Lower severance taxes are severely squeezing budgets in oil producing states, some to “revenue failure”

Severance taxes on oil and gas extraction make up a significant portion of the budgets of a number of states in the U.S., but the rapid decline of prices since November of 2014, has put several of those states in a bind as they prepare to re-evaluate current and upcoming operating budgets and taxation structures.

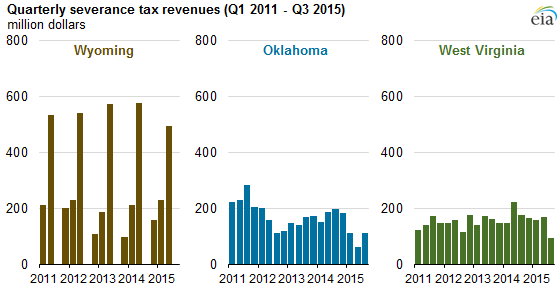

According to the Energy Information Administration (EIA), Alaska, Texas, North Dakota, Wyoming, Oklahoma, and West Virginia, in particular will be strongly affected by the coming re-evaluations.

Alaska especially vulnerable due to tax structure

Alaska has seen severance taxes fall faster than other states because the amount it collects is based on the operators’ net income rather than on the value or volume of oil extracted. Because net income after operating and capital expenses were near zero, the state collected almost nothing in the terms of severance tax revenue, reports the EIA.

In 2014, oil and gas severance taxes accounted for nearly 72% of the state’s tax revenue, making its fiscal gap in 2015 a significant hurdle. To help combat the growing deficit, Governor Bill Walker has proposed a number of initiatives to bring more money into the state’s coffers, including a 6% income tax, and changes to the Alaska Permanent Fund.

“This is a major paradigm shift in how the State of Alaska conducts business,” said Walker. “Never before has the state faced a deficit so large that we are draining more than $9 million from savings every day.”

Changes affecting the oil and gas industry directly include a $425 million cut from oil exploration credits. The state’s new budget plan will change the oil and gas tax credit system into a low-interest loan program, according to the governor’s office.

A diversified economy means Texas will likely avoid drastic change

According to the comptroller of Texas, revenues from natural gas production and oil production and regulation were down 48% and 51%, respectively, in November from where they were at the same time in 2014.

Despite the drastic fall in the revenue Texas is seeing from oil and gas extraction, severance taxes from the sector make up a relatively small portion of the state’s economy – 11% in 2014, according to the EIA. Because Texas has such a diversified economy, the state will likely be able to respond to lower oil and gas tax revenue without drastic changes, said the U.S. energy agency.

“[Texas’] diverse economy coupled with a large beginning balance and a conservative budget from the 2015 Texas Legislature should allow the state to absorb this reduction in project revenues,” said Texas Comptroller of Public Accounts Chris Bryan. Bryan said the government is still predicting economic growth north of 2%.

Spending cuts may be imposed in North Dakota

Production in North Dakota has remained largely flat throughout 2015, said the EIA, but total severance taxes were still down from more than $3.5 billion in 2014 to $2 billion in 2015. The state’s general fund budget collections from July through November of 2015, the first five months of the 2015-17 two-year budgeting period, were $152 million, 8.9% below the budgetary forecast, according to the EIA.

Office of Management and Budget Director Pam Sharp requested a forecast from Moody’s Analytics last week. If the forecast projects that state revenues will be 97.5% or less of what was projected during the legislative session last spring, it will trigger automatic budget cuts of up to 2.5%, or about $105 million, for most state agencies, according to the Grand Forks Herald.

While state law authorizes the governor to use the $572 million Budget Stabilization Fund to cover any budget gaps beyond 2.5%, Republican members of North Dakota’s House are asking that state agencies cut their budgets further before the governor uses the Stabilization Fund.

House Majority Leader Al Carlson suggested requiring agencies to cut 3% or 4% to alleviate some of the pressure felt on the state budget from lower oil prices. Carlson said agencies have been asked to submit 95% budget requests in leaner years.

Wyoming revises budget down $160 million

Mineral severance taxes from oil, natural gas, and coal production, along with associated federal mineral royalties, are the primary revenue source of revenue in Wyoming. Severance taxes alone accounted for 39% of the state’s receipts in 2014, according to the EIA.

Oil production has been up in the state, but lower prices have more than offset the greater number of barrels coming out of the ground. Natural gas prices have also take a significant hit on Wyoming’s budget, and the state produced 14% less natural gas in 2015, its sixth consecutive year of lower natural gas production, reports the Casper Star-Tribune.

In October 2015, the state revised its 2015-18 severance tax projections downward by nearly $160 million from January 2015 predictions.

Oklahoma declares a ‘revenue failure’

While Oklahoma only collected about 8% of its revenue through severance taxes in 2014, collections from state sales taxes and individual corporate income taxes are also significantly affected by oil and natural gas prices, said the EIA.

The state faces a fiscal 2017 deficit of $900 million on a general fund budget of nearly $7 billion.

In December 2015, the state declared a revenue failure, which requires state agencies to reduce spending, and allows for use of up to 37.5% of the state’s budget stabilization fund. A revenue failure is declared when the state revenues fall more than 5% of their projected levels, reports Oklahoma’s News 6.

West Virginia cuts budgets for most state agencies by 4%

Lower severance taxes forced the state of West Virginia to cut spending 4% almost completely across the board, with the exception of public schools, which saw a 1% cut, according to a statement released from the governor’s office in October.

“This is a difficult decision that results from several factors beyond our control,” Governor Earl Ray Tomblin said. “We are taking this action based on trends we see in the first three months of the fiscal year that we expect to continue throughout this budget cycle.”

Severance taxes accounted for 13% of West Virginia’s tax revenues in 2014. Falling coal production and low natural gas prices in the third quarter of 2015 resulted in the lowest total tax collection since 2008, pushing projections for fiscal year 2016’s budget deficit to more than $250 million.