Total + Tellurian to develop integrated gas project together

Total (ticker: TOT) is acquiring approximately 23% of Tellurian Investments, an early stage U.S. LNG export project that was founded by former Cheniere Energy (ticker: LNG) CEO Charif Souki and former BG COO Martin Houston. The transaction is at $5.85 per share for an amount of $207 million.

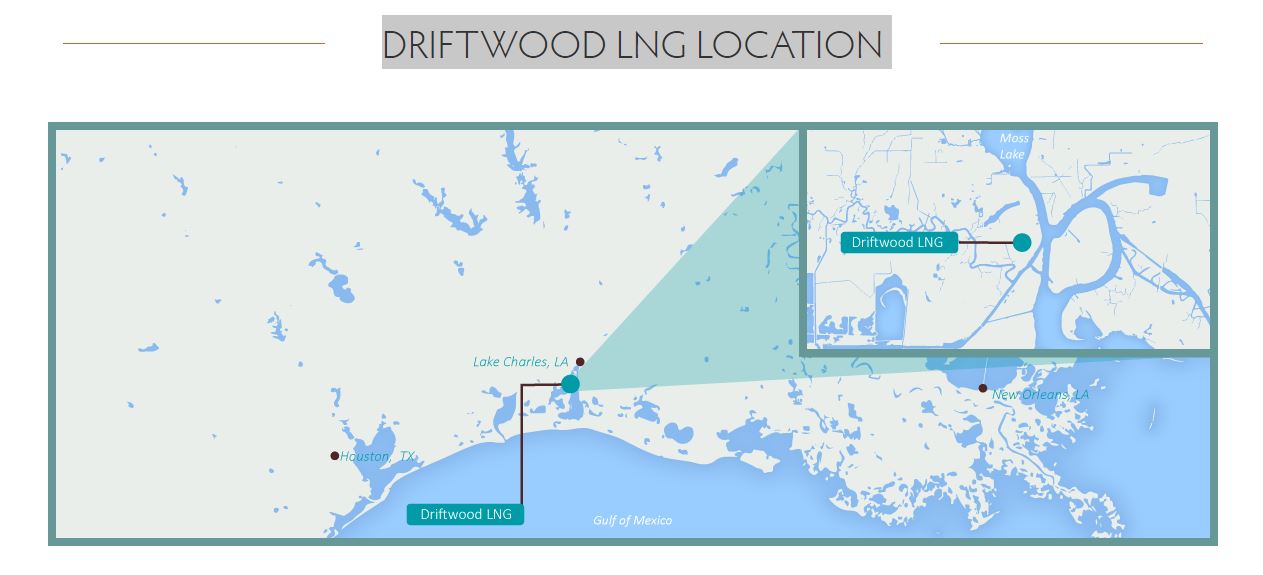

Driftwood LNG is Tellurian’s planned LNG export project in Louisiana that is currently in the engineering design and pre-filing phase. The Federal Energy Regulatory Commission (FERC) approved Driftwood LNG’s pre-filing request on June 6, 2016. Tellurian expects to commence construction of Driftwood LNG in 2018 and produce LNG in 2022, it said in a press release. The companies said the scope of the investment covers “the acquisition of competitive gas production in the U.S. to the delivery of LNG to international markets from the Driftwood LNG terminal.”

Tellurian President and CEO Meg Gentle said Tellurian was happy to have one of the major global LNG operators as a shareholder. Total President of Gas, Renewables and Power Philippe Sauquet said, “Investing in Tellurian at an early stage will give us the opportunity to potentially strengthen our mid and long term LNG portfolio thanks to a very cost competitive project.”

Total’s 2015 LNG production was 10.2 million tons. Total said its objective is to double its liquefaction capacity to around 20 Mt/y and increase its LNG trading portfolio to 15 Mt/y by 2020.

GE also an investor in Tellurian

Last month, Tellurian and GE announced that GE had made a $25 million preferred equity investment in Tellurian.

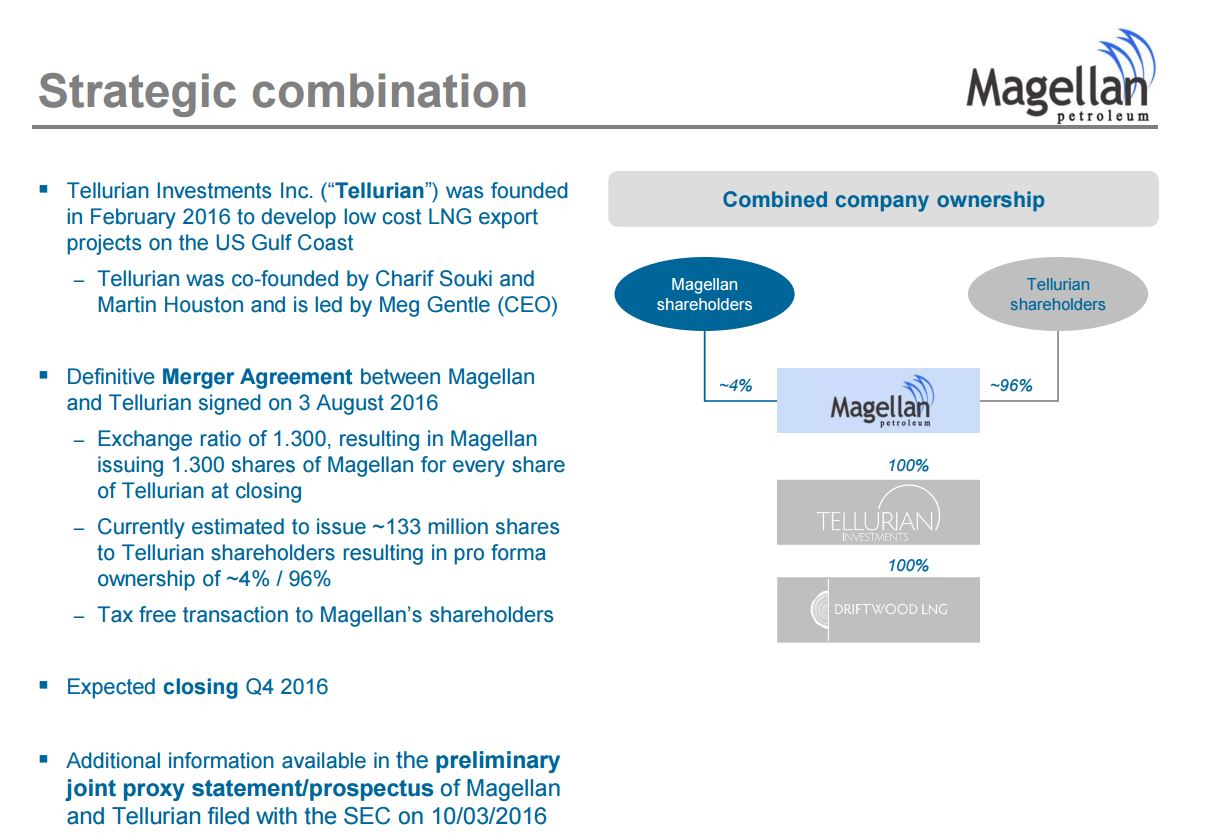

Magellan+Tellurian reverse merger expected to close Q1 of ’17

In August, Magellan Petroleum and Tellurian announced an agreement to enter into a reverse merger of Tellurian into Magellan, with Tellurian being the surviving entity. In today’s press release, Tellurian said it expects the deal to close in Q1 of 2017. Magellan’s shares trade on Nasdaq under the symbol MPET.

Magellan 10Q Note regarding Tellurian Merger

From Magellan Petroleum SEC Form 10Q for the Period Ending Sept. 30, 2016 - Note 2 - Merger with Tellurian

On August 2, 2016, Magellan, Tellurian, and Merger Sub entered into the Merger Agreement. Pursuant to the Merger Agreement, each outstanding share of common stock, par value $0.001 per share, of Tellurian will be exchanged for 1.300 shares of common stock, par value$0.01 per share, of Magellan, and Merger Sub will merge with and into Tellurian, with Tellurian continuing as the surviving corporation, a direct wholly owned subsidiary of Magellan, and the accounting acquirer. The Merger is expected to close in the fourth quarter of calendar year 2016 or the first quarter of calendar year 2017.

The Merger Agreement and the Merger have been approved by the board of directors of each of Magellan and Tellurian. Stockholders of Magellan will be asked to vote on the approval of the transactions contemplated by the Merger Agreement at a special meeting that is expected to be held during the fourth quarter of calendar year 2016 or the first quarter of calendar year 2017. The closing of the Merger is subject to customary closing conditions, including i) the receipt of Magellan and Tellurian stockholder approval; ii) all directors and officers of Magellan shall have resigned, except for any person(s) that might be designated by Tellurian; iii) a registration statement on Form S-4 to register the Magellan shares to be issued in the Merger shall have been declared effective by the SEC; and iv) shares of Magellan common stock to be issued in the Merger shall have been approved for listing on the NASDAQ.

The Merger Agreement also contains a non-solicitation provision pursuant to which Magellan may not, directly or indirectly, take certain actions to negotiate or otherwise facilitate an “Alternative Proposal,” a term generally defined as an inquiry, proposal or offer relating to a business combination with or acquisition of the assets of Magellan by a person or entity other than Tellurian. Magellan’s non-solicitation obligations are qualified by “fiduciary out” provisions which provide that Magellan may take certain otherwise prohibited actions with respect to an unsolicited Alternative Proposal if the Board of Directors determines that the failure to take such action would be reasonably likely to be inconsistent with its fiduciary duties and certain other requirements are satisfied.

The Merger Agreement may be terminated under certain circumstances, including in specified circumstances in connection with receipt of a "Superior Proposal," as such term is defined in the Merger Agreement. In connection with a termination of the Merger Agreement in the event of a Superior Proposal, a breach by Magellan of the non-solicitation provision noted above, or following a change by the Board of Directors of its recommendation to stockholders, Magellan will be required to pay to Tellurian a termination fee for any and all third-party transaction fees and expenses incurred by Tellurian with the drafting, negotiation, execution and delivery of the Merger Agreement and related documents (including fees and expenses for attorneys, accountants and other advisors), subject to a maximum of $1 million in the aggregate. A termination fee may also be payable in some circumstances in which an Alternative Proposal is made, the transaction fails to close and Magellan subsequently agrees to an Alternative Proposal. If the Merger Agreement is terminated by either party as a result of the failure to obtain the requisite approval by Tellurian stockholders, or by Magellan because Tellurian does not use commercially reasonable efforts to secure the approval for listing the Magellan shares of common stock to be issued in the Merger, then Tellurian will be required to pay to Magellan a reverse termination fee of $1 million.

In connection with and following the consummation of the Merger, certain contingent items of Magellan will become due and payable by the combined company, including (i) transaction fees payable in shares of Magellan common stock to Petrie; (ii) compensation payable in a combination of cash and Magellan common stock to members of the Special Committee; (iii) transaction incentive compensation payable in cash and common stock to Magellan's Chief Executive Officer, including release of prior transaction incentive compensation; (iv) employee cash bonuses payable under the employee retention cash bonus plan; and (v) the release of Magellan's contingent production obligations related to the Poplar field, via issuance of shares of Magellan common stock to the beneficiaries of such contingent obligations. In addition, the accelerated vesting provisions of the Company's remaining unvested stock options and unvested restricted stock are expected to be triggered, and these options and restricted stock are expected to become fully vested. In addition, upon the closing of the Merger, which constitutes a change in control, there is a risk that most of the Company's tax attributes may not be available to the Company to reduce the Company's potential US federal and state income taxes. As of June 30, 2016, the Company had foreign tax credit carry forwards amounting to $9.1 million, which, based on the Company’s estimated tax rate as of June 30, 2016, have the potential to offset approximately $26.8 million of taxable income.

For further information on these contingent items, refer to Note 17 - Commitments and Contingencies, Note 19 - Employee Retention and Severance Costsand Note 10 - Income Taxes.