Shell posts the largest profit of any major yet in Q3, but management said the industry isn’t out of the woods yet

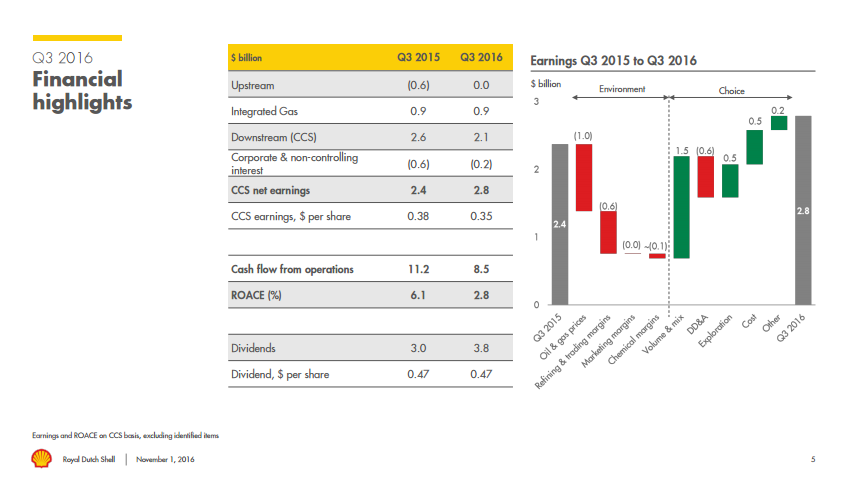

Royal Dutch Shell (ticker: RDSA) reported a larger profit than any of the other international oil majors to release third-quarter numbers so far – reporting $2.8 billion Tuesday. The higher than expected earnings were a welcome surprise after Shell reported Q2 earnings 50% below forecasts, but Shell and the rest of the oil and gas industry still have a rough path ahead of them, according to the company’s management.

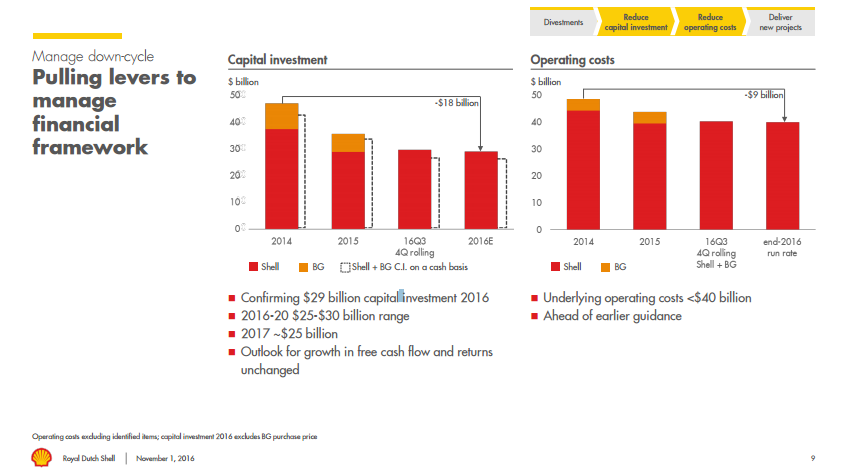

Shell attributed the performance to lower costs, saying that underlying operational costs for the year are at an annualized run rate of $40 billion, $9 billion lower than Shell and former rival BG’s costs in 2014. Shell closed its acquisition of BG earlier this year in a deal that made up 73% of the total M&A deal value for Q2.

“Shell delivered better results this quarter, reflecting strong operational and cost performance. But lower oil prices continue to be a significant challenge across the business, and the outlook remains uncertain,” Shell CEO Ben van Beurden said in the company’s press release.

RDSA appears to be counting on oil remaining in the $50-$55 per barrel range to make its plans for dividend growth and future development work. During the company’s conference call, Shell CFO Simon Henry was asked about the priority given to debt repayment and maintaining the company’s credit rating, to which he responded the company should be fine as long as prices remain around $50.

“The question between credit rating and dividend is one I hope not to have to face in practice at the moment,” said Henry. “It’s tight and it’s close and it does require the oil prices to stay roughly around $50. But we should be able to manage reasonably well through the next 12 months.”

International crude benchmark Brent fell below $50 over the weekend following news that OPEC was unable to make progress on a production agreement. Many market analysts are worried crude oil prices may take another dive if the group is unable to close a deal by the end of its next meeting November 30. Brent crude traded below $48 on Tuesday.

Shell has not cut its dividend since World War II, and appears to be reluctant to change that streak now, but another dip lower for oil prices could put substantial pressure on the company.

“In Shell’s case there’s been a lot of concern about the very high level dividend pay-out and the fact that those dividend pay-outs were not covered,” Divisional Director at Investec Charles Newsome told CNBC.

“I’m always deeply suspicious about companies that are paying uncovered dividends and effectively paying today and not investing for tomorrow, which is what appears to be going on here,” he added.

Shell appears to be looking for more ways to cut costs moving forward as well. The company said its preliminary 2017 budget would be approximately $25 billion, about $4 billion less than the capital the company plans to invest through the end of this year.