Synergy Resources Corporation (ticker: SYRG) announced it has finalized a turn-key contract for its third rig and will be adding it to its Wattenberg acreage immediately, according to a company news release on July 9, 2014. The terms of the new contract allow for the drilling of at least eight wells on SYRG’s Wiedeman lease, which will begin in August. Future operations of the rig will be determined on a pad by pad basis. The company holds contracts for all three rigs with Ensign Drilling Company and the remaining two rigs are under contract for the remainder of fiscal 2014.

Q3’14 Results

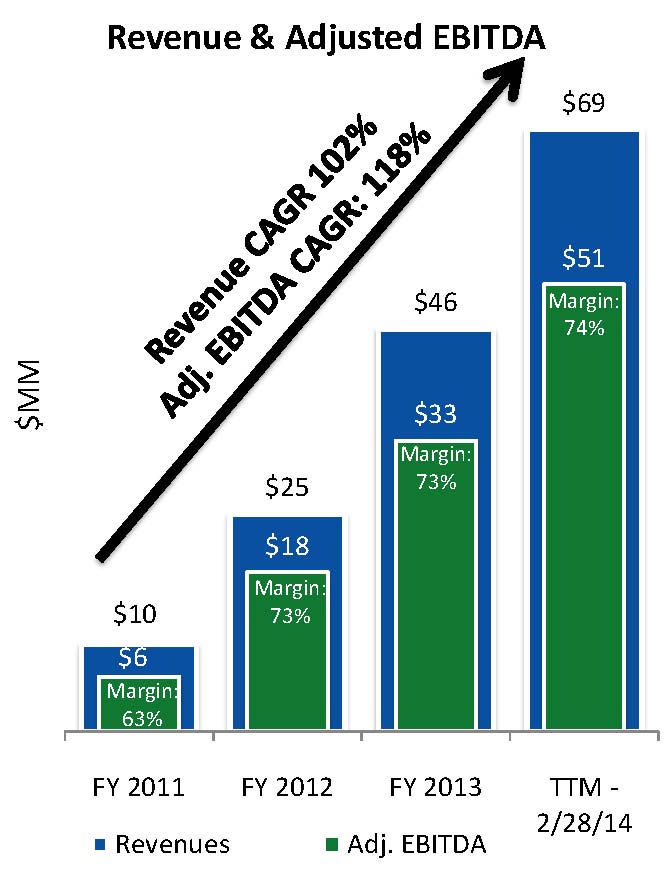

Synergy released its rig update in conjunction with its Q3’14 earnings release. The company has now increased its rig count to three compared to one at the end of fiscal 2013, and both production and revenue totals are on the rise. Revenue for Q3’14 totaled $25.7 million and operating income reached $11.3 million, which are respective year-over-year increases of 108% and 131%. Production climbed to an average of 4,120 BOEPD compared to 3,917 BOEPD in Q2’14 (5% increase) and 2,256 BOEPD in Q3’13 (83% increase).

Net income for the quarter was $7.2 million ($0.09 per share), up from $3.6 million ($0.07 per share) in Q3’13, and adjusted EBITDA equaled $18.9 million – 103% higher for the same period.

Source: SYRG June 2014 Presentation

Production Hits 6,000 BOEPD

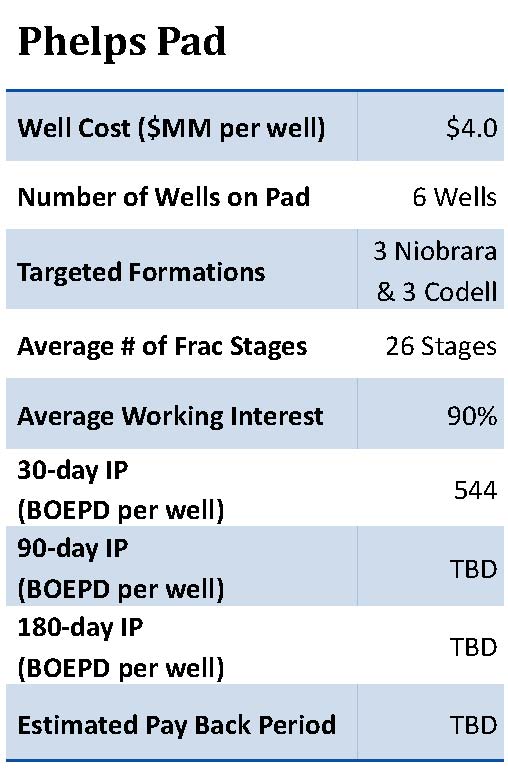

In a conference call with investors and analysts following the release, SYRG management said production for the last week of June 2014 reached roughly 6,000 BOEPD. The production jump, which was 46% higher than average quarterly flow, was aided largely by the Phelps pad coming online. SYRG said in June it is completing two other pads, the Eberle (95% working interest) and Kelly Farms (60% working interest), and expects production to reach as high as 9,000 BOEPD once these pads are turned to sales in August.

SYRG Preparing for Third Rig

SYRG is currently the operator of 16 producing horizontal wells in the Wattenberg but the number is on the rise. With the oncoming addition of the third rig, SYRG has stepped up its permitting process and currently has 50 horizontals approved for drilling. An additional 104 locations are in the processing stage. Management said the Automated Drill Rigs (ADR) they use run on natural gas and are more cost-efficient than conventional rigs. A total of 16 new horizontal wells are expected to come online within the next two months.

Management also revealed its slickwater completion methods are not only increasing returns but are approximately $300,000 cheaper than its hybrid frac jobs. Slickwater was used to complete the Phelps pad, which produced rates 50% higher than its previous pad. The same technique was used for the Union pad, which is in early production and has seen similar rates to the Phelps in its first 15 days.

Cash in the Ground

Synergy’s operations have ramped up but its costs have remained low. The balance sheet currently consists of $37 million in debt and $48 million in cash equivalents. Its borrowing base was recently increased to $110 million, leaving SYRG with $121 million in current liquidity. The company plans on utilizing its balance sheet as soon as possible with its ramped up operations. “Cash on the balance sheet is pretty much non-productive assets, so we take it and try to put it in the ground as fast as we can,” said Craig Rasmussen, Chief Operating Officer of Synergy Resources, in the call.

In EnerCom’s E&P Weekly database consisting of 86 companies, SYRG’s debt to market cap ratio of 4% was the fifth lowest total. In comparison to its peer group of 25 small cap companies, SYRG has the third lowest debt to market cap. Its three-year finding and development costs of $2.56/Mcfe are 23% below the total database median of $3.32/Mcfe.

In the Q3’14 earnings release, SYRG revealed its average realized price per BOE has increased by 14% on a year-over-year basis, while its costs per BOE have increased by just 6% in the same time frame. The company’s asset intensity, which is defined as cash required to maintain its current assets, is 35%. By definition, the remaining 65% of cash can be distributed in future projects.

With SYRG’S cost structure and low debt, management is focused on returns. “We’re all about cash flow, and we’re all about payback to us,” said Bill Scaff, co-Chief Executive Officer of Synergy Resources.

2015 Operations

Although 2014 is still in progress, it represents a transformational year for Synergy. The company exited fiscal 2013 with one rig in operation and will enter 2015 with three in its fleet. Capital expenditures for 2015 are estimated at $200 million to $225 million and will be funded from a combination of its credit facility, existing cash and cash flow from operations.

The company expects to drill 40 net wells with an average working interest between 80% and 90%. As part of expanding its footprint, SYRG plans on drilling in Nebraska and continues to evaluate the Greenhorn formation. Management did not declare guidance rates on production but said the production from upcoming pads, along with a “tidal wave of non-operated wells,” will contribute to the trend of production rate increases.

With the third rig and accelerating the permits, we’re making sure we’ve positioned ourselves for the next two years,” said Rasmuson. “No matter what happens, acceleration is in process.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.

Analyst Commentary

Johnson Rice & Co. Note – (7.9.14)

This morning, SYRG released in-line CFPS of $0.24 (vs cons’ $0.25 & our $0.28, see note). While it was telegraphed by the company, production delays (flooding/plant downtime) were worse than the Street modeled (4.1 mboe/d vs cons’ 4.5 & our 4.4). Production should rebound quickly and SYRG reiterated its prior fiscal ’14 exit-rate guidance of 6.5-9.0 mboe/d. For reference, consensus is at 8.2 mboe/d for 1Q:15, so hitting the exit midpoint should pressure ’15 numbers upwards. SYRG is also adding a third rig, which had also been telegraphed and accounted for in our/consensus numbers. The Union Pad (most western pad to date), looks strong and the wells came in at <$3.8mm apiece (vs prior's $4.0mm). We reiterate our Overweight rating, and would remind people that SYRG trades at a discount (5.3x '15 EV/EBITDA vs group's 5.9x), despite having strong growth (CFPS +87% y/y in '14 vs group's +26%) and the most exposure to the Niobrara in the public space (acres/EV).

• We believe the third rig is a positive in-so-much as it should allow SYRG to continue to grow at a pace well above the E&P group. This dramatic growth pushes SYRG to being well below the group on multiples by YE:15. As a reminder, us/consensus had already incorporated a third rig into numbers. That being said, SYRG should be able to put up >100% y/y growth in ’15; a rarity for a company trading below group multiples. By way of example, on 4Q:15 annualized EBITDA, SYRG will be trading at 4.4x EV/EBITDA, which is where the GoM group trades (i.e. cheap).

• The company should have ~250 permits in-hand before any legislation is passed regarding setbacks. Those permits have historically been grandfathered in, so 24 months of inventory should be “outside” of that legislation.

• We have adjusted our estimates to reflect 3Q actuals and today’s guidance. Production and CFPS for ’15 are moving from 9.8 mboe/d and $2.68 to 9.8 mboe/d and $2.36. The largest needle mover was our differential, which increased by ~$6/bbl.