchez III. “The lower level of capital spending will have no material impact on our land or lease position in any area, and we remain well-positioned to increase activity later as commodity prices begin to show signs of recovery.”

Gleeson van Riet, Chief Financial Officer of Sanchez Energy, believes the company’s $550 million borrowing base may be reduced in the upcoming fall redetermination, but reminded investors and analysts on the call that only $300 million of the credit facility has been elected for use. Management also does not believe it will need to draw from the base for the remainder of 2015. “With six years before any of our bonds mature, we feel very comfortable that we have the liquidity and capital base to provide us with a tremendous amount of flexibility for 2016 and beyond,” van Riet said.