Almost half of the state of New York is underlain by the Marcellus shale, the nation’s most prolific natural gas deposit. But thanks to a long running delay in permitting—to study hydraulic fracturing—ever since 2008, the State of New York has dragged its feet on shale development. In doing so it has kept landowners, citizens, municipalities and itself from benefiting from the shale boom, which requires fracturing shale to release the gas for production.

Then there’s Pennsylvania. As far as shale production goes, Pennsylvania and New York are like two brothers with opposite inertia. The one brother is motivated to get after it, while the other brother does a lot of nothing. Since 2007, New York has been dragging its feet when it comes to allowing companies to drill the Marcellus. In the same time period, Pennsylvania’s landowners, business community and citizens have reaped the benefits of drilling the Marcellus shale in a big way.

The Fruits of Pennsylvania’s Labor

While its brother New York has sat idle since 2007/8, Pennsylvania has drilled gas wells. Pennsylvania produced and sold 86 times more natural gas than New York in 2012, according to the EIA. Currently, New York has roughly 7,000 gas wells in production. Pennsylvania has more than 55,000 – second only to Texas.

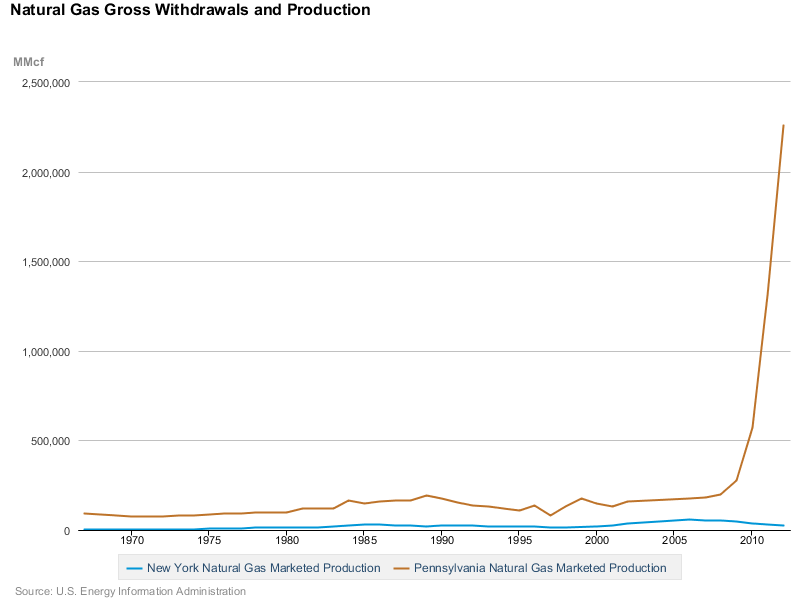

The accompanying chart tells the story. The gold line that rockets straight up the right side of the chart, beginning in 2008, represents Pennsylvania’s natural gas marketed production through 2012, according to the EIA. The flat blue horizontal line lying on the bottom of the chart represents New York’s natural gas marketed production for the same period.

New York’s production shrank to 26.4 Bcf in 2012 from 54.9 Bcf in 2007, while its brother Pennsylvania had a major growth spurt during the period. Natural gas produced and sold by the state of Pennsylvania grew to 2,260 Bcf in 2012 from 182 Bcf in 2007. Such is the effect the shale boom.

A 2011 report entitled The Economic Opportunities of Shale Energy Development, authored by University of Wyoming professor Timothy Considine for the Manhattan Institute, stated the following regarding New York’s moratorium on drilling in the Marcellus:

“What ending the moratorium means for New York:

- $11.4 billion in economic output and $1.4 billion in tax revenues;

- $4 million in economic benefits from each well but only $14,000 in economic damages from environmental impacts;

- Some 15,000 to 18,000 jobs could be created in the Southern Tier and Western New York, regions which lost a combined 48,000 payroll jobs between 2000 and 2010;

- 75,000 to 90,000 jobs could be created if the area of exploration and drilling were expanded to include the Utica Shale and southeastern New York, including the New York City watershed.”

70,000 Marcellus Landowners Sue New York

New Yorkers have felt the pinch. New York began its review of hydraulic fracturing in 2008 after state lawmakers passed legislation to promote shale gas development in New York. Six years later, property and mineral rights owners along with oil and gas companies operating in Pennsylvania’s Marcellus shale are still waiting for the results.

Missing the shale boat prompted a group of 70,000 mineral owners in New York to file a lawsuit earlier this year against the governor and two state agencies for illegally prolonging the review process.

The Joint Landowners Coalition of New York Inc. demanded that the state complete their studies of the environmental and health effects of hydraulic fracturing. “The current delay of five and a half years is legally unjustifiable, the suit asserted,” according to an article by Law360 written at the time the suit was filed. “The group was joined in the suit by the Kark Family Trust, LADTM LLC and Schaefer Timber & Stone LLC, who all claim that the state’s delay has prevented them from benefiting from mineral rights on their land.”

“They are unable to sell, auction, lease or otherwise dispose of their mineral rights by reason of the negative reputation that is being created for New York state as a result of the protracted delays associated with the supplemental generic environmental impact statement process,” the complaint said.

Suit is Thrown Out

The lower court dismissed the suit on July 14, 2014, finding that the landowners did not have standing to sue Governor Cuomo, the environmental agency and the health department.

Landowners File Appeal

Joint Landowners Coalition of New York filed an appeal July 28, 2014, with the state Appellate Division of the New York Supreme Court, asking it to overturn the lower court decision.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.