Mark Papa’s Silver Run will own 89% interest in Centennial

Silver Run Acquisition Corporation (ticker: SRAQ), a special purpose acquisition company (SPAC) run by former 14-year EOG Resources (ticker: EOG) CEO Mark Papa, agreed to purchase approximately 89% interest in Centennial Resource Production, an independent E&P located in the core of the Southern Delaware Basin, from an affiliate of Riverstone Holdings LLC. Two weeks ago, Riverstone acquired a majority stake in Centennial from Natural Gas Partners (NGP) for $175 million.

Centennial had earlier filed for a proposed $100 million IPO, which now will not happen.

In accordance with the agreement, Riverstone has agreed to assign, and Silver Run has agreed to assume, its right to purchase the interest in Centennial to Silver Run and will participate in the transaction as an equity holder directly in Silver Run.

Riverstone and its controlled investment funds will purchase an estimated $810 million of Silver Run Class A common stock at $10.00 per share. In addition, certain funds managed by Capital World Investors and certain funds managed by Fidelity Management and Research Company will purchase $200 million of Silver Run Class A Common Stock at $10.00 per share. The proceeds of both stock sales will be used to fund a portion of the cash consideration required to effect the Centennial acquisition, but the company did not say how much it agreed to pay for the Centennial acquisition.

Following the closing of the Centennial acquisition and related transactions, Riverstone and its affiliates will be the single largest stockholder of Silver Run, with an approximate 51% ownership interest. NGP is expected to retain a significant equity stake in Centennial, approximating 11% of the outstanding interests, and will have a representative on the Silver Run Board of Directors.

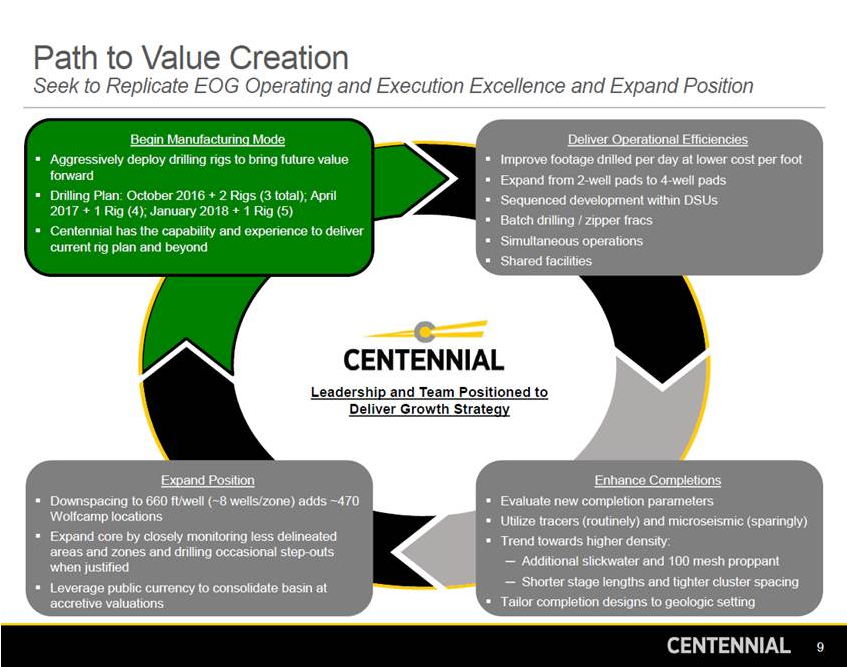

Mark Papa, who presided over EOG for 14 years, under whom the company’s share price grew 1,000%, will lead the Denver-based company following the consummation of the deal, according to a company press release. Centennial’s existing senior management team led by CEO Ward Polzin will provide transition services for a period of time as Papa looks to permanently fill management positions.

Silver Run is expected to be renamed Centennial Resource Development Corp. and trade on the NASDAQ under the ticker CDEV once the deal is completed.

Silver Run’s ownership

Silver Run completed its IPO in February, raising $450 million, with the aim of investing in U.S. energy companies. This most recent acquisition could indicate that major investors are moving more quickly to secure assets and acreage at depressed prices as U.S. crude prices remain below $50 per barrel.

More than 97% of the company is held by institutional investors, with Wellington Management Group holding approximately 10.2% of the company’s outstanding stock. Other major investors include Hartford Capital Appreciation Fund and Hartford Capital Appreciation HLS Fund, which collectively hold roughly 8.3% of the company, The Baupost Group with a 7.5% interest, TD Asset Management with 6.3% interest, Adage Capital Partners with a 5% interest, and 65 other holders with smaller shares in the company, according to information from Bloomberg.

An overview of CDEV

The anticipated initial enterprise value of the combined company is approximately $1.7 billion, implying a multiple of 12.6x and 6.6x projected calendar 2017 and 2018 adjusted EBITDA, respectively, and post-closing equity value of $1.8 billion at $10.00 per share.

Silver Run expects to be debt-free at the closing of the transaction and have $100 million of cash-on-hand and an undrawn revolving credit facility to fund future drilling and acquisitions.

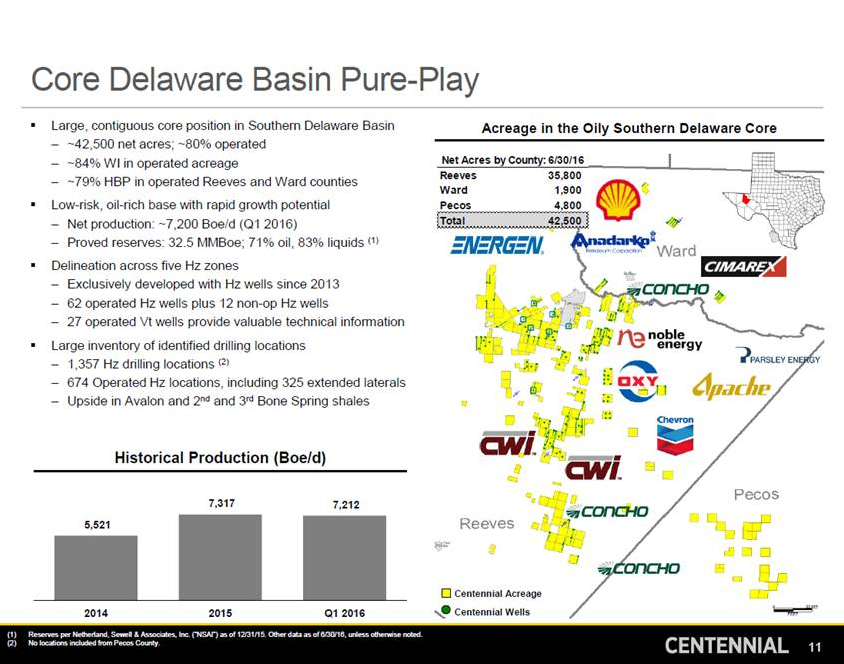

Centennial is a pure-play Delaware Basin company with 42,500 net acres primarily in Reeves and Ward counties. In its press release announcing the acquisition, Silver Run said Centennial is producing approximately 7.2 MBOEPD from a position with five currently producing shale zones that has the upside for seven more. Reserves are believed to be at 48.6 MMBOE of net proved reserves based on internal estimates. The company reported 1,357 gross identified potential horizontal drilling locations on its acreage.

Gross Identified Horizontal Drilling Locations

Zones:

3rd Bone Spring Sandstone 64

Upper Wolfcamp A 398

Lower Wolfcamp A 329

Wolfcamp B 300

Wolfcamp C 266