Tellurian and its Driftwood LNG export project move forward

Tellurian Investments Inc. announced that GE Oil & Gas has made a $25 million preferred equity investment in Tellurian Investments with an implied Tellurian common stock value of $5.94 per share.

Tellurian is in the engineering design and pre-filing stage for a proposed 26 million tonnes per annum Driftwood LNG export facility to be located in Calcasieu Parish, Louisiana, on the U.S. Gulf coast. Tellurian was co-founded by two well known LNG veterans, Charif Souki and Martin Houston.

The Federal Energy Regulatory Commission (FERC) approved Driftwood LNG’s pre-filing request on June 6, 2016. Tellurian expects construction to begin in 2018 and targets the project to become operational in 2022.

GE made big news in the U.S. energy space last month when it announced that its GE Oil & Gas was combining with Baker Hughes Inc., resulting in a $32 billion oil services and technology company.

Tellurian’s reverse merger with Magellan Petroleum shoots for Q4 closing date

In August 2016, Tellurian entered into a reverse merger agreement with Magellan Petroleum Corporation (ticker: MPET) which it expects to close in the fourth quarter of 2016. After the transaction is consummated, Tellurian’s management team and board members will replace the current Magellan management and board.

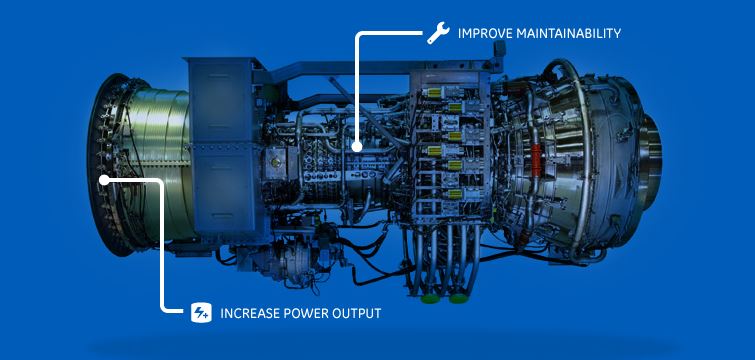

In Magellan’s presentation regarding the Magellan-Tellurian combination, the company references that its refrigeration compressors will be driven by GE aeroderivative natural gas turbines.

Tellurian plans to use GE’s aeroderivative turbines to derive its refrigeration compressors at the Driftwood LNG export facility. GE aeroderivative compressors are also used in natural gas power generation plants.

Tellurian’s idea: provide lowest cost LNG

Tellurian LNG said it plans to set a standard as a low-cost provider of LNG facilities as well as LNG shipments to its customers.

In the registration statement (Amendment No. 1, dated Nov. 8, 2016) the company said it plans to “minimize construction costs through utilization of proven technology and a modular design process that reduces installation and interconnection costs throughout the facility.”

The company said it intends to own liquefaction facilities, storage facilities and loading terminals at one or more sites along the United States Gulf coast. The pro-forma company said it plans to sell LNG produced at its facilities to creditworthy customers, and to pursue complementary business lines in the energy industry.

Artist’s rendering of proposed Driftwood LNG export plant by Tellurian Investments which plans to merge with Magellan Petroleum.

Capitalizing on North America’s natural gas supply

The combined company said it plans to purchase gas supply for its LNG Facilities from the North American natural gas market and contract for pipeline and storage services upstream of the LNG facilities in order to maximize its access to low-cost gas supply, according to the filing.

The Driftwood LNG export facility and pipeline are. The company estimates construction costs of $450 to $550 per tonne, before owners’ cost, pipeline cost, financing cost, and contingencies, and said it expects to begin producing LNG in 2022.

Charif Souki was previously CEO of Cheniere Energy (ticker: LNG) and Martin Houston was COO of BG Group. The Tellurian co-founders installed former Cheniere executive Meg Gentle as Tellurian’s president and CEO. Gentle is to be the combined company’s CEO, with Souki as chairman and Houston as executive vice chairman. Former Magellan Petroleum CEO Antoine Lafargue will serve as the combined company’s CFO.