Shell’s Fort Sumter discover in the Gulf of Mexico will help the company reach 900 MBOEPD of offshore production by the end of the decade

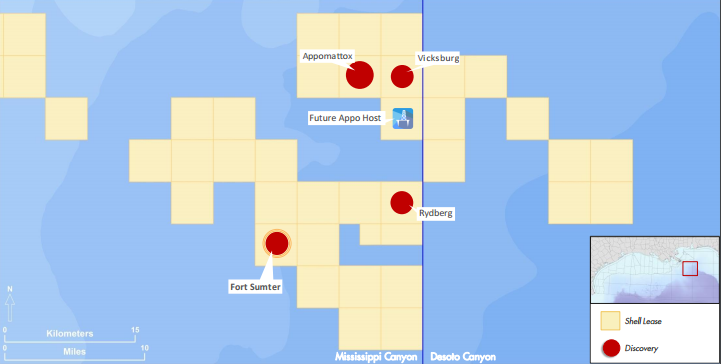

Royal Dutch Shell (ticker: RDSA) announced the discovery in the Mississippi Canyon Block 566, 73 miles offshore, southeast of New Orleans in the Gulf of Mexico.

The discovery, called Fort Sumter, has initial estimated recoverable resources of more than 125 MMBOE, according to a company press release. The company’s release indicated that further appraisal and planned wells in adjacent structures “could considerably increase recoverable potential in the vicinity of the Fort Sumter well.”

Fort Sumter was drilled in a water depth of 7,062 feet to a total vertical drilling depth of 28,016 feet measured depth. The block is nine square miles in size and is 100% operated by Shell. An appraisal sidetrack well was later drilled to a depth of 29,200 feet, the company added.

Even as oil prices struggle to gain traction above $40 per barrel, Shell’s latest discovery could still prove economical. Wells drilling in the Gulf of Mexico by other operators, such as Murphy Oil Company (ticker: MUR), have breakeven prices around the $40 mark.

Since 2010, Shell has discovered around 1.3 billion barrels of oil equivalent in the Gulf of Mexico, the company said. Deep water production is expected to increase to about 900 MBOEPD by early 2020s from already discovered reservoirs, and deep water production growth remains a priority for the company, Shell said.

“The Fort Sumter discovery[‘s] … proximity to our nearby discoveries in the area, and to highly prospective acreage to the southeast, makes Fort Sumter particularly significant,” said Ceri Powell, Executive Vice President Exploration. “These successes demonstrate there is still running room in the producing basins of our heartlands where large, high-value discoveries have the potential to further strengthen our deep-water competitiveness.”

Something to celebrate

Shell is entitled to a few minutes to pop the champagne to celebrate its GOM discovery, particularly in the aftermath of its difficulties in Alaska’s Chukchi Sea last year.

Shell expects to write off $4.1 billion as part of its exploration program that included the Alaska effort which ended after determining its exploration well in the Chukchi Sea was non-commercial in the current price environment. The $4.1 billion write down will be in addition to the $7 billion Shell had invested in the Arctic up to this point, including $2.1 billion to acquire its license in the Chukchi Sea, where its now-abandoned Burger J exploration well was located.

Q2 2016

Yesterday, Shell reported Q2 results.

Second quarter 2016 summary (unaudited results):

- Following the acquisition on February 15, 2016, BG Group plc (“BG”) has been consolidated within Royal Dutch Shell’s results.

- Royal Dutch Shell’s second quarter 2016 CCS earnings attributable to shareholders were $0.2 billion compared with $3.4 billion for the same quarter a year ago.

- Second quarter 2016 CCS earnings attributable to shareholders excluding identified items were $1.0 billion compared with $3.8 billion for the second quarter 2015, a decrease of 72%.

- Compared with the second quarter 2015, CCS earnings attributable to shareholders excluding identified items were impacted by the decline in oil, gas and LNG prices, the depreciation step-up resulting from the BG acquisition, weaker refining industry conditions, and increased taxation. Earnings benefited from increased production volumes from BG assets.

- Second quarter 2016 basic CCS earnings per share excluding identified items decreased by 78% versus the second quarter 2015.

- Cash flow from operating activities for the second quarter 2016 was $2.3 billion, which included negative working capital movements of $2.5 billion.

- Total dividends distributed to shareholders in the quarter were $3.7 billion, of which $1.2 billion were settled by issuing 50.5 million A shares under the Scrip Dividend Programme.

- Gearing at the end of the second quarter 2016 was 28.1% versus 12.7% at the end of the second quarter 2015. This increase mainly reflects the impact of the acquisition of BG.

- A second quarter 2016 dividend has been announced of $0.47 per ordinary share and $0.94 per American Depositary Share (“ADS”).

Shell will be presenting at EnerCom’s The Oil & Gas Conference on Monday, August 14, 2016, in Denver, Colorado at 3:30 p.m. EST. To learn more about the conference and its presenters, click here.

Watch Royal Dutch Shell CEO Ben van Buerden’s two-minute commentary regarding Shell’s Q2 results, below.