Oil’s persistent slide has moved some OPEC members into action.

WTI traded down again Wednesday, off almost $3.00 from the day’s high to close at $90.83, a 17-month low. Brent crude closed at $94.14, a 27-month low following a price cut by Saudi Arabia.

Yesterday Reuters reported that OPEC output had hit its highest levels since 2012, thanks to more supply coming mainly from Libya and Saudi Arabia, and other OPEC producers.

“The lack of any cutbacks underlines the relaxed view of OPEC’s core Gulf members to oil’s slide from $115 in June to $97 on Tuesday – a level they can tolerate, but which puts budgets in producers such as Iran and non-member Russia under pressure,” Reuters reported. “Supply from the Organization of the Petroleum Exporting Countries averaged 30.96 million Bpd in September, up from 30.15 million Bpd in August, according to the survey based on shipping data and information from sources at oil companies, OPEC and consultants.”

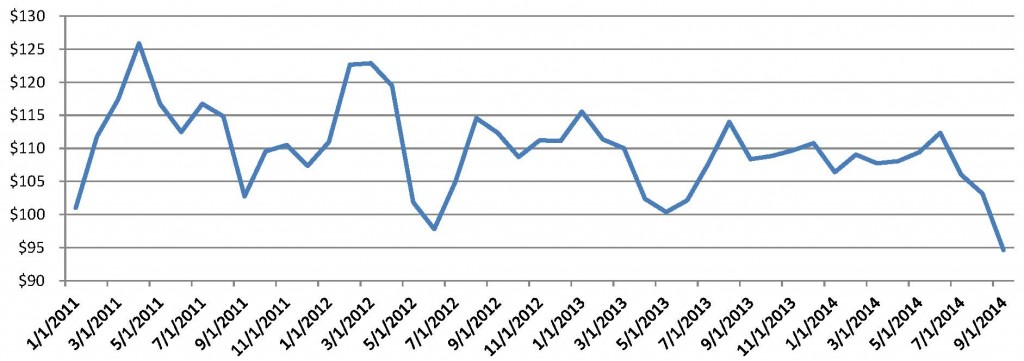

BRENT SPOT PRICE (2011 – PRESENT)

Attacks in Iraq, Syria Still Not Affecting Oil Prices

Thus far the Islamic State’s (ISIS) rampage from Syria across Iraq has not affected world prices or oil export levels from Iraq’s southern oil fields, although the barbaric killers known for beheading enemy soldiers, civilians, children and Christians, were only 16 miles from Baghdad when the BBC filmed this report on Sept. 29.

“OPEC’s own forecasts suggest demand for its crude will fall to 29.20 million bpd in 2015 due to rising supply of U.S. shale oil and supplies from other producers outside the group – almost 1.8 million bpd below current output according to this survey,” Reuters said.

Meantime Bloomberg reported that U.S. oil exports could break a record held since 1957, “as traders find ways around a four-decade ban on supplies leaving the country. The U.S. sent 401,000 barrels a day abroad in July, 54,000 barrels a day shy of the monthly record set in March 1957, according to data compiled by the EIA. While Canada accounted for 93 percent of the shipments, Italy, Singapore and Switzerland also took oil from U.S. ports. Coupled with Alaskan supplies bound for Asia, total U.S. exports will reach 1 million barrels a day by the middle of 2015, according to Citigroup Inc.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.