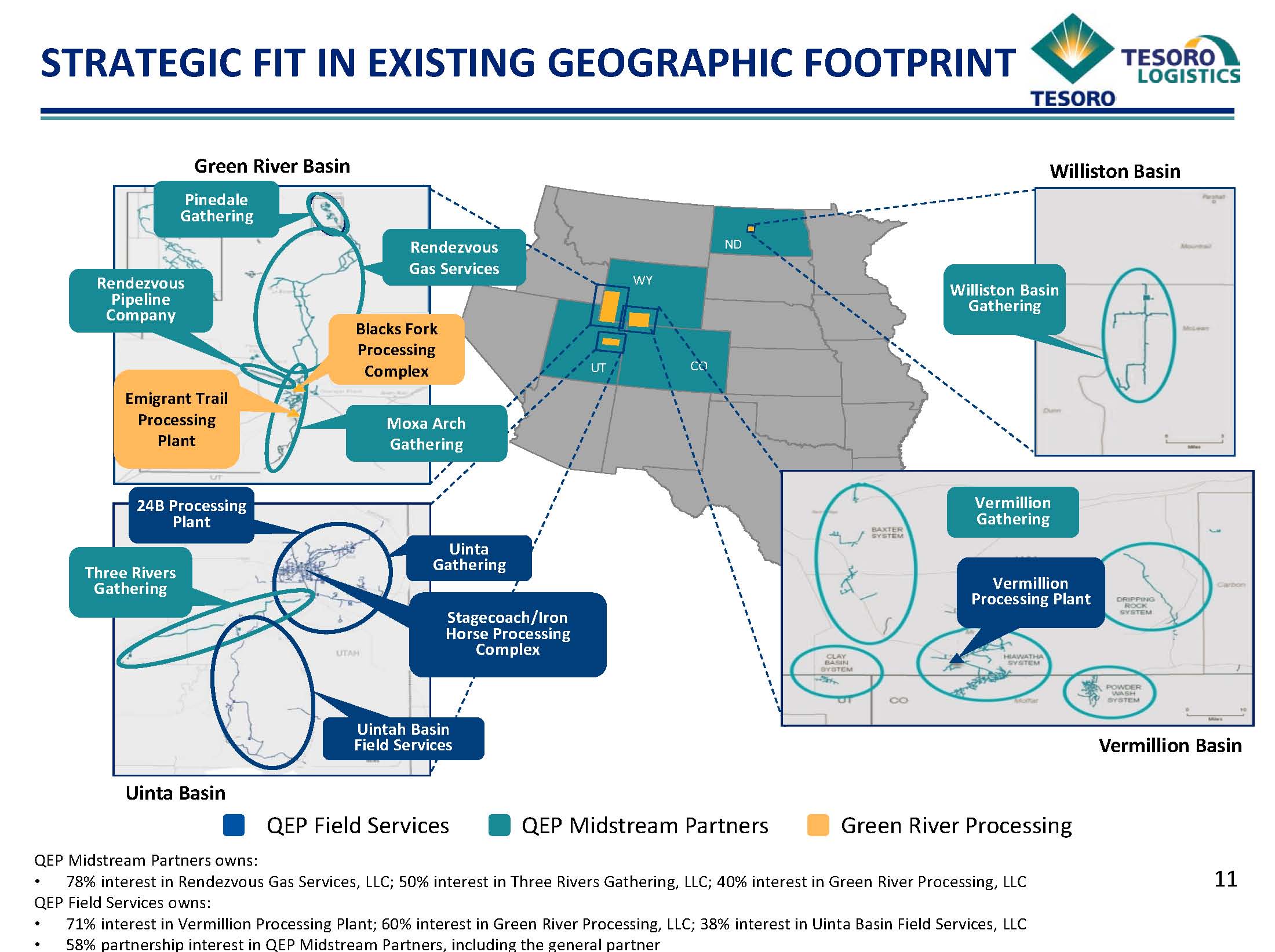

On Sunday, October 19, 2014, Tesoro Logistics (ticker: TLLP) announced the acquisition of QEP Field Services in a deal equaling $2.5 billion. TLLP also acquires a 58% working interest in QEP Midstream Partners (ticker: QEPM), a wholly owned natural gas gathering and processing business of QEP Resources (ticker: QEP). The transaction is expected to close in Q4’14.

Tesoro Logistics is a fee-based limited partnership owned by Tesoro Corporation (ticker: TSO). The partnership operates midstream and downstream assets primarily in the western and Mid-Continent regions of the United States. TSO is one of the country’s largest refiners, operating six facilities and more than 2,200 retail stations with a combined capacity of 850 MBOPD. Since the initial public offering in April 2011, TLLP has increased terminalling volumes by more than 700%.

QEP Midstream Partners was spun off from QEP Resources, Inc. (ticker: QEP) in August 2013. The company serves as a master limited partnership and operates midstream services to QEP and other operators in the Green River, Uinta and Williston basins.

Source: TLLP Acquisition Presentation

Tesoro Expands Services

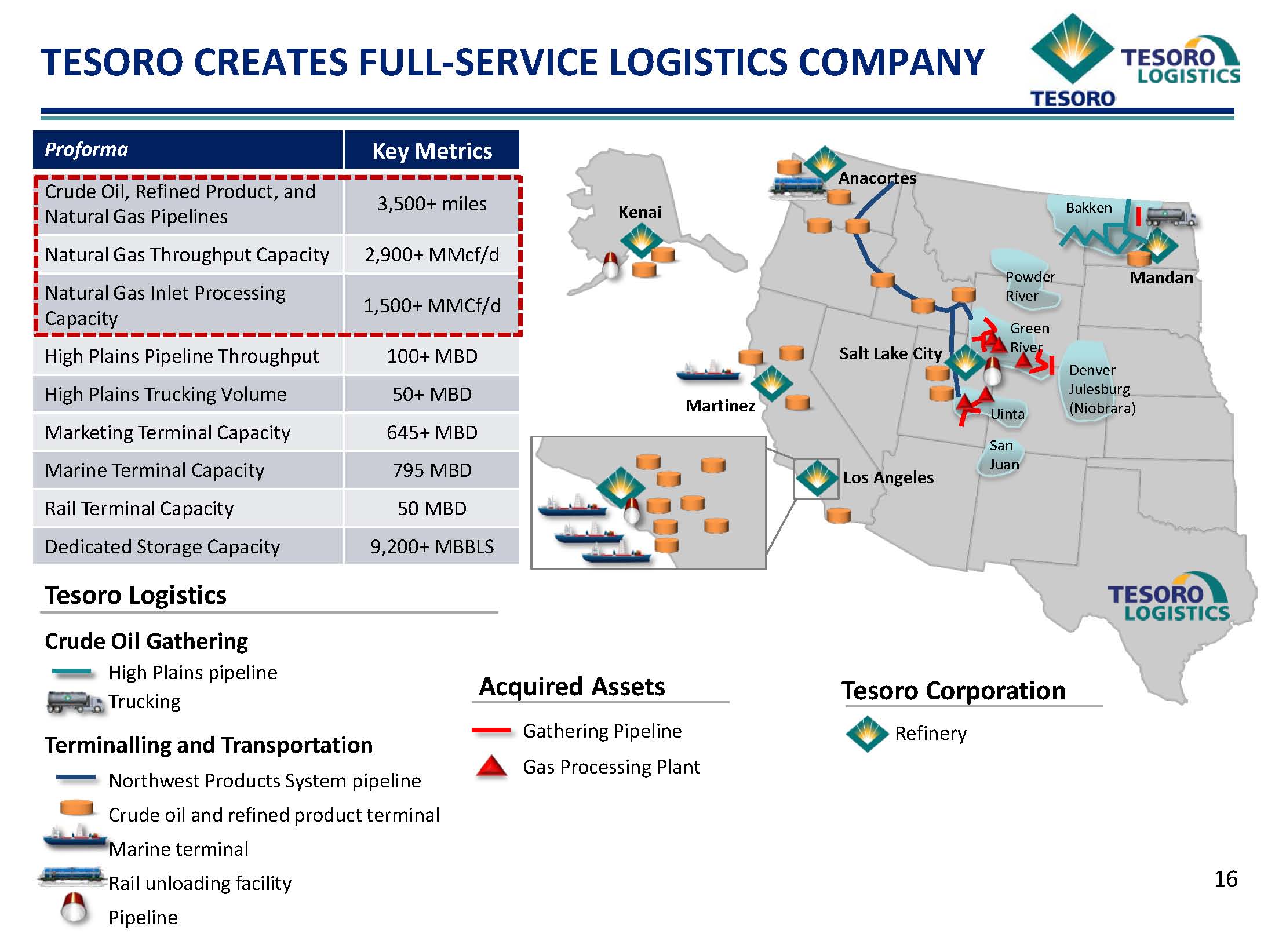

With the midstream acquisition, Tesoro is now a “full service logistics company,” according to its press release. The new company holds more than 2.9 Bcf/d of natural gas throughput capacity through its 3,500 mile pipeline network – enough to stretch from Dallas to Los Angeles three times. TLLP now expects half of its revenue to come from third parties, which management said is a “critical part of our growth strategy,” in a conference call following the release.

Management singled out the two main business drivers in the call: the quality of assets and the desire to create a “full service” company.

“The key importance of this opportunity, and why we felt it was so critical, was, the high-quality set of assets in a very solid basin,” said Greg Goff, President and Chief Executive Officer of Tesoro, in the call. “We believed it was important for us to create a full suite of services. We wanted to have a full-service logistics company to go out and offer not only services to current customers that we have, but to expand our customer base.”

Management added that the accretive properties will strengthen its current position in the Bakken. The company now has assets capable of handling crude oil, natural gas and produced water.

“We don’t view it as much as a step-out,” said Goff. “We view it more as a creating the platform to really expand our services with many things that complement what we do already.”

Source: TLLP Acquisition Presentation

Full Merger on the Horizon?

As previously mentioned, Tesoro is now the majority owner (58%) of QEPM’s overall working interest. Management said it intends to make an offer to fully combine the two companies once the current transaction closes. TLLP currently produces more than three times the amount of natural gas liquids as QEP Field Services. The company expects to realize savings of roughly $20 million in 2015 due to synergies.

This wouldn’t be TLLP’s first merger; in 2013, the refiner made its mark on the west coast with the $1.1 billion acquisition of the Los Angeles Refining Marketing and Logistics business. Management said the company has generated $1.3 billion through the purchase. With its new asset under the hood, Tesoro believes it holds more than $400 million of organic growth projects.

In order to finance the QEP Field Services acquisition, Tesoro announced a private placement offering of $1.3 billion in senior notes the day after the deal was finalized. Its borrowing base has also expanded to $900 million ($210 million drawn). Distribution for Q3’14 is expected to increase by 4%, or $2.57 on an annualized basis. Overall distributions are expected to double in 2015.

Management does not expect the new financial commitments to have any impact on future operations, said Steven Sterin, Chief Financial Officer of Tesoro. “One of the key things we want to do as we structure this transaction is not in any way sacrifice the growth potential that does exist in our base business,” he said.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.