Sale takes FCX production down to 7,000 barrels of oil and NGLs, 74 MMcf of natural gas per day

Privately held Sentinel Peak Resources LLC, which is based in Denver, has closed its previously announced acquisition of the onshore California assets of the oil and gas subsidiary of Freeport-McMoRan Inc. (ticker: FCX) for $592 million in cash, before closing adjustments, the companies announced in separate press releases.

Under the terms of the agreement, FCX has the right to receive additional proceeds of $50 million per annum in each of 2018, 2019 and 2020 if the price of Brent crude oil averages $70 per barrel or higher in that calendar year.

The onshore California properties acquired from FCX are operated by Sentinel Peak Resources California LLC and currently produce approximately 28,000 BOEPD, making Sentinel Peak the fourth largest onshore oil producer in the State of California, the company said.

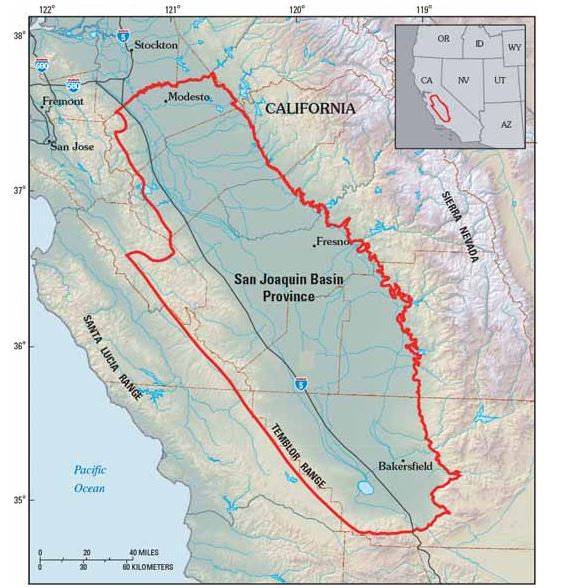

Sentinel Peak is focused chiefly on heavy oil development in California’s San Joaquin Basin. The company was formed in 2016 by Quantum Energy Partners and California oil and gas executive Michael Duginski, who serves as the company’s president and CEO.

Duginski said Sentinel Peak plans to begin investing in several of the former FCX projects in 2017.

$6.6 billion in asset sales for FCX in 2016

In mid-December FCX completed the sale of its deepwater Gulf of Mexico (GOM) properties to Anadarko Petroleum Corporation (ticker: APC) for $2.0 billion in cash.

Under the terms of the agreement with Anadarko, FCX has the right to receive additional proceeds of up to $150 million, to be paid as Anadarko realizes future cash flows in connection with a third-party production handling agreement for the Marlin platform.

Following completion of these recent oil and gas asset transactions, FCX’s portfolio of oil and gas assets is whittled down to production onshore in South Louisiana and on the GOM Shelf, plus oil production offshore California and natural gas production from the Madden area in Central Wyoming. In third-quarter 2016, these properties produced an average of 7,000 barrels of oil and NGLs per day and 74 MMcf of natural gas per day, FCX reported.

During 2016, FCX completed $6.6 billion in asset sale transactions. FCX has been selling off its oil and natural gas assets in order to return its focus to copper, gold and molybdenum. FCX is the world’s largest public copper miner.

FCX cancelled its planned oil and gas IPO in May 2016.