Strategic Oil & Gas (ticker: SOG.TO), a Canadian exploration and production company based in Calgary, Alberta, announced year-over-year increases to both its production and proved + probable reserves in its Q4’14 earnings release. Volumes for fiscal 2014 averaged 3,462 BOEPD and 2P reserves reached 13.9 MMBOE, representing respective increases of 6% and 9%.

The Marlowe formation, located in northern Alberta, is the driver for SOG’s future growth. Of the 500,000 acres held by the company, about 350,000 (70%) are spread across the Marlowe field, where reserve auditors have mapped more than 3 billion BOE in place.

Strategic Catalysts

The junior E&P has spent the last few years building out its infrastructure position in northern Alberta. “Today, Strategic controls everything in the top 70 miles of Alberta, including the plants, the batteries and the roads,” said Gurpreet Sawhney, President and Chief Executive Officer of Strategic Oil & Gas, at EnerCom’s the Oil & Gas Conference® 19 last year.

The infrastructure investments present SOG with the ability to easily move its product to market, providing room to run on its Muskeg drilling program. SOG drilled at a 100% success rate in 2014 and added two more pipelines to its footprint. The pipelines saved the company 30% on transportation costs and will be used exclusively in 2015. Despite the approximate 50% reduction in oil prices, Strategic’s corporate operating netbacks decreased only 3% to $23.23/BOE. The netbacks at Marlowe are described by the company as “competitive” at $32.00/BOE, which generates a rate of return of approximately 20%.

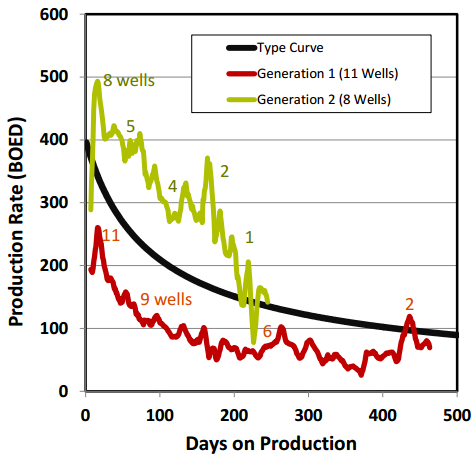

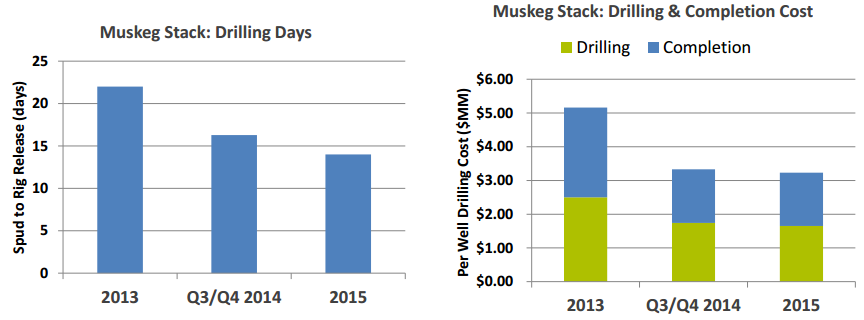

The Muskeg formation, located within the Marlowe, is one of four stacked formations in the region and contributed to the increase in production volumes. The exploitation of the Muskeg is still in the early stages and only 19 wells have been drilled to date, but recent wells are already outperforming initial type curves of 250 MBOE. In addition, drilling and completion costs have dropped by 30% since 2013 as Strategic has shortened drilling days and improved efficiency. Internal estimates by SOG show the formation holds more than 1 billion BOE and management believes the company can organically grow production to 30 MBOEPD. The company directed 91% of its 2014 capital expenditures at Muskeg development.

Strategic in the Short Term

Due to the commodity environment, SOG elected to stop its winter Muskeg drilling program to preserve capital. Its revised 2015 expenditure budget for the first half of 2015 is $11 million, and 700 BOEPD of production at its Bistcho, Cameron Hills and Lame locations have been shut-in until prices recover. The expected volumes, including the shut-in production, will average 3,000 BOEPD for 1H’15, with 35% of production hedged at CN$90.15 (about US$72.00). Management is actively evaluating options such as asset sales, funding alternatives and eliminating certain spending programs to navigate the difficult environment.

New Website

You can follow Strategic’s story at its new web site, www.sogoil.com, created by EnerCom, Inc.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.