M&A activity down in terms of volume, but Shell-BG megadeal pushes overall dollar value up

The second quarter of 2015 showed the largest amount of activity in mergers and acquisitions (M&A) in the oil and gas sector by value since the fourth quarter of 2012, reports the Energy Information Administration (EIA). $115 billion of M&A activity was reported in Q2, but 73% of that value came from Royal Dutch Shell’s (ticker: RDSA) acquisition of BG Group (ticker: BG) for $84 billion.

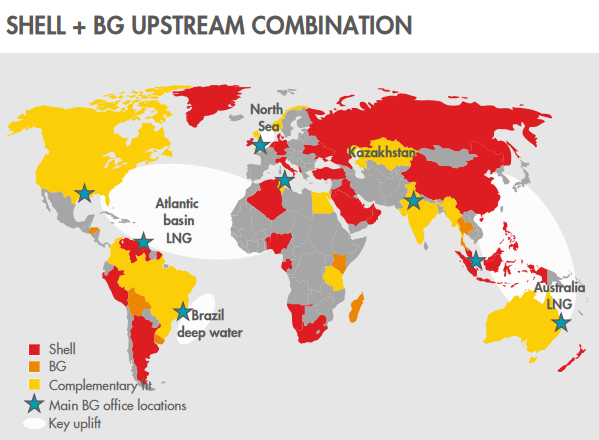

In Shell’s press release announcing the deal, RDSA CEO Ben van Buerden said the acquisition would help solidify the company’s position in the natural gas market. “BG will accelerate Shell’s financial growth strategy, particularly in deep water and liquefied natural gas … Furthermore, the addition of BG’s competitive natural gas positions makes strategic sense, ahead of the long-term growth in demand we see for this cleaner-burning fuel.”

Without the value of the Shell/BG megadeal, however, the value of M&A deals in the second quarter of 2015 would have only totaled $31 billion, $18 billion higher than in the first quarter, which was the lowest since at least 2008, according to the EIA.

The second quarter was also well below normal levels in terms of deal volume. 137 deals were announced in the second quarter, the lowest number of M&A deals since fourth-quarter 2008 and 42% below the 235 median quarterly number of deals over the previous two years.

Other notable M&A activity in Q2’15

While the Shell/BG deal was largely responsible for Q2’15 being the second largest quarter in terms of dollar value for M&A since 2008, there were several other noteworthy transactions in the second quarter as well.

Yesterday, Noble Energy (ticker: NBL) closed on the all-stock acquisition of Rosetta Resources (ticker: ROSE) for $3.9 billion, including ROSE’s $1.8 billion of debt, representing a 28% premium on Rosetta’s 30-day average stock price. For its part, Noble received 50,000 net acres in the Eagle Ford Shale and 56,000 net acres in the Permian Basin, which includes more than 1,800 gross horizontal drilling locations and net unrisked resource potential of 1 billion BOE.

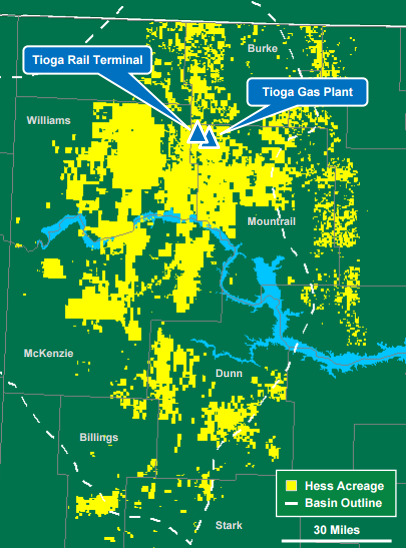

Private equity company Global Infrastructure Partners (GIP) purchased a 50% stake in Hess Corporation’s (ticker: HES) Bakken midstream assets for $2.675 billion in a deal that closed July 1, 2015. The joint venture will operate under the name Hess Infrastructure Partners, with the company pursuing an initial public offering (IPO) in third-quarter 2015.

In another deal that was completed on the first of the month, Siemens (ticker: SIE) acquired Houston-based Dresser-Rand (ticker: DRC) for total consideration of $7.8 billion following approval from the E.U. antitrust regulator. In its press release, SIE said that the acquisition would give the company “a comprehensive portfolio of equipment and capability for the oil and gas industry and a much expanded installed base, allow us to address the needs of the market.”