Proceeds to help TransCanada fund acquisition of Columbia Pipeline Group

TransCanada Corporation (ticker: TRP) completed its public offering of Common Shares. The Offering was announced on November 1, 2016 when TransCanada entered into an agreement with a syndicate of underwriters led by TD Securities, BMO Capital Markets and RBC Capital Markets under which they agreed to purchase from TransCanada and sell to the public 60,225,000 common shares which includes the full exercise by the underwriters of an over-allotment option granted to them.

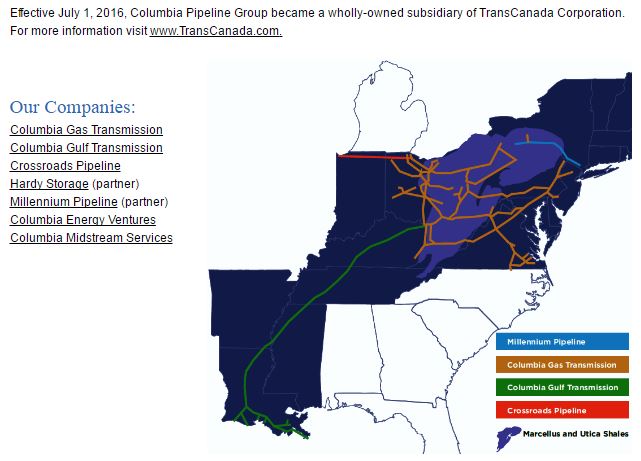

The purchase price of $58.50 per share resulted in total gross proceeds of approximately $3.5 billion, the company said. Proceeds from the offering will be used to repay a portion of the US$6.9 billion senior unsecured asset sale bridge term loan credit facilities which were used to partially finance the Columbia Pipeline Group, Inc. acquisition.