Technological innovation to drive U.S. shale oil output to nearly 8 MMBOPD by 2035

While the U.S. shale industry is currently taking a beating along with most other crude oil producers around the globe, BP’s (ticker: BP, BP.com) 2016 Energy Outlook forecasts that the industry will get back on the track of growth, and double output in the next 20 years. BP expects U.S. tight oil production to peak in the 2030’s at nearly 8 MMBOPD, double its current levels.

“We see U.S. tight oil falling over the coming years, but thereafter tight oil picks up,” BP Chief Economist Spencer Dale said. According to the report, the increases will be driven by “technological innovation and productivity gains.”

U.S. oil will eventually be constrained by side of resource; shale gas will grow 5.6% annually

Globally, tight oil production is expected to increase by 5.7 MMBOPD to 10 MMBOPD by 2035. The U.S. will remain the predominant source, but will eventually be constrained by the size of the resource base available, according to the report. Because of the constrained resource base, nearly half (0.9 MMBOPD) of the increase in tight oil production globally will come from outside the U.S. in the final ten years of the projection.

BP expects shale gas will grow 5.6% per annum from 2014 to 2035, resulting in its share of global gas production more than doubling to 24% from 11%.

Economic growth expected to drive demand – fossil fuels will supply 80% of total energy in 2035

BP’s base case scenario anticipates that global GDP will more than double in the next 20 years, driving continued growth in demand for energy. Due to increases in energy efficiency, the company expects demand will only grow by about a third over that same time period, however.

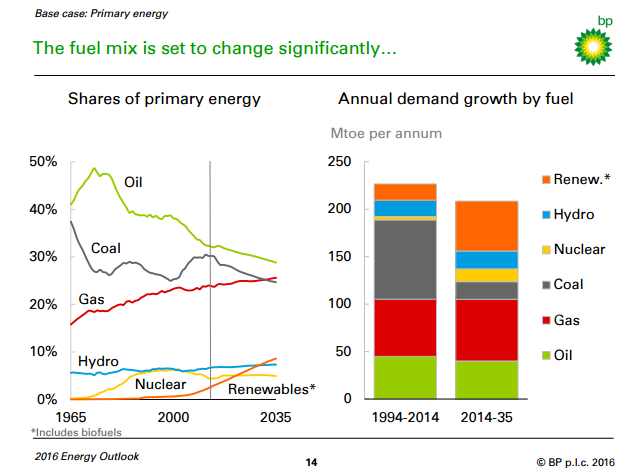

Even though the growth in energy demand will be small compared to the rapid growth in the economy, BP expects 60% of the additional demand will be met by fossil fuels, meaning fossil fuels will make up almost 80% of total energy supplies in 2035.

Natural gas is expected to be the fastest growing fossil fuel, but the use of renewables is anticipated grow by a factor of four over the next 20 years.

BP remains bearish in the short-term

While the company’s report forecasts strong growth over the next 20 years, BP expects oil prices to remain low in the near term, reports Bloomberg. BP expects that the record crude surplus will keep prices depressed for the first six months of the year.

“We are very bearish for the first half of the year,” Chief Executive Officer Bob Dudley said. “In the second half, every tank and swimming pool in the world is going to fill and fundamentals are going to kick in. The market will start balancing in the second half of this year.”

Non-OPEC production has withstood low oil prices better than many expected. Approximately 2 MMBOPD will be placed into storage over the next six months, according to Chistopher Bake, a member of the executive committee at Vitol Group, the world’s largest independent oil trader. That surplus is equivalent to the output of Nigeria, Africa’s largest oil producer.

With storage filling so rapidly, prices may drop suddenly once the top of the tanks is reached, cutting off production. “I wouldn’t be surprised if this market goes into the teens,” said Jeff Currie, head of commodities research at Goldman Sachs Group.

Prices could settle between $30 and $100 per barrel

Looking at the long-term, BP does expect prices to recover somewhat once the market begins to balance out. Dale was unwilling to say what price assumptions were used for the company’s base case scenario, but he did say he expects them to settle between $30 and $100 per barrel. BP’s chief economist also said he expects events to ensure prices would spike up again on occasions to $100, but that this was not a natural “resting place” for the price, reports The Guardian.