Company Production Record in October

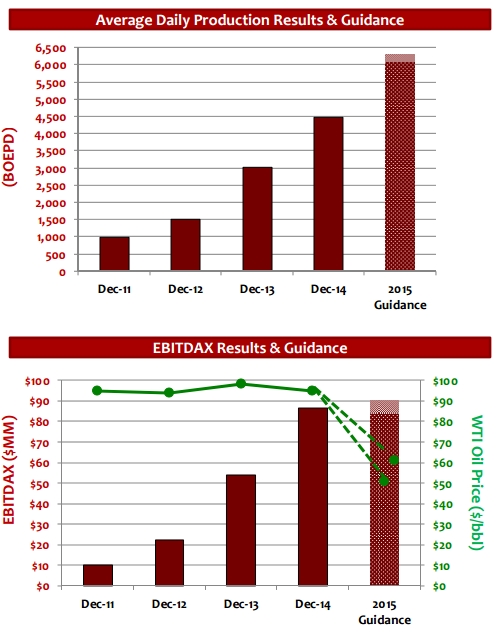

Lonestar Resources (ticker: LNREF) announced a company production record in its Q3’15 results, and the upward volume trend is expected to continue through the end of the year.

Lonestar averaged production of 6,614 BOEPD in Q3’15, representing a 14% increase sequentially, with volumes exceeding 7,500 BOEPD in the month of October alone. The October achievement “[sets] the stage for another production record in the fourth quarter of 2015,” said management in a press release.

Net oil and gas revenues for Q3’15 were $30.2 million, a decrease of only 5% compared to Q3’14, even though realized wellhead prices have fallen by 53% over the same time frame. Lonestar benefited from $8.8 million in revenue from its crude oil hedges, offsetting the majority of the oil price decline. Crude oil provided 89% of overall revenue in the quarter.

The significance of its hedging plan continues into 2016, as 51% to 57% of currently budgeted oil production is set at an average strike price of $77.15/barrel. In 2015, an estimated 60% to 64% of oil production guidance is hedged at an average strike price of $82.23. Gains on the hedging side led to net income of $7.4 million in the quarter.

Eagle Ford Operations

Eagle Ford Operations

Lonestar operates 35,487 net acres in the Eagle Ford Shale and divides its properties into the Western, Central and Eastern regions. Approximately 5,000 net acres have been strategically added since the beginning of fiscal 2015, adding 16 net drilling locations.

Production expectations have been surpassed “across the board,” said Frank Bracken, Chief Executive Officer of Lonestar, in a September interview with Oil & Gas 360®. Its Q3’15 operations focused solely on its Western assets, as five wells were drilled and two more are planned for the fourth quarter. Two wells have already been drilled in its Central portion for Q4’15, but completions were deferred to align production rates with its budget.

Two more wells are planned to be spud in the Eastern trend before year-end, and are nearby operations from Apache Corp. (ticker: APA). Apache brought online two wells in the southern portion of Brazos County in Q2’15, reporting total average 30-day volumes of 1,935 BOEPD.

A total of 14 wells have been drilled in the first nine months of 2015, with 11 residing on the Western assets. Two offset wells in its Horned Frog location in La Salle County are averaging 30-day rates of 1,377 BOEPD – more than double the rates of 107 other offset wells drilled by neighboring operators and among the top decile in the region.

Preliminary 2016 plans call for the drilling and completion of 14 to 16 wells on a budget of $70 to $80 million. As of September 30, 2015, $101 million was available on its $180 million borrowing base, which is currently being redetermined. At the moment, management is reviewing partnership opportunities to expand its operational footprint, much like the drill-to-earn joint development agreement with IOG Capital. Analysts were encouraged by the strategy, with Mike Kelly of Seaport Global Securities saying, “We really like the potential strategy of partnering/joint-bidding with a group who will pay for PDP’s while LNR snags the undeveloped acreage.”

All six analysts covering Lonestar have the stock listed as a “Buy,” according to data compiled from Bloomberg.