States generating less income from oil and natural gas

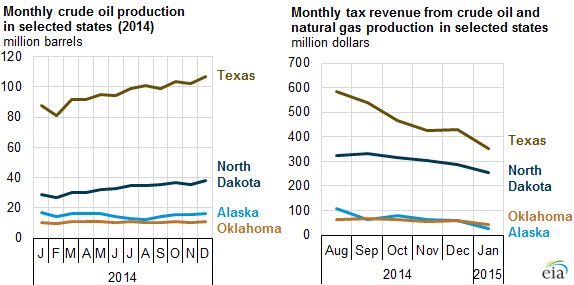

The decline in oil prices in since June of last year has reduced oil and natural gas production tax revenues in some of the largest oil and natural gas production states, according to the Energy Information Administration (EIA).

Texas, North Dakota, Alaska and Oklahoma – four of the five top oil and natural gas producing states in the United States – have all seen tax revenue from the oil and gas sector fall in recent months. California produces more oil than both Alaska and Oklahoma, but its economy is much larger, making it relatively less affected by changes in the oil and natural gas prices and production, says the EIA.

Texas has seen revenue from natural gas fall 41% since September 2014, receiving $108.9 million in natural gas production taxes in February 2015, compared to $183.5 million in September. Oil production and regulation taxes fell 48% in same period, generating $185.1 million in February of this year compared to $357.5 million in September, according to the state’s comptroller. The EIA estimates crude oil and lease condensate production in Texas also increased to 107 MMBO in December 2014 from 88 MMBO in January 2014.

In North Dakota, tax revenues from oil and natural gas production decreased to $254.1 million in January 2015 from $323.6 million in August 2014, a 21% reduction in less than six months. Production continues to increase despite declines in prices, according to the EIA. The home of the Williston Basin is projecting $869 million in less revenue through 2017 based on current prices, which accounts for about 20% of its previously planned revenue forecast.

Alaska, which relies on revenue from crude oil production for 90% of its operating budget, saw tax revenue from production fall to just $26 million in January of this year from $108 million in August 2014, a 76% decline in tax revenues. The state’s 2015 revenue projections assumed oil prices at $105 per barrel.

Oklahoma collected $62 million in funds from production oil and natural gas taxes in August 2014. This value declined 31% to $43 million in January 2015, reports the EIA. The agency also reports that the state’s production was relatively flat during that same period.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.