Saratoga Resources (ticker: SARA) is an independent exploration and production company with 52,103 net acres under lease in the Gulf of Mexico (GOM). Approximately 62% of its acreage is on the traditional Louisiana coastline and the remaining 32% is located in the shallow GOM. SARA operates and holds substantially 100% working interest in all of its wells.

Saratoga announced on June 3, 2014, its Rocky 3 well tested at 1,572 BOEPD gross (1,288 BOEPD net to SARA) – a company record. Oil consisted of approximately 97% of the production stream. The rate nearly matches average daily production from all of SARA’s net producing assets in Q1’14. In a conference call with analysts and investors following its Q1’14 news release, Saratoga management said production in March 2014 was up 41% compared to volumes in February and January following extensive changes to its field operating teams.

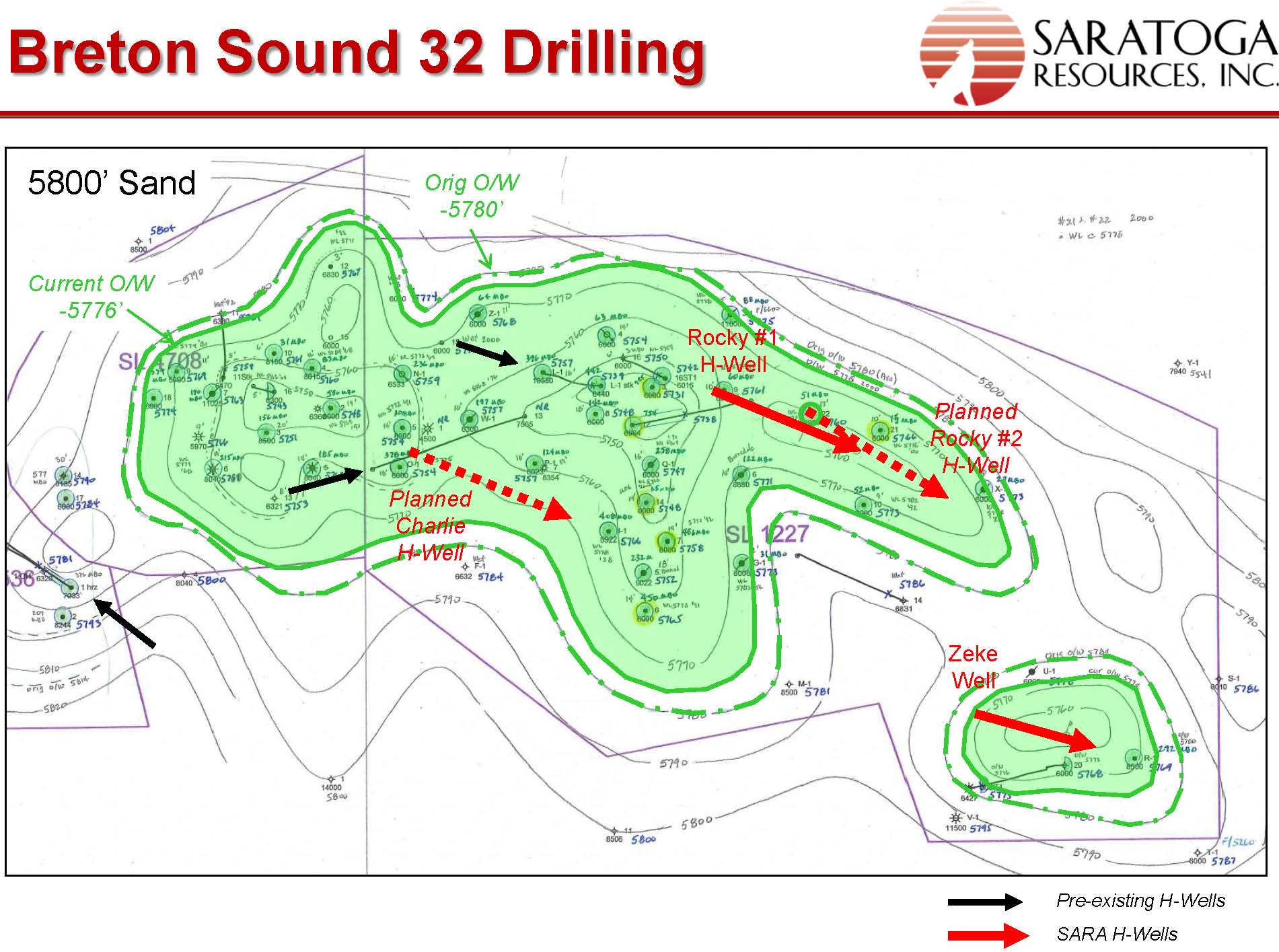

The Rocky 3 will be produced at 650 BOEPD due to current capacity limitations at the field. Two other horizontal wells in the same field were producing 367 BOEPD gross (320 net) near the end of May 2014 and have been online since 2013. Management said its horizontal drilling program is applicable for its properties in Breton Sound Block 32 (where the Rocky was drilled) and Grand Bay field, and testing is underway to evaluate potential in SARA’s other leases.

OAG360® interviewed Andy Clifford, President of Saratoga Resources, to discuss Saratoga’s future.

OAG360: In your opinion, why did your Rocky 3 horizontal well perform so much higher than expected?

We stayed within the highest resistivity sand towards the top of the sand package that we were targeting compared to the previous two wells, Rocky 1 and Zeke. We learned a lot from drilling those wells. We try to be as close to the bit as possible, and our geologist and directional experts were on the rig to determine logging while drilling data, using the right mud and effectively using the rotary steerable drilling technology. Additionally, we want to get the cost down with each subsequent well. Current completed well costs are in the $5 million to $7 million range and we want to shave $1 million off the cost going forward, if possible.

Source: SARA March 2014 Presentation

OAG360: Horizontal drilling in the Gulf of Mexico is different than drilling horizontally onshore. Can you tell our readers what your goal is with horizontal drilling on the shelf and how it works?

We took a page out of Energy XXI’s (ticker: EXXI) book and saw what they were doing. Targeting fields with low structural dip, strong water drive and defined by high quality 3D are all things that applied to us. Furthermore, and compared to EXXI, we do not have flanks of salt domes to contend with so we expect a higher success rate. EXXI claims to get 2.5 to 3x EURs with horizontals versus verticals in the same reservoir and we saw the same results from some early wells completed in the 1980s by Kerr-McGee. We also are seeing 2.5 to 3x production rates as well as recoveries – great for cash flow and great for reserves.

The vertical wells in high permeability sands like we have seem to exhibit coning whereas the horizontal wells show more of a cresting effect so that water hits later. We are doing reservoir simulation to accurately model the production history of the 5800’ sand at BS-32 field to identify new locations for horizontal wells.

Tell us about your horizontal well inventory. How many horizontal well prospects like Rocky 3 do you have on your blocks and how many will you drill in 2014?

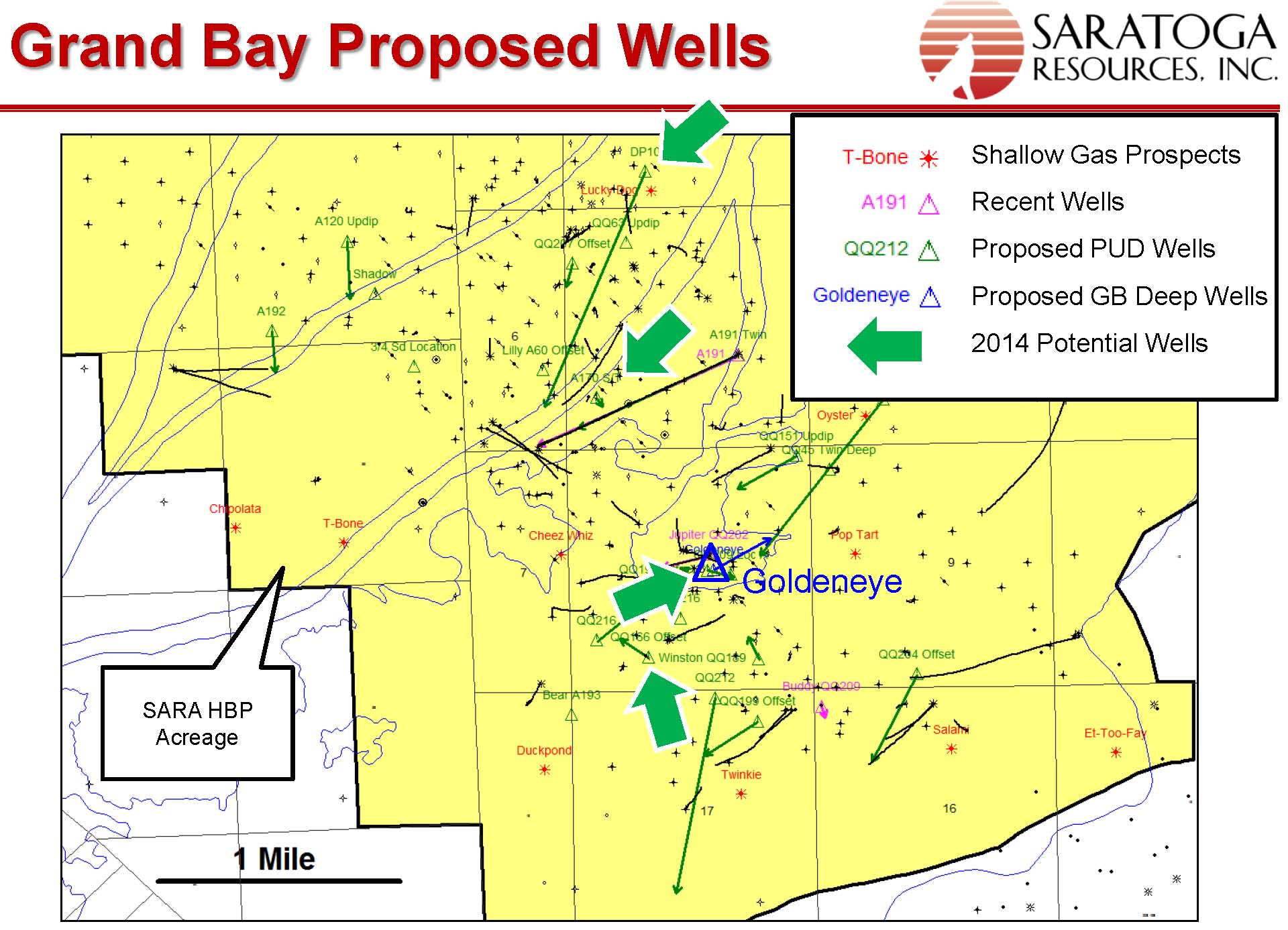

We are doing reservoir simulation and other studies to identify new locations for more horizontal wells, not only in the Breton Sound 32 field but will also look at Breton Sound 18, Main Pass 25 and Grand Bay fields as ideal candidates. We are “reverse engineering” some of our previous identified development wells at Grand Bay in order to pick out horizontal well sweet spots that will give us a better initial rate of return and quicker payout. We would expect another three to four wells in BS-32 during next couple of years with one or two more towards the end of the year and into 2015. That includes the Rocky 2, which we actually skipped over in order to drill the Rocky 3.

You made some repairs and conducted maintenance on infrastructure during Q1’14. Will you be able to increase your takeaway capacity in the near term?

Source: SARA March 2014 Presentation

We see some near term production capacity constraints at BS-32 that we hope to remedy for not too much cost. We will likely lay a second pipeline from our platform to the sales point, where we have sufficient tie-in capacity. We are also looking at the whole system so that when we drill more Rocky 3’s, we won’t have to shut in other wells. We are stepping up our maintenance across the board and de-bottlenecking our capacity but it will take time, probably thru 2014, to get all the kinks taken care of. We don’t expect a lot of capex to do it all but part of the exercise is to improve conditions in the field and morale. The result of Rocky 3 really helped with morale.

What will be Saratoga’s focus going forward? Continue with workovers, de-risking your acreage blocks or continue horizontal drilling?

All of the above, but finding joint venture partners for our Goldeneye prospect under Grand Bay is a big priority. That well excites us a lot and we expect realistically to drill it to 16,500’ in the fall, given the need to negotiate agreements, although the well is permitted and ready to drill. We will concentrate our near term efforts on legacy wells and bringing our shut-in wells back online. We will also identify and permit more horizontals.

We don’t think our acreage needs any de-risking. It is all low risk except perhaps the geopressured section where Goldeneye sits. That is pseudo-development since the seismic amplitudes we are targeting are updip from production and we have conducted successful tests with productive analogs in fields to the immediate north of Grand Bay.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom, Inc. has a long only position in EXXI.