January 8 Deadline Looms in Suncor’s Hostile Takeover Attempt

Ernst & Young is one of many analyst firms expecting energy-related divestitures and stock-for-stock deals to rise in 2016, and one of the year’s first deals could involve Canadian Oil Sands (ticker: COS) and Suncor (ticker: SU). But if Canadian Oil Sands gets its wish, the potential merger will be nothing more than a failed attempt.

Less than Two Weeks Away

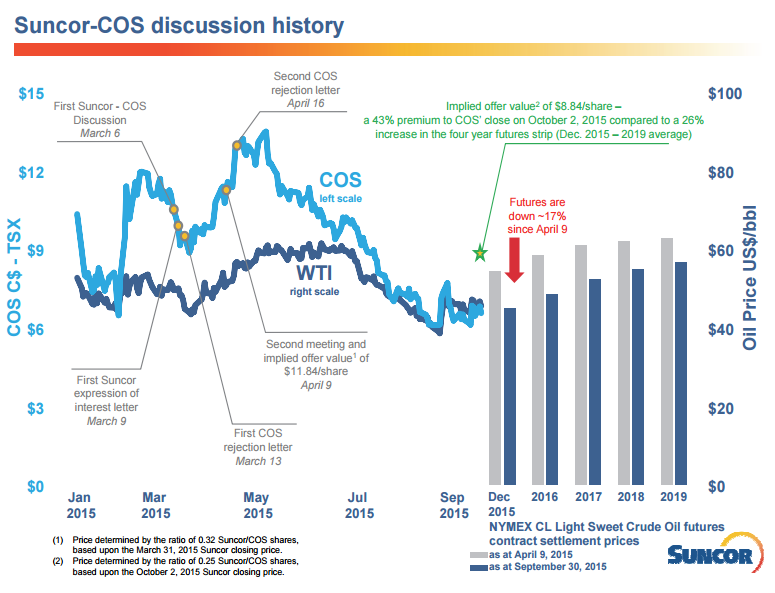

Suncor has been in pursuit of COS since March 2015, but buyout offers aimed at the Canadian Oil Sands board of directors have been unsuccessful. SU resorted to a hostile takeover attempt in October, and both sides continue to make their case to COS shareholders via literature, presentations and specialized web pages.

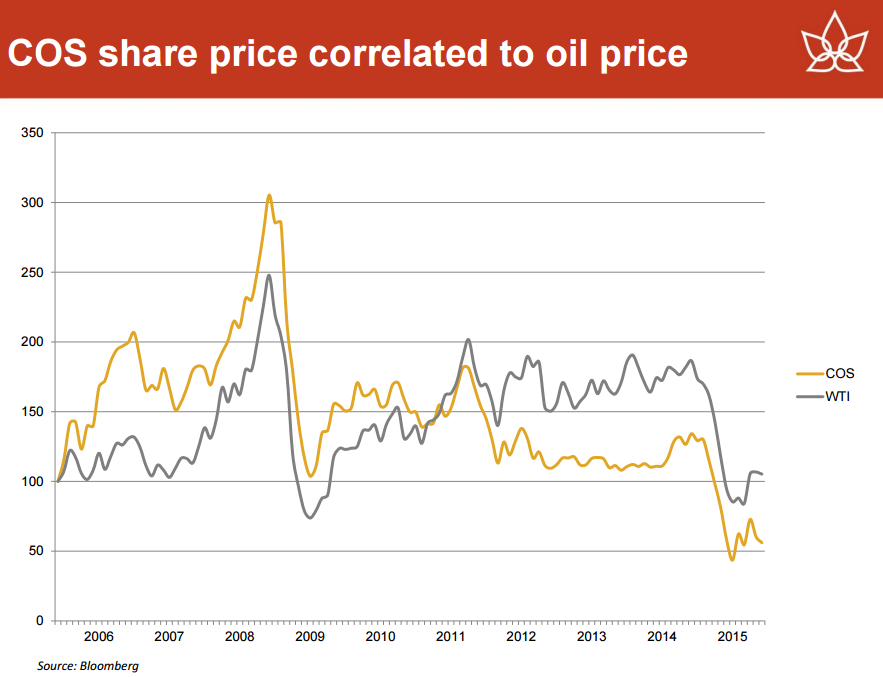

On December 29, 2015, Canadian Oil Sands sent another letter to its shareholders urging against the merger, calling SU’s offer a “Hail Mary low-ball bid.” A key selling point of COS’ reasoning is the oil price. Since COS is focused exclusively on oil sands, its shares show correlation of 98% with oil prices. As we all know, oil commodities have lost more than half of their value in 2015, which leads the COS board to claim that its share prices will have significant upside once prices recover.

“Our shareholders want to capture the upside of their COS investment, not lock-in the downside,” says the latest COS letter. “Suncor says it is offering you a ‘premium’; a premium on our lowest trading price in 15 years is no favour.”

Canadian Oil Sands adds that it has no debt maturities until 2019 and says it is fit to operate in the current commodity environment. The company also points out that the SU offer is a straight stock-for-stock proposal, which would leave COS shareholders without any cash benefits and collectively amount to less than 8% ownership of Suncor shares.

Suncor’s Rebuttal

The COS letter published today comes exactly two weeks after SU sent a letter of its own to the relevant parties, highlighting a shareholder return program and the risks involved with COS as a standalone company.

“Hope is not a strategy,” alleges the SU letter. “Despite falling oil prices and failing production, the COS Board and management have continued to tell you to ‘do nothing’ to protect the value of your COS shares.”

Distributions were a key target in Suncor’s case: COS slashed its dividend by 85% at the beginning of the year in a cost-saving move, and SU says COS shareholders would receive a distribution uplift of 45% if they accepted the hostile takeover. Suncor is also in the midst of a shareholder return program that has generated a five year compounded annual growth rate greater than 20%, and a repurchase program that bought back $5.3 billion of shares from 2011 to 2014.

SU also pointed out its free cash flow – something that the company believes is not in the cards for COS. “It could take as long as ten years before COS would have enough cash flow to fix its balance sheet and reinstate a significant dividend,” alleges SU, with current strip pricing in consideration.

Picking Sides

Brendan Wood International, a consulting firm, has been polling retail and institutional investors on the voting outcome. At the moment, the firm says the race is too close to call, although many investors “simply think the price is too low.”

At the beginning of the month, COS said it was “exploring alternatives that offer our shareholders full and fair value for assets.” No other offers have been made public to date, leading SU to claim that “there is no evidence a better offer will emerge for COS.”

Canadian Oil Sands Relationship with Suncor

Canadian Oil Sands and Suncor are two of seven companies involved in the Syncrude oil sands project of Alberta. Syncrude’s output is massive – average 2015 production to date is nearly 250 MBOPD, making it the largest oil sands project in Canada. COS’ interest of 37% gives it the largest stake, while Suncor owns 12%. However, COS’ lone assets are in the Syncrude venture, while Suncor is the fifth largest energy company in North America.