SM Energy plans to use the proceeds to improve liquidity

Denver-based SM Energy Company (ticker: SM) announced today that the company has entered into two agreements to divest non-core assets for a combined price of $172.5 million. The transactions are expected to close late in the third quarter of 2016, according to the company’s press release.

One of the two packages sold is composed primarily of waterflood assets in New Mexico, while the second package includes producing assets in North Dakota and Montana. Year-end 2015 net proved reserves associated with the assets totaled approximately 9.5 MMBOE (87% oil) and was all proved develop. Second quarter 2016 net production from these assets was approximately 3.3 MBOPED (82% oil). Net acreage associated with the sale is approximately 79,000 acres, according to SM Energy.

The implied deal metrics were approximately $18.16 per BOE of proved reserves, $52,272.73 per flowing BOE, and $2,183.54 on a per acre basis.

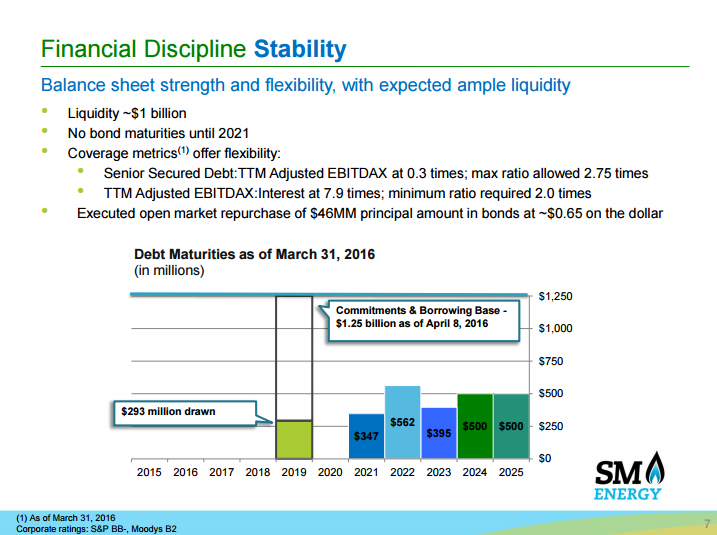

The deal is a “net positive as these properties were likely not going to see any capital allocation and funds [are] to be used to pay down [the] revolver,” a note from Wells Fargo Equity Research said today. SM Energy has a higher debt-to-market cap ratio compared to its peers in EnerCom’s E&P Weekly scorecard at 143% compared to a median of 63% for the week ended July 22, 2016. The company plans to use the proceeds from the sale to help strengthen the balance sheet.

“We are committed to improving liquidity and debt metrics while managing our portfolio to focus on our highest return assets,” said SM Energy President and CEO Jay Ottoson. “Proceeds from these sales will be applied to the outstanding balance on our revolving credit facility and for general corporate purposes.”

SM Energy added that these two sales “make-up the majority of non-core asset sales anticipated during 2016, announced in February of 2016.”

SM Energy will be presenting at EnerCom’s The Oil & Gas Conference 21 in Denver, Colorado, on Tuesday, August 16, at 5:10 p.m. EST. To learn more about the company’s presenting at this year’s conference, click here.