Saratoga Resources (ticker: SARA) is an independent exploration and production company with offices in Houston, Texas and Covington, Louisiana. Principal holdings cover 51,901 gross/net acres with 60% held by production, located in the transitional coastline and protected in-bay environment on parish and state leases of south Louisiana and in the shallow Gulf of Mexico Shelf.

Saratoga expanded its boundaries in 2013. The primary focus continues to be reworking wells, but SARA’s operations for fiscal 2013 included drilling its first horizontal (Rocky) and high angle (Zeke) wells. Management has said in each of its last two quarterly earnings calls that it intends on proceeding with its horizontal program in 2014.

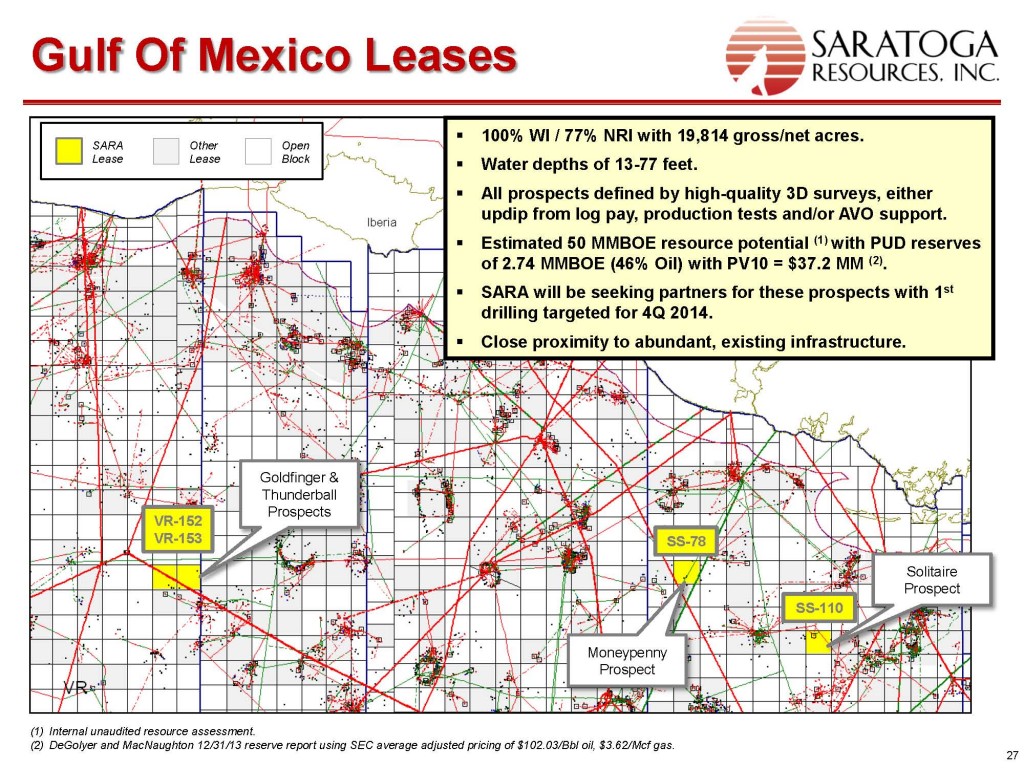

The company also bolstered its asset base by acquiring 19,814 gross acres in the Gulf of Mexico in fiscal 2013. Roughly half of the properties were acquired for $880,000 through a Bureau of Ocean Energy Management lease sale in March 2013. The company is the sole operator of the region with a 100% working interest and 77% net revenue interest. Test results in the most recent quarter estimated 50 MMBOE of resource potential in the plays with 2.74 MMBOE in proved undeveloped reserves. SARA is currently looking to create a partnership and plans on drilling the first well in the region by Q4’14.

Andy Clifford, President of Saratoga Resources, said the company is conducting 3D surveys on each potential drill site and will soon begin the permitting process.

2014 Operations Underway

SARA will continue with its well workovers and recompletions in 2014. In the past year, 17 of 22 recompletions along with nine of 10 workovers were successful. The majority of the wells are being operated in the Grand Bay field, which Saratoga says has not produced a dry well in more than 70 years.

Four new wells will be drilled in the upcoming year, including a step-out well on Rocky horizontal project commencing within the next few weeks. Three workovers have already been completed in Q1’14 and have added roughly 2 MMcf/d to SARA’s production. With the addition of Rocky 2, management believes new overall 2014 production will contribute 3.3 MMcf/d and 279 BOEPD (total of 624 net BOEPD) to its stream.

The company reported $32.5 million in cash on hand due to a public offering in 2013 and expects to fully fund its 2014 expenditures through existing cash and projected operations. Its hedging program is also being evaluated and additional layers may be added if deemed appropriate by management.

Q4’13 Results

Saratoga was hampered by shut-ins due to construction, low gas lift supplies, unexpected downtime and field operating issues for fiscal 2013. Overall, production dropped by 28% year over year to reach 803 MBOE, and the company reported a net loss of $26.4 million ($0.84 per share). Non-cash charges, such as re-classifying reserves as part of the 5-year SEC rule, accounted for $11.7 million of the loss.

However, management believes it has resolved all operational issues and will rebound in 2014. Its oil production was not part of the significant decline, as production dropped roughly 10% in comparison to a gas drop of 54%. Going forward, the company anticipates oil will consist of 75% of the stream.

The company anticipates a considerable boost in production due to the estimated 624 BOEPD from new projects. The company expects the improved field performance, along with switching from testing to production, will begin to show positive effects by Q2’14. Despite the drop in production and re-categorization of volumes in 2013, overall reserves stayed relatively consistent at 73.7 MMBOE for a PV-10 value of $1.38 billion. Proved reserves currently consist of 17.2 MMBOE for a PV-10 value of $410.8 million.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. As of the report date, neither EnerCom nor any of its employees has a financial interest in any equity or debt of any company mentioned in this report.