Amin Nasser named Saudi Aramco President and CEO

Saudi Arabian Oil Company announced today that acting president and CEO, Amin H. Nasser, will take the helm of the world’s largest energy company on a permanent basis. Nasser was named president and CEO pro-tem May 1, during a shakeup in Saudi Arabia’s ministers.

The former president and CEO, Khalid al-Falih, was named Chairman of Saudi Aramco and the health minister of the country by Saudi King Salman. Salman also changed the line of royal succession in the Kingdom, shifting the power within the royal family as well.

Nasser served as vice president of petroleum engineering and development, business line head of exploration and production, and finally as E&P senior vice president, before being promoted to his current position. Nasser is the fourth Saudi national to head Aramco, and has spent more than 30 years working for the company.

As part of the appointment to the permanent position of president and CEO of the company, Nasser was also given a seat on Aramco’s 10-member supreme council. The Aramco Supreme Council announced that it had agreed on a five-year business plan for the firm, including the related capital program, but did not give any further details, reports The Wall Street Journal.

Reap what you sow: can Aramco dig the kingdom out of its hole?

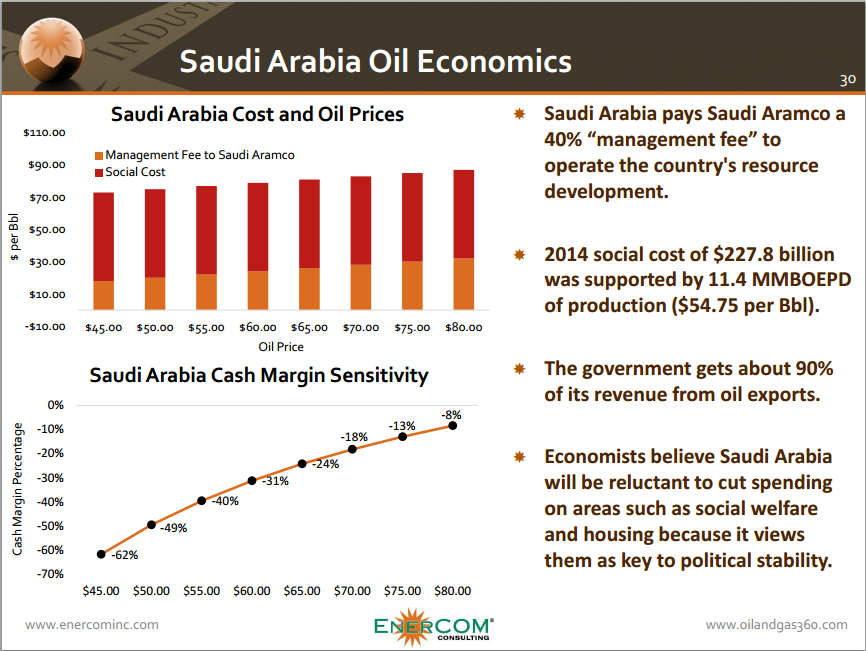

Nasser is taking the helm of Aramco as the oil and gas industry faces record-low crude oil prices brought on by a global glut. Saudi Arabia spearheaded the OPEC policy decision to maintain production at high levels, contributing to the oversupply that sent prices tumbling.

Faced with the decline in value of its production, Saudi Aramco has looked to cut cost wherever it can by pushing contractors for better deals on oil well services to negotiating discounts on its phone and power bills.

Saudi Arabia has also been trying to find ways to cut costs, according to sources familiar with the country’s financial planning. Saudi Arabia may cut as much as 382 billion riyals ($102 billion) in government spending this year in order to soften the blow from lower oil prices. Despite efforts to contain the effects of low oil prices, the International Monetary Fund (IMF) anticipates that Saudi Arabia will post a deficit of 19.5% of GDP this year, with debt remaining high in the medium-term.