Shell leads the way with $30 billion divestiture plan

Earnings season has gone as expected thus far, as the majority of energy companies are reporting losses and writedowns due to the commodity downturn. Some are fighting to maintain their dividends at all costs, while others are abandoning the investor incentive in hopes of adding some protection to their balance sheets.

Regardless of a company’s respective situation, all are honing in on their most economic projects to ride out the oil price rout. That includes pulling back on near-term exploration and production costs, hoping that other ventures will become economic again once commodity prices make a turnaround.

However, some ventures may not fit into a company’s growth plan at all. The solution? Remove the assets from your portfolio, and turn them into cash.

It’s a Buyer’s Market

Leading the way on the impending divestiture front is Royal Dutch Shell (ticker: RDS.B). The Netherlands-based major is planning to sell as much as $30 billion in assets over the next three years. To be fair, Shell expects to close on its $70 billion acquisition of BG Group next week and some assets will be sold as part of the transition. Regardless, the $30 billion goal is unquestionably massive. The number alone is more than the market capitalizations of sizeable E&Ps like Apache Corp. (ticker: APA), Anadarko Petroleum (ticker: APC), Noble Energy (ticker: NBL) and Pioneer Natural Resources (ticker: PXD).

“The buyers are there, particularly in the downstream and some local gas markets, and then more non-traditional routes such as MLP, private equity, and some other oil and gas companies,” said Ben van Beurden, Chief Executive Officer of Shell, in the company’s Q4’15 conference call.

Petrobras (ticker: PBR), still feeling the sting from its wide-ranging scandal, is seeking buyers for assets valued at $58 billion. The company aims to complete the sales by 2019, including $15 billion by the end of 2016.

Also noteworthy is Halliburton’s (ticker: HAL) attempt to sell about $10 billion in assets in coordination with the Baker Hughes (ticker: BHI) merger, although that search is being executed to appease antitrust laws.

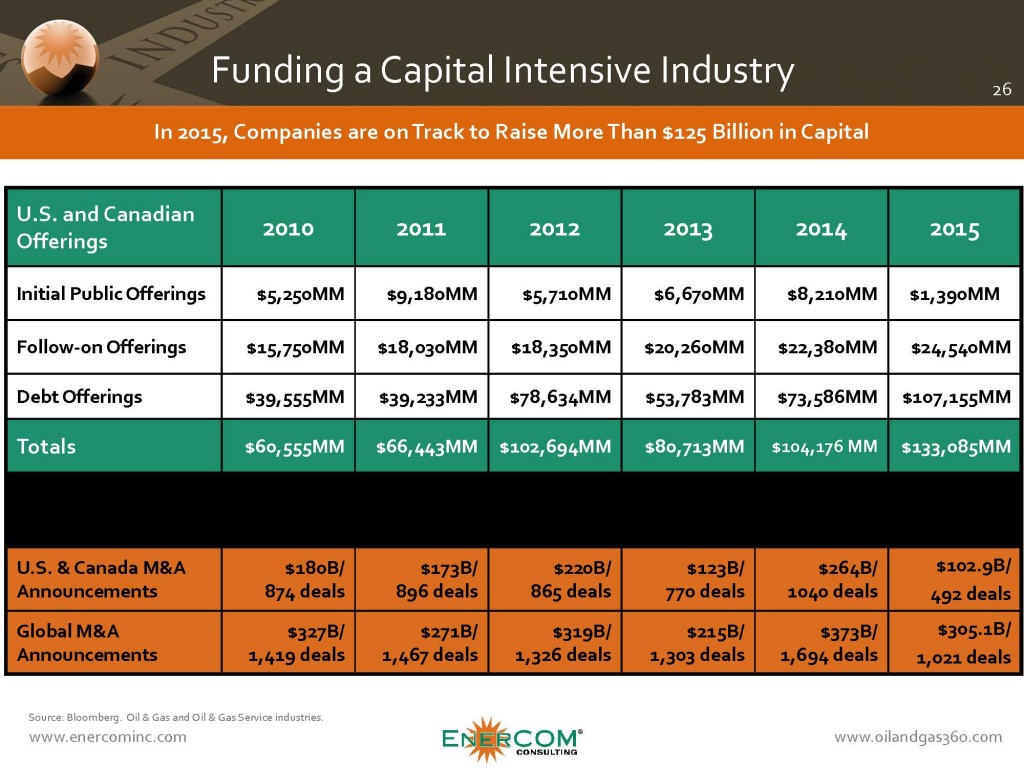

M&A Expected to Rise

The timing of the sales isn’t ideal, considering we’re on the downcycle. However, some companies don’t have much of a choice, and a report from Deloitte expects the volume of deals to increase this coming year. “Potential sellers may have been able to stave off divestitures, and buyers did not appear willing to take on the risk of potentially overpaying in the event of a more prolonged downturn,” said the report.

Private equity figures to factor into the selloffs, and some groups like Tailwater Capital have plenty of “dry powder” at their disposal. “We’re surprised that the lending counterparts haven’t forced parties to sell their assets,” said Jason Downie, the firm’s co-founder, in a recent interview with Oil & Gas 360®. “The senior lenders have been, in a sense, kicking the can down the road. Our expectation is that M&A activity will increase their year, whether it’s consolidation (which is what should happen) or the sale of non-core assets.”

Ernst & Young revealed in December that, although the absolute number of deals was lower than usual, the $2.3 trillion of valuations involved were the highest on record. “While the top megadeals garnered most of the attention, there was robust activity in the upper-middle market too and that is expected to continue in 2016,” said Rich Jeanneret, EY Americas vice chair, transaction advisory services. “The U.S. will remain a hotbed for sustainable M&A activity in the immediate term, especially as financial markets continue to reward dealmaking. An overwhelming 74% of US executives expect to do deals in 2016.”

The Hot Plays will Remain Hot Commodities

Despite the difficult environment, some of the best onshore plays in the United States still provide attractive rates of return. Companies poised to take advantage of the downcycle are doing so, snatching up bolt-on acquisitions and adding to their footprints.

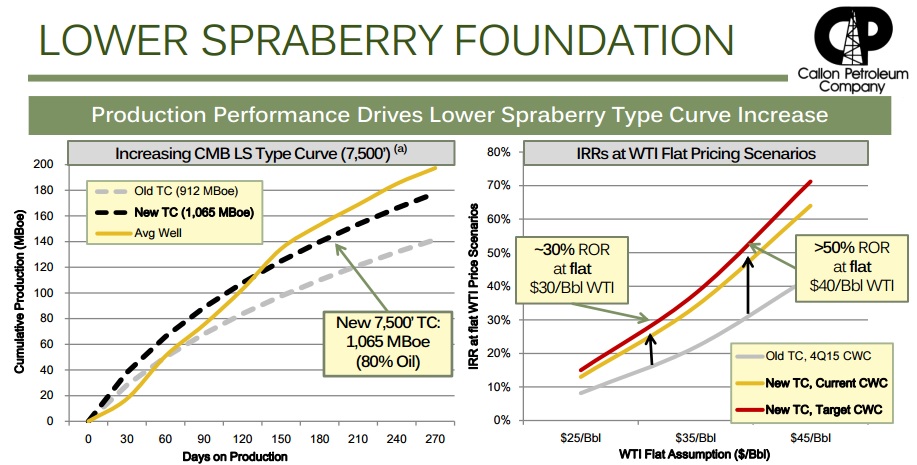

The Permian is one of those plays, and private equity funneled $2 billion into the region’s ongoing operations just last week. Its rates of return rank among the elite: drillers like Callon Petroleum (ticker: CPE, callon.com) believe its Lower Spraberry wells generate a 30% ROR at $30/barrel prices for West Texas Intermediate.

The SCOOP/STACK play in Oklahoma is also becoming a more prominently mentioned name in the oil and gas universe. Devon Energy (ticker: DVN) forked over $3.45 billion to increase its STACK footprint in December, amounting to approximately $23,750 per acre. Management describes the region as the “best emerging development play in North America.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.