In August, James Baker of Simmons & Company said Royal Dutch Shell’s (ticker: RDS.B) public offering of its midstream segment would be a “sea change event.” It did not disappoint. Bloomberg reports it was the best trading debut by an energy company in 2014.

Shell Midstream Partners, L.P., trading on the New York Stock Exchange under the ticker SHLX, debuted today and raised $920 million through the offering. Shell originally anticipated pricing the note between $19 and $21, but officially settled on $23 per unit available to the public. Per the release, 40 million units were made available with the underwriters holding a 30-day option to purchase an additional 6 million units. The public will hold 29% interest upon closing of the offering (33.4% if the additional units are offered). Royal Dutch Shell will own the remaining interest.

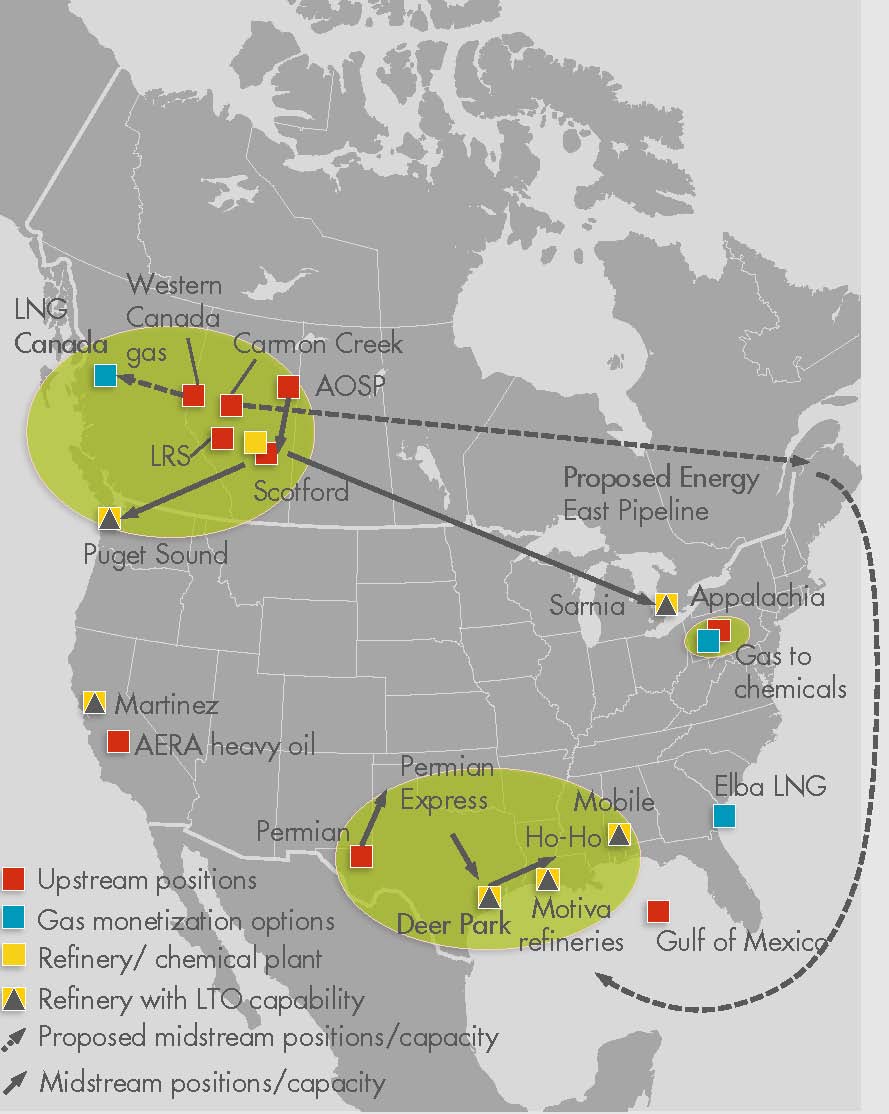

Source: Shell Investor Day Presentation

Market Reaction

Shell Midstream Partners had three major interest points heading into today:

- MLP benefits, which include low interest rates, high yields and protection from commodity price swings.

- Its parent company is the third largest oil company in the world based on market value.

- Its IPO was projected to be the largest for an MLP in more than a decade.

The market’s reaction spoke for itself. The original price of $23.00 per unit opened on the market at $32.00 per unit (39% above initial pricing) and closed at $33.35.

Overall, SHLX has roughly 137 million units, with Shell currently owning 71% (97 million). Considering the end of day unit price, the market capitalization of SHLX rose to $4.57 billion from $3.15 billion prior to trading (45% increase). The value of Shell’s ownership rose approximately $1 billion, ending at $3.23 billion from $2.23 billion pre-trading.

Shell’s management expected initial fundraising for the MLP to be in the range of $750 million. With the raised pricing bringing in $920 million, along with the jump in unit value, Shell ended the day with $1.17 billion above its preliminary estimates.

Source: Shell Investor Day Presentation

The Reasoning Behind the Success

SHLX features a yield of 3.25%. The 56 “Midstream and other” companies in EnerCom’s MLP Scorecard (with filings for the last 12 months) average a yield of 4.8%. Additionally, SHLX midstream only encompasses pipelines in the Gulf Coast region with access to refineries on the east coast. So what drew so many investors to Shell’s midstream division?

“Parent company size and credibility is a big thing,” said Nathan Strik, energy and utilities analyst at Fidelity Investments, in an interview with The Wall Street Journal. “The sponsor is obviously a huge company, and there’s a credible story for growth for years to come.”

The Journal also reports SHLX’s growth is buoyed by the “access to a host of assets in the form of asset sales by its sponsor Royal Dutch Shell. Money managers are modeling out a 20% to 30% annual distribution-per-unit growth based on incremental acquisitions.”

Shell previously announced plans to divest as much as $15 billion in assets through 2015 to concentrate on plays with the highest returns. Included in those plays is the LNG market. Shell’s midstream position provides it with access to LNG export terminals in the Gulf of Mexico, and the company has bolstered its gas assets with recent acquisitions in the Gulf, Canada and Alaska.

MLP Scene

Energy investors have been taking their lumps over the past month, enduring dropping oil prices and bearish markets in hopes for better days ahead. The energy MLP scene was among the hardest hit – the Cushing 30 MLP index was down as much as 10% this month, but stocks have nearly recovered to rates in September. Its decline (and rise) was followed by the S&P 500 index, according to data compiled from Bloomberg.

Miller Howard, an $8.5 billion money manager, blamed the wild MLP swings on inexperienced investors. The firm wrote earlier this month: “There are many novice investors in MLPs that don’t really know what they are, what they do, or what the long-term story is. They’re just in it for the yield, or following the “hot dot” of excellent performance for the past decade.”

The MLP route has gained popularity in recent years as a way for E&Ps to navigate away from market volatility. The current amount in MLP mutual funds is approximately $32 billion – more than 10 times the amount from four years ago, Miller Howard said. Its rapid growth may have outpaced the learning curve for certain investors. However, “insiders” like Kelcy Warren, Chief Executive Officer of Energy Transfer Equity, see opportunity where others see trouble. Warren invested $62.5 million this month to scoop up 1.2 million of his company’s units when prices were spiraling downward.

Further possibilities that the market overreacted on the MLP selloff: The majority of production is already hedged so companies won’t be exposed to falling commodity prices until next year at the earliest. The majority of volumes in pipeline systems are natural gas, not crude oil, which has been a major driver of recent market volatility.

With an estimated $640 billion needed for infrastructure buildout through 2035, the MLP market is unlikely to fade any time soon. In August, Forbes reported at least 17 E&Ps had announced plans to form MLPs from their existing assets, most of which involve midstream segments. Mark Druscoff of Forbes says, “With so much growth potential, MLP insiders may still not get an answer to their question of how big the market can get, but that’s a pretty good problem to have.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom, Inc. has a long only position in Shell.