China National Offshore Oil Corporation (CNOOC) and its partner, Husky Energy (ticker: HSE) announced that their Liuhua 34-2 offshore gas field commenced operations on December 15, 2014.

The Liuhua 34-2 gas field is located in the Eastern South China Sea, approximately 300 kilometers (186 miles) southeast of the Hong Kong Special Administrative Region, with water depth ranging from 850 to 1,250 meters (2,788 to 4101 feet). Liuhua 34-2 is part of the larger Liwan Gas Project that consists of three natural gas fields: Liwan 3-1, Liuhua 34-2 and Liuhua 29-1, which share a subsea production system, subsea pipeline transportation and onshore gas processing infrastructure.

Liwan 3-1 started producing in March of 2014, according to Husky. The field has nine deepwater wells located in approximately 1,200 to 1,500 meters (3,937 to 4,921 feet) of water about 75 kilometers (46.6 miles) from a shallow water platform, which in turn is connected by pipeline to the onshore Gaolan Gas Terminal. The Energy Information Administration reports that CNOOC expects the Liwan gas project, which includes three fields and 4 to 6 Tcf of reserves, to produce up to 180 Bcf per annum and to be one of the company’s largest new sources of incremental gas production in the next few years.

The Liuhua 29-1, located 43 kilometers northeast of the Liwan 3-1, has not yet begun production. According to Husky, negotiations are underway for the gas sales contract for the field. A discovery well tested at a restricted rate of 57 MMcf/d in early 2010, with future deliverability expected to surpass 90 MMcf/d. First production is anticipated in the 2018 timeframe.

Husky holds a 49% interest in the Liwan Gas Project and operates the deepwater infrastructure. CNOOC holds the remaining 51% interest in the project and operates the shallow water facilities and the onshore Gaolan Terminal. The nationally owned E&P is one of three such companies in China, but is the only company specializing in offshore operations. The government enforces an ad valorem resources tax of 5% on all oil and gas production but the market prices relate closely to those of international markets.

China’s oil and gas sector continues to ramp up as the country aims to reduce its reliance on coal, whose emissions have left some of the country’s 1.357 billion residents in clouds of smog. As many as 20 LNG import terminals have either been proposed or are under construction, with CNOOC either participating or leading 11 such projects.

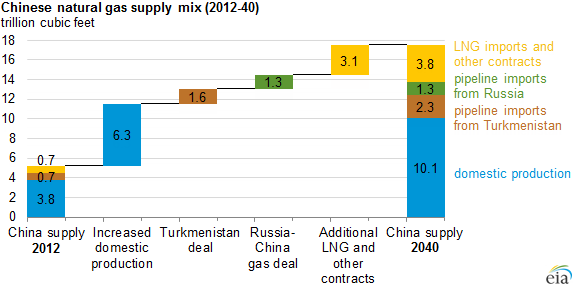

China is projected to be the world’s largest hydrocarbon importer in 2014 and its natural gas demand is forecasted to more than triple to 17.5 Tcf by the year 2040. Its LNG import volume is expected to increase five-fold during the time frame, but more than half of its needs will be meet domestically through oil and gas operations that are gaining steam.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.