Sanchez Energy presents at EnerCom’s The Oil & Service Conference™ 14

Sanchez Energy Corp. (ticker: SN, SanchezEnergyCorp.com) presented today at EnerCom’s The Oil & Service Conference™ 14 at 9:00 a.m. PST. The Houston-based company is a focused on acquisition and development of unconventional oil and natural gas resources in the Eagle Ford Shale. In the company’s year-end results, Sanchez reported record production of 5.3 MMBOE.

At the conference, Sanchez’s management team said the company remains focused on cost reduction and financial flexibility. “In this downturn, it is a necessity to lower costs,” said Cham King, a capital markets associate with SN.

Strong returns in the Eagle Ford

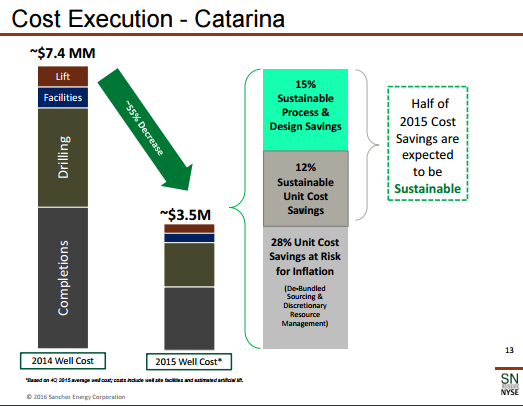

Sanchez has focused in on its best returning assets in order to achieve higher rates of return. In the company’s Catarina acreage, which will receive 60% of the company’s $200-$250 million 2016 capital budget, Sanchez lowered the average cost of a well to approximately $3.5 million, down 47% from the 2014 average cost of $7.4 million per well.

In addition to lowering the cost of its wells in Catarina, Sanchez is also seeing increases in its type curves. According to the company’s presentation, the type curve for Western Catarina wells has increased from approximately 600 MBOE to 750 MBOE. With the lowered costs and higher returns, Sanchez is realizing a 37% IRR on its wells in the area.

The South Central Catarina is showing even stronger results, as well. According to SN, the company is seeing IRRs of 81% from wells in this area. The company’s calculations are based on $55 per barrel of oil, $3.50 per Mcf, and NGL prices at a 25% discount to WTI.

The South Central Catarina is showing even stronger results, as well. According to SN, the company is seeing IRRs of 81% from wells in this area. The company’s calculations are based on $55 per barrel of oil, $3.50 per Mcf, and NGL prices at a 25% discount to WTI.

Strong hedge position locks in revenue

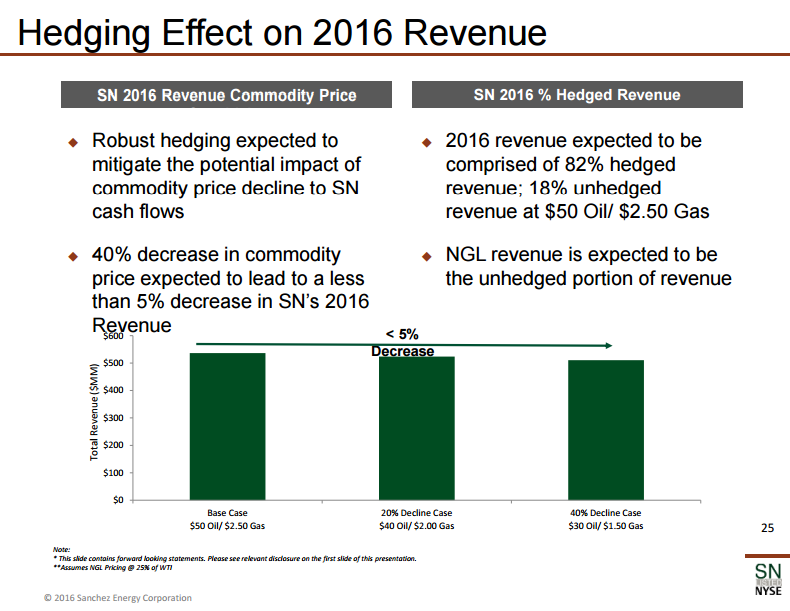

The company has also focused on creating a strong balance sheet to withstand the commodity price downturn. The company currently has 105% of 2016 oil production, and about 97% and 75% of 2016 and 2017 gas production, respectively hedged, allowing the company to lock in revenue for 2016.

Sanchez’s hedges will leave it relatively protected against any further declines in commodity prices. SN estimates that a 40% decrease in commodity price would lead to a less than 5% decrease in the company’s 2016 revenue.

Following the company’s $430 million in divestitures in 2015, SN currently has liquidity of $735 million, consisting of $435 million of cash and a $300 million elected commitment on its revolving credit facility. Sanchez currently has no bank debt, and no outstanding debt maturities until 2021, giving the company financial flexibility through at least the remainder of this year.