Shell exits Abu Dhabi due to project economics

Royal Dutch Shell (ticker: RDSA) announced today that the company will not continue the joint development of the Bab sour gas reservoirs with Abu Dhabi National Oil Company (ADNOC). According to a press release put out by Shell today, the company concluded “the development of the project does not fit with the company’s strategy, particularly in the economic climate prevailing in the energy industry.”

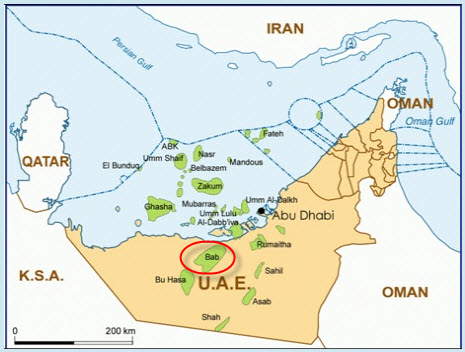

The joint venture was originally announced in April, 2013, with Shell taking a 40% stake in the project, which was originally planned to operate for 30 years, according to a press release. Located 150 kilometers (90 miles) south-west of the city of Abu Dhabi, in the U.A.E., the project was expected to cost $10 billion, reports U.A.E. paper The National.

The original purpose of the project was to supply natural gas to domestic markets in the U.A.E. starting in 2020, but with the dramatic drop of oil and gas prices over the last 18 months, the project has quickly become uneconomic.

“The reason most probably is going to be a commercial reason,” said the U.A.E.’s energy minister, Suhail al Mazrouei, on the sidelines of the World Future Energy Summit in Abu Dhabi. “The price of gas has dropped by more than 50%. Developing a more expensive solution is not going to be viable at this time … we do not want to develop gas that is more expensive than the gas we can import.

The high hydrogen sulfide content of the gas that would be produced from the Bab reservoirs would require treatment to sweeten the gas, making it more expensive to produce.

Shell’s relationship with ADNOC remains “very good,” according to Shell’s Vice President for Abu Dhabi, Kuwait and Syria Andrew Vaughan, reports Bloomberg. “We are still interested in the ADNOC concession,” he said.

Shell said in November that talks continued with Abu Dhabi about taking a stake in Abu Dhabi Co. for Onshore Petroleum Operations, a unit of ADNOC focused on onshore oil fields.

Shell shores up the balance sheet

Shell’s exit from Abu Dhabi is not the first project cancelled by the company in recent months. RDSA announced in September that the company would pull the plug on its Arctic drilling program and take a $4.1 billion impairment.

The company decided to abandoned its Burger J exploration well offshore Alaska following disappointing results, according to the company.

Analysts thought that the move was likely to shore up the balance sheet as the company focuses on larger projects. “I imagine investors will be OK with a $1 billion hit versus tens of billions in the future,” said Bernstein’s analyst Oswald Clint.