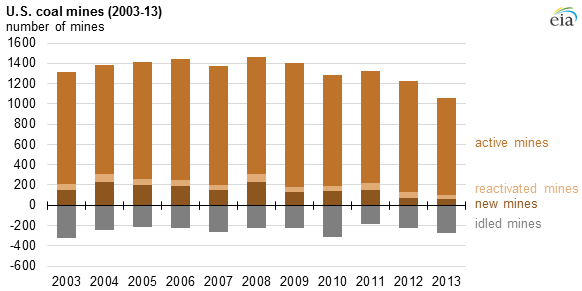

The Energy Information Administration (EIA) released its data for the number of new and reactivated coal mines that began production in 2013, showing that the year had the lowest number of active coal mines since the administration began tracking numbers in 2003. In 2013, 103 mines came online as 271 were idled or closed, resulting in a 14% decline in the total number of producing mines from 2012 to 2013, according to the EIA. The 2013 total was 397 fewer coal mines than in 2008, when coal production was at its highest.

Preliminary 2014 data on coal production from the Mine Safety and Health Administration indicated a slight increase both in production and in new and reactivated mines for 2014, these levels will still be below previous levels, according to the EIA.

The decline in the number of active coal mines in the U.S. reflects reduced investment in the coal industry, strong competition from natural gas, stagnant electricity demand, a weak coal export market, and regulatory and permitting challenges.

The opening, reopening, and idling or closing of mines serves as a measure of coal industry growth or contraction. The number of mines fluctuates with the demand for coal, almost all of which is used to produce electricity. Examples of this fluctuation can be seen in 2008, when higher coal demand increased the number of new mines, and in 2010, when lower coal demand led to fewer new mines and more idled mines.

Clean Power Plan could reduce coal production by 45% in parts of the U.S.

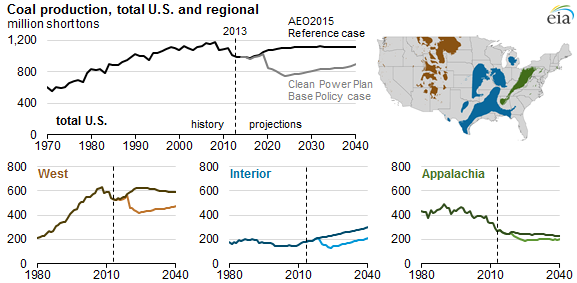

Coal has become an increasingly unattractive fuel source for electrical power generation in the U.S. as focus shifts to cleaner-burning sources of energy like natural gas. On June 2 of this year, the Environmental Protection Agency (EPA) passed its Clean Power Plan, which aims to lower carbon emissions by 30% by 2030 from power plants, many of which are coal-fired.

While it only accounts for 37% of all energy in the U.S., coal is responsible for 75% of carbon emissions, making it the primary target for emissions regulations.

Based on the EIA’s analysis of the effects of the Clean Power Plan, levels of coal production will fall to levels last seen in the late 1970’s, with coal production in the West being particularly hard-hit. Coal production recovers by 2040 in the administration’s analysis, but never reaches levels that would have been seen otherwise.

With relatively low average output per mine, the Appalachian region often makes up the largest share of new and reactivated mines, and in years with fewer mine additions, the Appalachian region also makes up most of the decline in new or reactivated mines, according to the EIA.

Natural gas takes the lead

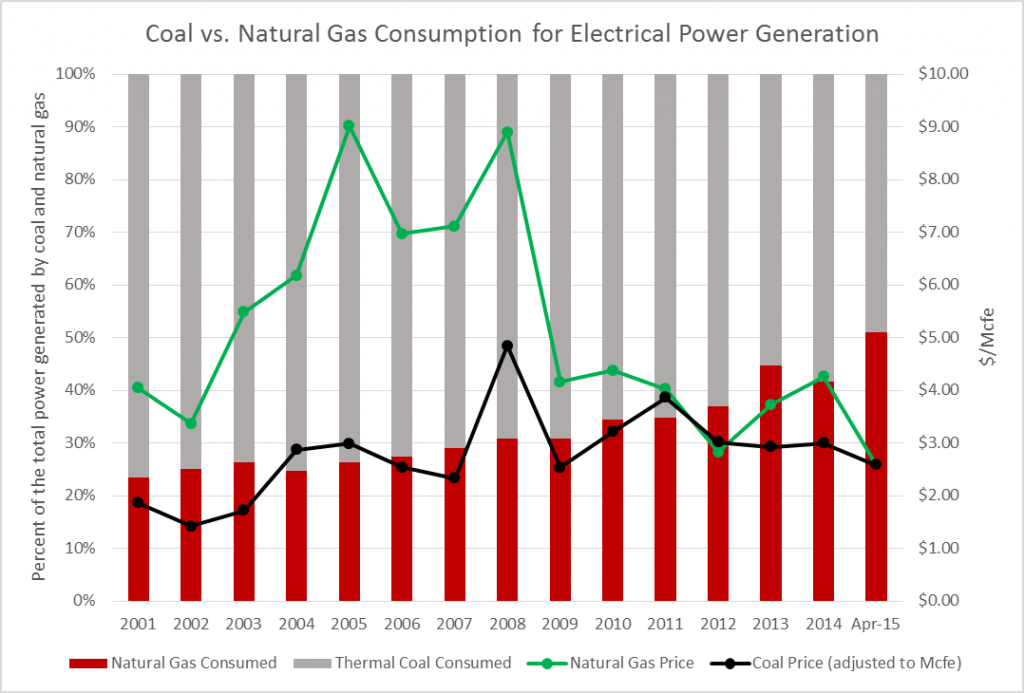

As the political costs associated with coal use continue to climb, and natural gas prices continue to fall, many electrical power generators are choosing to switch to gas to meet their demand. In April 2015, natural gas took the lead as the primary source of electrical power generation for the first time ever.

This chart, provided by EnerCom Analytics, shows the increasing use of natural gas as opposed to coal for electrical generation. The grey and red bars show the percentage of power generation coal and natural gas are responsible for, with 100% representing the total power generation from just those two power sources. The green and black lines show the price of both commodities, with coal adjusted to $ per Mcfe to ensure that the price comparison is on an energy equivalent basis.

Coal Producers: Losing the War?

Several large coal producers have declared bankruptcy including Alpha Natural Resources (ticker: ANRZQ), the nation’s second largest producer, which filed for bankruptcy protection in August. Patriot Coal (ticker: PATCA), Walter Energy (ticker: WLTGQ) and James River Coal (ticker: JRCCQ), have also sought bankruptcy protection since the start of 2014.

Arch Coal (ticker: ACI) is facing difficult times ahead with its debt load, prompting some analysts to ask if it will be the next coal miner to declare, reports Reuters. The company is awaiting a determination on debt swaps today.

Through the end of June, 2015, U.S. coal industry employment was down 24 percent since late 2011, according to the Labor Department, a decline of 21,000 jobs, CBS News reported.