Estimates show Saudi Arabia pulling cash to cover deficit

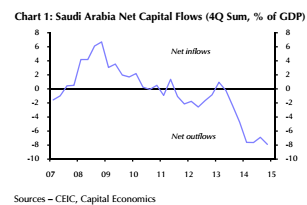

Saudi Arabia has withdrawn as much as $70 billion from global asset managers as low oil prices continue to put financial pressure on OPEC’s largest producer, according to financial services market intelligence company Insight Discovery. Saudi Arabia is likely to post a deficit of 19.5% of GDP this year amid low oil prices due to a global glut, according to information from the International Monetary Fund.

The Saudi Arabian Monetary Agency’s (SAMA) foreign reserves have slumped by nearly $73 billion since oil prices started to decline last year as the kingdom keeps spending to sustain the economy and fund its military campaign in Yemen.

This month, several managers were hit by a new wave of redemptions, which came on top of an initial round of withdrawals this year, people with knowledge of the matter told CNBC. “It was our Black Monday,” said one fund manager.

Nigel Sillitoe, CEO of Insight Discovery, said fund managers estimate that SAMA has pulled out $50-$70 billion over the past six months. Other industry executives estimated that SAMA has pulled out even more than $70 billion from existing managers.

Fund managers with strong ties to Gulf sovereign wealth funds, such as BlackRock, Franklin Templeton and Legal & General, have received redemption notices, sources told CNBC.

“The big question is when will they come back, because managers have been really quite reliant on SAMA for business in recent years,” Sillitoe said.

Since the third quarter of 2014, SAMA’s reserves held in foreign securities have declined by $71 billion, accounting for almost all of the $72.8 billion reduction in overall overseas assets. Some fund managers have seen several billions of dollars of withdrawals, amounting to a fifth to a quarter of their Saudi assets under management.

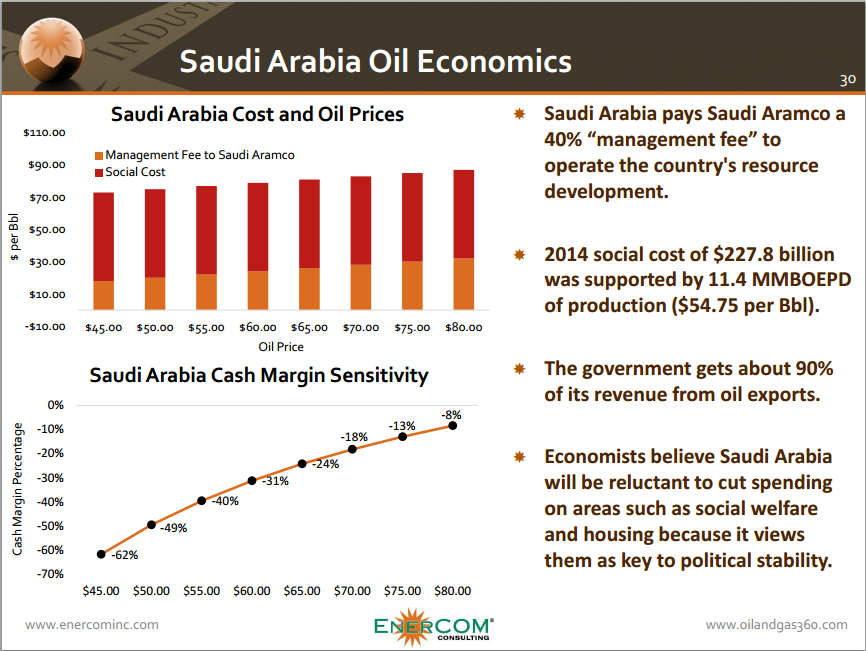

With oil accounting for 80% of revenue, SAMA has been forced to find ways to buffer the blow to the economy. The financial agency plans to raise between 90 billion riyals ($24 billion) and 100 billion riyals ($26.7 billion) in bonds before the end of the year as it seeks to diversify its $752 billion economy, reports Bloomberg.

While foreign-exchange reserves could sustain the country for years, analysts have said that using them to avoid further cost-cutting could put its credit rating at risk. The Saudi government, so far, has been short on specifics on how it will reduce spending, though planners are said to be considering measures long viewed as off-limits or unnecessary, including phasing out fuel subsidies and investing in renewable energy.

The country has a population about 30 million people, with spending forecast to reach 1,082 billion riyals this year according to Riyadh-based Jadwa Investment Co. The kingdom’s finances are depleted by continued subsidies, hand-outs to public sector workers and the Yemen conflict. The International Monetary Fund predicts the budget deficit will exceed 400 billion riyals ($106.6 billion) this year.

Khalid Alsweilem, a former official at the Saudi central bank and now at Harvard University, said the fiscal deficit must be covered almost dollar-for-dollar by drawing down reserves. “We are much more vulnerable,” said Alsweilem, commenting on the fact that Kuwait, Qatar and Abu Dhabi all have three times greater reserves per capita than Saudi Arabia. “That is why we are the fourth rated sovereign in the Gulf at AA-. We cannot afford to lose our cushion over the next two years.”

Saudi’s financial reserves peaked at $737 billion in August of 2014. They sat at $672 billion in May 2015, but with Brent below $45 per barrel, the Kingdom will need to spend at least $12 billion per month from its sovereign fund in order to support social spending alone.