Total sells North Sea midstream assets

On August 27, Total (ticker: TOT) announced that it sold its FUKA and SIRGE gas pipelines, along with the St. Fergus Gas Terminal, to North Sea Midstream Partners for £585 million (approximately $905 million). The Frigg UK Pipeline (FUKA) is a 362-kilometer, 32-inch pipeline with a nominally capacity of 1,271 MMcf/d, while the Shetland Island Regional Gas Export System (SIRGE) is a 234-kilometer, 30-inch gas pipeline with a capacity of 665 MMcf/d. Total owns a 100% and 67% interest in FUKA and SIRGE, respectively. The St. Fergus Gas Terminal is fed by 20 fields in the Northern North Sea, and has a capacity of 2,648 MMcf/d, according to the company’s press release.

Based off the capacity of the assets, which totals 4,584 MMcf/d, North Seas Midstream Partners purchased the assets at approximately $0.20 per MMcf/d of capacity.

“The sale of these midstream transportation assets is another example of Total’s strategy of active assets,” said Patrick de La Chevardiere, CFO at Total. “Transferring ownership to an entity specializing in midstream UK assets creates value for us and ensures a long and bright future for the facilities.”

Total sells service stations in Turkey

In addition to the assets the company sold in the North Sea last week, Total announced today that it is also divesting its service station network and commercial sales, supply and logistics assets located in Turkey to Demirören for €325 million (approximately $356 million).

Total said that it will maintain a petroleum product marketing presence in Turkey through its lubricant activities, including a blending plant in Menemen and odorless LPG operations. The two business will be transferred to a separate company prior to the completion of the sale, according to the press release.

“The transaction is yet another illustration of the Group’s strategy of actively managing our asset portfolio,” comment Phillippe Boisseau, member of Total’s executive committee and president of marketing & services. “After operating in Turkey for several years, we conducted a review of our position and the competitive environment. We concluded that it would be difficult to attain a large enough retail market share to achieve the level of profitability expected for our operations worldwide.”

Total Oil Türkiye, a wholly owned subsidiary of TOT, is the fifth-largest oil distributor in Turkey. It sells its fuel products and LPG through a network of 440 service stations, and represents a retail market share of 5.5% as of December 31, 2014.

Capitalizing on strengths

The decision to divest approximately $1.3 billion in midstream and downstream assets come as part of Total’s plan to continue capitalizing on its strength in the upstream sector. In its year-end 2014 presentation, the company said that it would continue to focus on upstream projects, reducing refining exposure to Europe and expanding its marketing in growth areas.

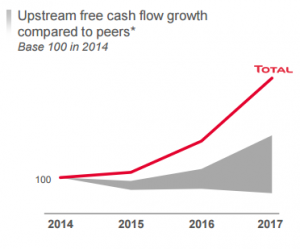

Compared to BP (ticker: BP), Chevron (ticker: CVX), ExxonMobil (ticker: XOM) and Shell (ticker: RDSA), Total compared favorably in generating free cash flow growth through its upstream operations, according to information from Wood Mackenzie. The company has decided to focus on upstream operations in the low price environment and selling its non-core midstream and downstream assets.