Tesoro Corporation purchases Western Refining

Tesoro Corporation (ticker: TSO) announced a definitive agreement Thursday under which it will acquire Western Refining Inc. (ticker: WNR) at an implied current price of $37.30 per Western share in a stock transaction, representing a 22% premium to the company’s closing price Wednesday. The equity value of the deal is $4.1 billion and includes the assumption of approximately $1.7 billion of Western’s net debt and the $605 million market value of non-controlling interest in Western Refining Logistics, LP (ticker: WNRL) for total consideration of $6.4 billion, according to the company’s press release.

Under the terms of the agreement, Western shareholders can elect to receive 0.435 shares of Tesoro for each share of Western stock they own, or $37.30 in cash per share. The acquisition is expected to be tax-free to Western’s shareholders who elect stock.

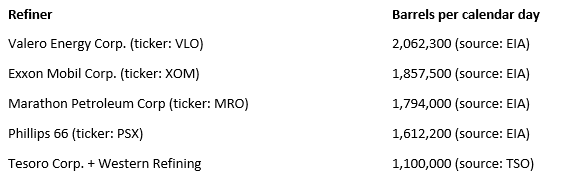

The acquisition will make Tesoro the fifth-largest refiner in the United States, the company said in a press release. The U.S. EIA refining capacity stats are available in a table.

Western’s refineries are located in Texas, New Mexico and Minnesota, adding to Tesoro’s locations in California, Washington, Alaska, Utah and North Dakota, giving the combined company a broader reach in the United States.

Tesoro said it will remain on track for achieving an investment grade credit rating following the deal. The company’s total debt currently stands at $1.2 billion, according to Bloomberg. $450 million of that will be due in 2017, and the company has approximately $2.0 billion available on its credit revolver.

The company has increased its share repurchase authorization by $1.0 billion to over $2.0 billion in total. TSO expects to maintain its current quarterly dividend of $0.55 per share after closing.

The combined companies will deliver $350 million to $425 million of annual cost savings within two years, Tesoro said in the press release today.

“Our increased scale and diversity will enable us to leverage and enhance in-house technical capabilities, which we expect will result in cost efficiencies, the ability to drive more growth and increased productivity,” Tesoro Chairman and CEO Greg Goff said.

Shrinking WTI-Brent spread puts the squeeze on refiners

The combination comes at a time when refiners are facing lower margins due to a narrowing of the WTI-Brent spread. At its peak, the spread between the U.S. and international crude oil benchmarks was as much as $28, giving U.S. refiners a competitive advantage to their counterparts across the Atlantic, but in the last year alone the spread has tightened 75%, and the average spread is now just $1.65, according to The Wall Street Journal.

This has been most acutely felt by East Coast refiners, which compete both with trans-Atlantic refineries and with those in the Gulf. Companies like Philadelphia Energy Solutions, which operates the largest refinery on the U.S. Atlantic coast, filed for IPOs, but later were forced to change course, pulling the plug on the offering, and letting go of employees.

The wide spread that allowed for such a pronounced competitive advantage is unlikely to return, too. With the end of international export restrictions on U.S. shale producers, U.S. E&Ps are now able to sell their crude in a global market and no longer need to offer WTI at such a steep discount to its international counterpart.

“It’s very dangerous to be in a position where you’re betting on a differential staying the same forever,” said PBF Energy (ticker: PBF) CEO Tom Nimbley said. “Those days are gone.”