Quarter-over-quarter daily production increases by 19%, current volumes highest in company history

Increased efficiency, shorter drilling days and wells exceeding type curves prompted Sanchez Energy (ticker: SN) to upwardly revise guidance for the second straight quarter, the company said in an operations update on July 15, 2015. Current volumes are the highest in company history.

The producer, operating almost exclusively in the Eagle Ford Shale, reported Q2’15 production of 53,920 BOEPD (69% liquids), an increase of 19% compared to Q1’15’s average of 45,217 BOEPD (71% liquids). Sanchez is now projecting full-year guidance of 44,000 to 48,000 BOEPD – a far cry from its initial 2015 guidance of 40,000 to 44,000 BOEPD. The company has bumped up its forecasted output by 2,000 BOEPD in each of its last two operations releases. KLR Group believes another jump is possible, saying, “Preliminarily, we expect to remain above full year guidance at 50,000 to 51,000 BOEPD.” Johnson Rice also believes the volume projections are “conservative.”

Growth Stage in Stride

In a press release, Tony Sanchez III, president and chief executive officer of Sanchez Energy, said, “This improvement in productivity has allowed us to put online additional wells in the first half of 2015 without spending additional capital beyond the budget or increasing the number of drilling rigs working on our assets.”

The company has efficiently built up its portfolio through a series of acquisitions and working down drilling and completion costs. Its three-year production replacement ranks among the best of its 87 peers on EnerCom’s E&P Weekly Benchmarking report. Its percentage of 927% is well above the industry median of 351% and is the eighth highest on the list.

Management will be presenting at EnerCom’s The Oil & Gas Conference® 20 to further discuss their Eagle Ford story.

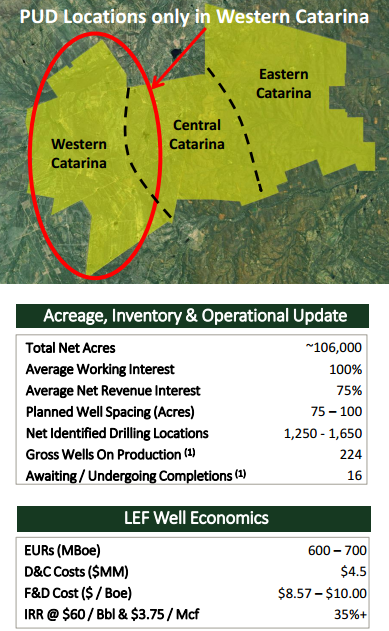

Catarina Continues to Impress

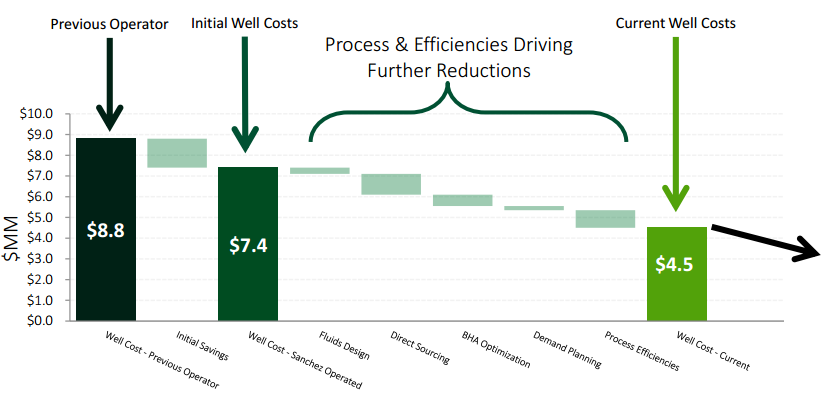

Sanchez has three core areas in the Eagle Ford but is currently directing the majority of activity to its 106,000 net acres in the Catarina. Its two most recent two-well pads in the south-central portion averaged 24-hour initial production rates of 1,400 to 1,800 BOEPD and are tracking above the type curve of 600 to 700 MBOE. Management said the south-central wells are rivaling production numbers from the western side. Well costs have dropped to below $4.5 million from previous costs of about $6.5 million.

A total of 50 wells must be drilled in the Catarina annually, per commitment terms which ended on June 30, 2015, dating back to the acquisition of the assets last year from Royal Dutch Shell (ticker: RDS.B). Sanchez ended the drilling commitment term with 68 completed wells and are allowed to “bank” 18 wells over into its newest term, meaning only 32 wells must be drilled before June 30, 2016.

“By banking these wells, the Company has increased flexibility on obligatory drilling for the next year,” said Sanchez. “Although it is still early, we are increasingly optimistic about the performance of wells outside of the core Western Catarina area and plan to provide additional details during our second quarter earnings call.”

Operational Overview

Overall, Sanchez operates about 231,000 net acres in the Eagle Ford Shale of South Texas and plans on running four gross rigs (3.5 net) over the course of 2015. Its first well in the Tuscaloosa Marine Shale is expected online by Q3’15.

A total of 35 gross wells (30 operated) were brought online in Q2’15, increasing its year-to-date completed well count to 77 gross wells (59 operated). SN’s total well count in the Eagle Ford amounts to 565 gross (449 net) with 32 gross (29.5 net) awaiting completion. Approximately half of all producing wells are located in the Catarina.

The company’s 2015 capital plan remains unchanged at $600 to $650 million and is expected to spud 75 net wells and complete 88 by year-end. Reaching its goal would place its total completed net well count at nearly 150. The declining drilling costs has SN expecting to come in on the low end of its guidance.

As of Q1’15, SN reported total liquidity of $645 million, consisting of $345 million in cash and an elected commitment of $300 million from its $550 million borrowing base. In response to the announcement, Capital One Securities boosted SN’s cash flow per share estimates to $1.00 from $0.83 and EBITDA estimates to $95 million from $85 million.