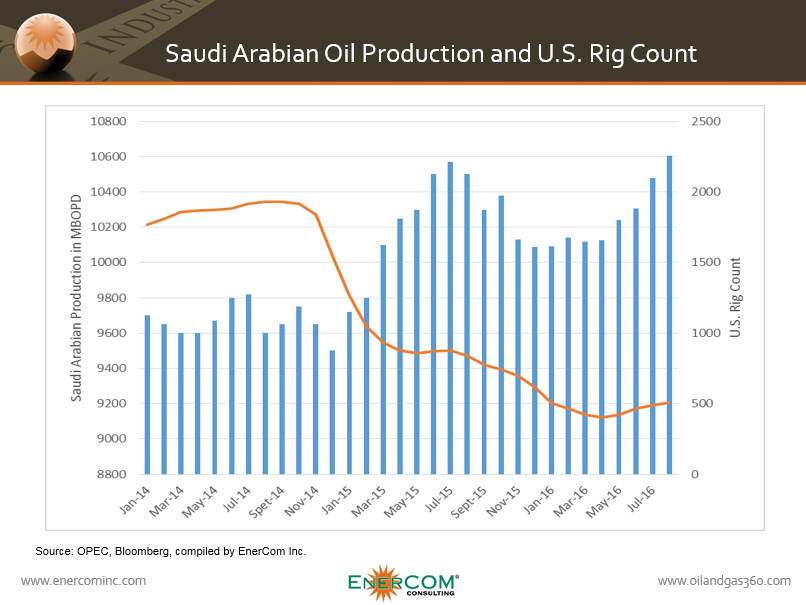

U.S. output down 460 MBOPD since May, making Saudi Arabia the largest global oil producer for now

As lower oil prices put pressure on U.S. shale expansion, Saudi Arabia has reclaimed the top spot as the world’s largest producer of crude oil, according to the International Energy Agency’s (IEA) monthly report.

“Saudi Arabia’s elevated oil production has allowed it to overtake the U.S. and become the world’s largest oil producer,” the Paris-based IEA said in its monthly report on Tuesday.

OPEC’s largest producer has added 400 MBOPD of production since May, largely offsetting a 460 MBOPD decline from American shale producers. The shale boom was responsible for making the U.S. the largest hydrocarbon producer, ahead of both Russia and Saudi Arabia, in 2014 and 2015.

U.S. output in August stood at 12.2 million barrels a day, including natural gas liquids, according to the IEA. The drop in U.S. production came as the number of rigs drilling for oil and gas fell to a record low of 404 on May 20, according to data from Baker Hughes Inc. That number has since recovered to 508 as of Sept. 9.

IEA sees market balance farther out than previously forecast

It its monthly report, the IEA revised its outlook for market balance as well. Oil demand growth is slowing, with gains for 2016 revised down 0.1 MMBOPD to 1.3 MMBOPD from the agency’s previous report. Momentum is also expected to slow further into next year, with demand growing 1.2 MMBOPD in 2017 as “underlying macroeconomic conditions remain uncertain,” the IEA said Tuesday.

World oil supplies dropped 0.3 MMOBPD in August as non-OPEC producers continue to slow their rate of production. Non-OPEC supply is expected to grow 0.4 MMBPD next year following an anticipated yearly decline of 0.8 MMBOPD in 2016.

Stockpiles will grow through 2017: IEA

Slowing demand growth and the continued increases in global production will push market balance further out than the IEA previously forecasted, however. Stockpiles are expected to continue growing through 2017, the fourth consecutive year of oversupply.

“Supply will continue to outpace demand at least through the first half of next year,” the IEA wrote in its report. “As for the market’s return to balance — it looks like we may have to wait a while longer.”

Today’s IEA monthly report came one day after OPEC’s monthly report which was out yesterday. As far as predicting an end of the global oil glut, both groups said almost the same thing: it’s going to take longer to work it off than we previously said.

U.S. crude oil benchmark WTI was down over $1.00 following the IEA report today. International Brent crude is fairing slightly better, down $0.89 this afternoon.